This morning, radiology imaging provider Pro Medicus (ASX: PME) reported net profit of $13.54m, up 12.4% on the first half last year. This was achieved through a combination of record half yearly revenue of $31.6 million (up 7.8%) and a record EBIT margin of 59%.

Capital IQ had broker consensus estimates of about $29.6 million in NPAT for the full year, which leaves some heavy lifting for the second half based on this half’s profit. That may explain the initial sell-off in shares, on the open this morning.

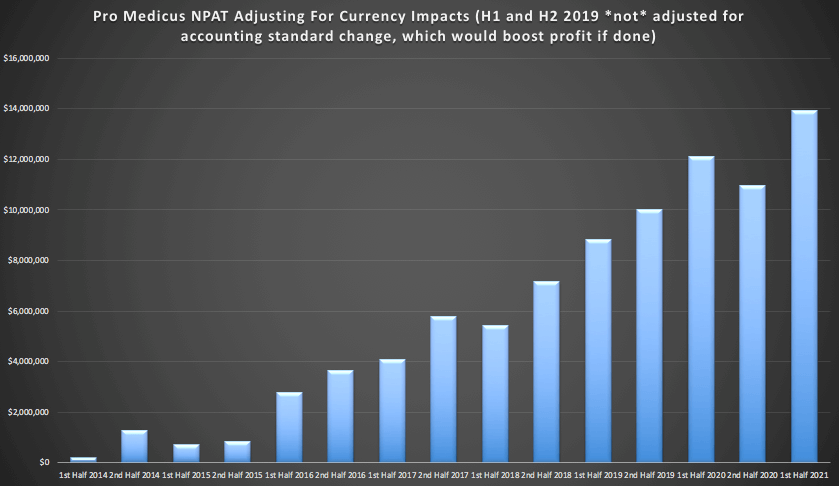

Historically, I have tracked net profit adjusted for the impact of currency movements. As you can see below, on this measure the company bounced back very strongly from the second half last year, which was heavily impacted by covid, as discussed in our FY2020 Pro Medicus results coverage.

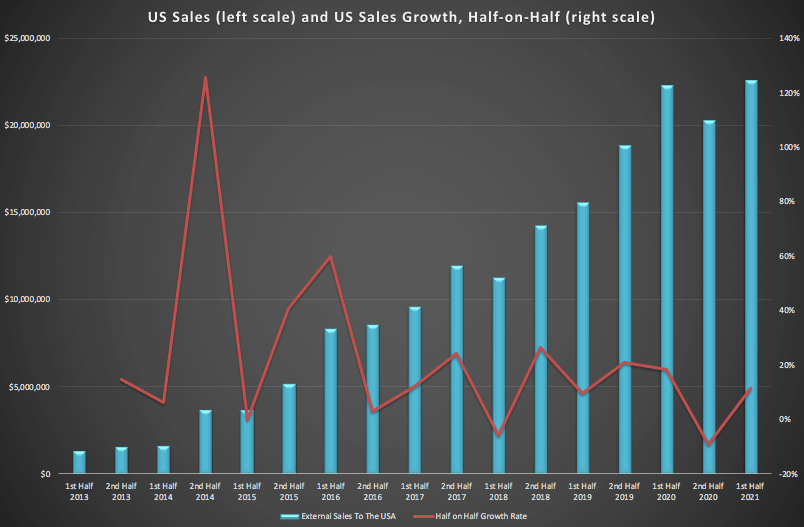

Now, as a reminder, Pro Medicus splits its business by geography, and the main growth market is the USA. Up until recently, you could argue that the USA was a proxy for the Visage 7 viewer, while the Australian revenue was a proxy for the older Radiology Imaging System (RIS) product.

However, this dichotomy has broken down due to the good traction achieved by the Visage Open Archive product which contributes an increasing amount of USA revenue. As a reminder, Open Archive is the PME vendor neutral archive. It a medical imaging technology in which images and documents are stored in a standard (DICOM) format with a standard interface, such that they can be accessed in a vendor-neutral manner by other systems (such as the Visage Viewer).

Happily, the company recently sold all three modules on offer to the Intermountain network, so going forward North American revenue will include Visage 7 viewer, Open Archive, and the clinical workflow product.

In any event, it was good to see US revenue return to growth after the covid-impacted second half of FY 2020.

Personally, I would have liked to see higher revenue from the USA, but I can readily look past the slight disappointment because covid has prevented many people from going to the hospital in the USA.

At the last results, the company said scan volumes were sitting just below normal levels, and the company said today that scan volumes have in fact begun exceeding prior levels for some clients. However, the west coast of the USA is yet to see a full recovery, and it’s reasonably safe to assume that overall covid was still a negative on volumes for the half to December 2020, albeit not nearly as much as it was in the half to June 2020.

This slightly disappointing revenue performance was well compensated by an increase in margins. This was achieved due to a higher proportion of remote work, and an online-only RSNA, which is usually a huge expenditure for the company. While margins will likely fall once in person meetings come back to the fore, the CEO did say “whilst we don’t envisage that 59% margins are sustainable long-term, we believe there is scope for margins to improve on what they have been historically.” That implies good things about the continued high quality of the business.

Happily, the company produced strong free cash flow of $12.6 million, not much below profits, and has over $50m in the bank. So it has no need for external funding and has plenty of ability to invest in growth.

On all the measures I track, Pro Medicus seems to be in extremely good shape. On the conference call, the CEO Sam Hupert confirmed that they company had not lost any tenders from its pipeline. When questioned about the changing terminology used to describe the pipeline (now called “diverse and growing”) he said something along the lines of, “Changing the terminology is not to suggest that the pipeline has decreased; quite the opposite.”

Other heuristics are all pointing in the right direction. For example, the company renewed one of its bigger contracts at a higher (minimum) price, reflecting both increased usage and, it was implied on the call, at least a small uplift in pricing. More significant uplifts can be expected should the company be successful in cross selling its Open Archive product to existing Visage 7 clients. On the call, the CEO said they are already in discussions with some customers about this. Obviously, the process will be a slow one as customers will likely want to wait until the end of their existing contracts, if they do want to change.

Finally, I was particularly interested in the company’s plans to expand outside its highly desirable niche of large US-based teaching hospitals and health networks. Happily, it is clear that the company is already selling to smaller health groups (which they do not announce) and the CEO pointed out in response that their European contracts are with government owned hospitals. True, the CEO says that “clearly there is a point where the cost of sale doesn’t make it worth it or groups won’t pay our premium price”, but he also said he thought the number of organisations falling into that category is reducing. This is good news since it implies that, though it may take a fair few years, the company is still planning to sell to a wide variety of clients in the long term. As the CEO put it, “the whole market is fair game.”

Is The Pro Medicus Share Price Too High?

Prior to these results, I said that I was going to be very slowly taking some profits at above a share price of $40. I have done so, with my most recent sale at $46.50. At present, I am still reviewing my valuation ranges, though I do not expect to make large changes in response to these results. As I have not completed my re-evaluation, I’d like to keep open my potential to trade shares in the stock, and I may continue to be active in it.

In this seperate piece, I discuss the potential influences on the Pro Medicus share price, that I suspect are just over the horizon. We’ll be giving access to this extra content to readers of our free email in the coming days (you can join below).

In the meantime, suffice it to say that after these results I intend to remain a shareholder of Pro Medicus. On top of that, I am comfortable having it as my largest shareholding, even at current prices, in part because it continues to be the highest quality company on the ASX (in my opinion).

Importantly, it appears to be improving as a business and remains well positioned to start commercialising algorithmic radiology in the next few years.

This post is not financial advice, it is general in nature, and you should click here to read our detailed disclaimer.

Finally, I was fortunate to be asked about the Pro Medicus results on Ausbiz TV today, and you can see the interview below.

Claude Walker Discusses Pro Medicus Results H1 FY2021 from Claude Walker on Vimeo.

A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.