While this article focuses on share market opportunities arising from the pandemic it in no way seeks to minimise the very real human tragedy that is occuring.

According to my framework for investing during a pandemic, certain companies will benefit from the pandemic. We call these companies short term beneficiaries, long term beneficiaries, through paradigm change or as an example of fool’s gold.

As the pandemic continues to play out, I have been predominantly been targeting companies that are a mix of fool’s gold and short term beneficiaries.

Please note this is an Ethical Equities investment diary entry and is not advice. I do not know your situation, and I do not give recommendations. If you haven’t already, please read this disclaimer.

Marley Spoon (ASX: MMM)

One such company is Marley Spoon (ASX: MMM), which has seen its share price rise a whopping 200% in the last few days. Personally, I can scarcely believe it, especially since I actually bought shares at 27.5c a few days ago (in accordance with our framework.)

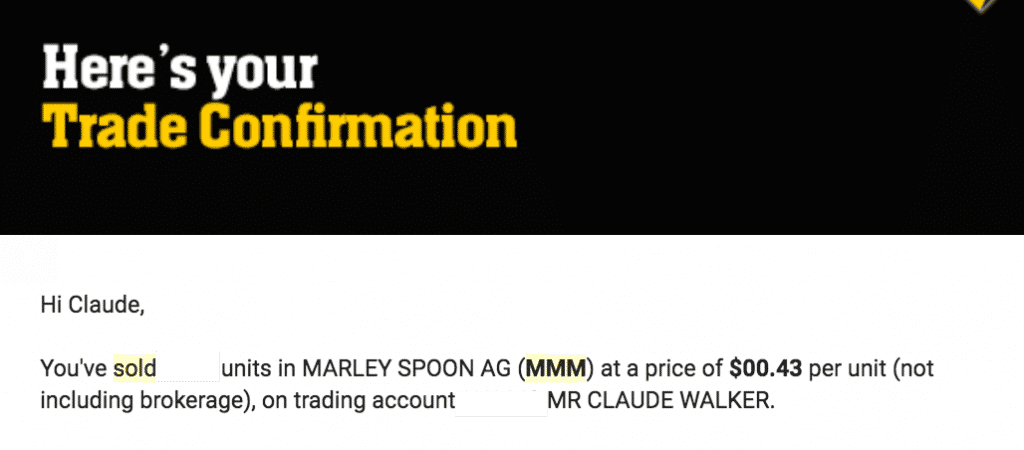

Unfortunately, I actually messed this one up, and subsequently sold my shares too early, as you can see below:

This was an excruciating decision because my sociological framework should have told me that the share price would continue to soar as more and more people bought into the hype around Marley Spoon.

Personally, I don’t feel confident in the current valuation, but I have now bought back about 40% of my original position just to try to stop the psychological pain of having sold too early. In the long term, I think Marley Spoon will face stiff competition, but it will be interesting to follow along with the story when there are so many unknowns about how it will manage this growth spurt.

I’ve got low conviction on this one. I guess my trading of Marley Spoon while profitable has been quite silly. I don’t pretend to be above emotional decisions, but I do think it’s important to reflect and learn.

Open Learning (ASX: OLL)

In comparison, I have higher conviction in OpenLearing (ASX: OLL), which provides software for online delivery of university courses and professional development courses to universities and businesses in Australia and Malaysia.

The company says that “OpenLearning is attracting interest from education providers around the world who are exploring the design and delivery of online courses as a result of the recent travel restrictions imposed due to the outbreak of the coronavirus (COVID-19) global pandemic.”

Unfortunately, OpenLearning only has really tiny revenues of less than $2m at present, with ARR of just under $1m. But as I pointed in this analysis of OpenLearing, it does have more than a year’s worth of cash in the bank, implying it has a good chance of funding itself through the pandemic. On the other hand, Marley Spoon already has debt, so I am more concerned about its funding.

As with Marley Spoon, I have taken some profits by selling some of my OpenLearning shares, as disclosed in advance in this post. However, it is still currently my second biggest stock position after Pro Medicus (ASX: PME). OpenLearning is up around 90% on its lows.

MNF Group (ASX: MNF)

Finally, VOIP telecommunications provider MNF Group (ASX: MNF) is also a potential beneficiary of the pandemic. The company recently said:

“MNF advises that the company is currently experiencing strong demand for core products across its three operating segments – Global Wholesale, Domestic Wholesale and Direct. The key product in demand is Australian based phone numbers, which are used for collaboration and conferencing applications. MNF is also currently experiencing higher than normal usage volumes across all segments.”

On top of that, the directors have cumulatively spent over $750,000 buying shares in recent weeks. I bought back into the stock around $3, in recent days. Unlike OpenLearning and Marley Spoon, MNF Group is actually profitable. To me, that means it is lower risk.

Overall, I wish I had bought more MNF Group, and do not feel like selling any of my shares. On the other hand, I’m very iffy about Marley Spoon as I feel it might be Fool’s Gold (according to the framework). On the other hand, I feel MNF Group is most likely to be a beneficiary of a paradigm shift.

MNF Group is up around 30% on its lows.

Following The Framework

Today, I bought shares in another company (disclosed here) that would be classified as either Fool’s Gold or a Long Term Beneficiary (or a bit of both) depending on how well they can retain extra customers driven to try the service as a result of the pandemic.

While I didn’t really like the business before the pandemic, at this stage it is still trading near its lows, so I consider the risk vs reward favourable.

Note for those who don’t know about Sharesight

If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid decision, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.