This morning, audio visual networking software company Audinate (ASX: AD8) released its results for the 1st half of FY 2022, reporting modest revenue growth of just over 30% on the prior corresponding period, to $20.2 million in Australian dollars. It made a loss of about $2.2 million for the half, and cash burn increased significantly to about $4.7 million, elevated in part because the company paid bonuses that had been expensed in the prior period.

With over $50 million of cash in the bank, Audinate does not need to worry about that sort of cash burn, but it’s still worth keeping an eye on.

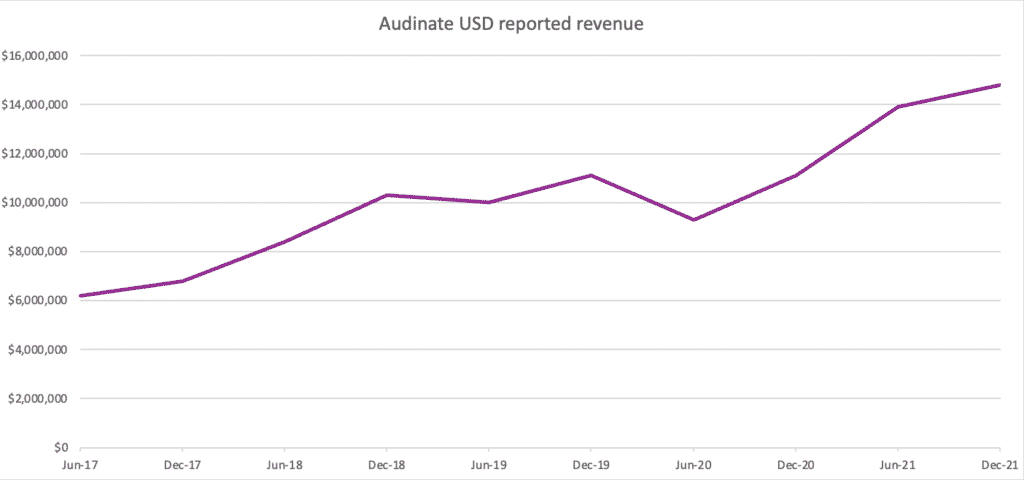

Because Audinate invoices its clients (and pays for components) in US dollars, it makes sense to track its organic growth in USD. As you can see below, while its US dollar half year revenue was up around 30% on the prior corresponding period, it was only up 6.4% on the prior period.

That’s not a terrible result, but it’s not great either, given that operating expenses grew faster. That means that Audinate still isn’t showing any of the operating leverage that shareholders must believe in. At a share price of $7.65, Audinate has a market cap of just under $600 million, and therefore trades on around 15 times revenue, based on annualising this most recent half. Increasing cash burn, despite an increase in revenues, hardly fills one with confidence at first glance.

Having said that, if we look below the hood, the business seems to be in very good health.

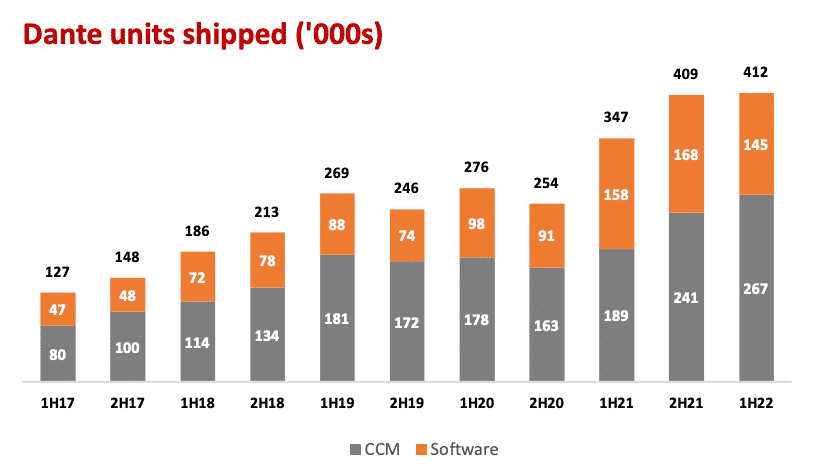

First of all, the company has been hampered by a reduction in one-off design royalty software fees. These fees are not so attractive as subscription fees, and are thus being phased out. This lead to a reduction in software units shipped, from 168 in the prior half to 145 in this half. The drag on revenue was only about $200k (USD).

Upfront license fees were a barrier for some smaller OEMs, so Audinate has moved towards a subscription model, in order to drive more design wins. This slows revenue growth a bit in the near term, but should pay off in the long term. This move was forecast in the last results, and partially explains why the half on half revenue growth was less than impressive.

But it’s not all bad news when it comes to subscription revenues.

On the Audinate conference call, the company said that during the half it “made substantial development process to Dante Controller that will allow it to be paid for and enabled by end users, rather than at manufacturing time.” This is very important because the benefit of the Dante Controller software goes to the AV professionals who design, install and troubleshoot the large venue AV systems. It makes a lot more sense to be charging them for the software product, rather than charging the manufacturer, who then passes it on to the AV professional who is the end user.

Pleasingly, the CEO said that this new business model was off to a strong start and was already generating revenue from at least one AV installation company.

This is a very important change. Previously, Audinate’s customers were only OEM manufacturers like Yamaha, Bosch, and Bose and many other OEMs. Now, it is selling product to these OEMs but also the installation and consultant companies who install the AV systems into buildings.

The second reason these results aren’t as bad as the 6.4% half on half revenue growth might indicate is that the hold up is on supply, rather than demand. On the Audinate conference call, the company said:

“Demand for Dante products continues to be strong, and to date price increases have been accepted by our customers, and so the company expects to be able to pass on input price increases. Unfortunately, lack of chips has materially hampered the company’s ability to deliver products to customers.“

To be specific, on the Audinate conference call the company has already pushed through price increases on the Ultimo chip, the AVIO adapters and some software products. Unfortunately, these price increases only recoup the increasing input costs arising from inflation and chip shortages generally. To wit, gross margin was actually down very slightly to 75.6% compared to 76.9% for the previous corresponding period. That’s not great to see.

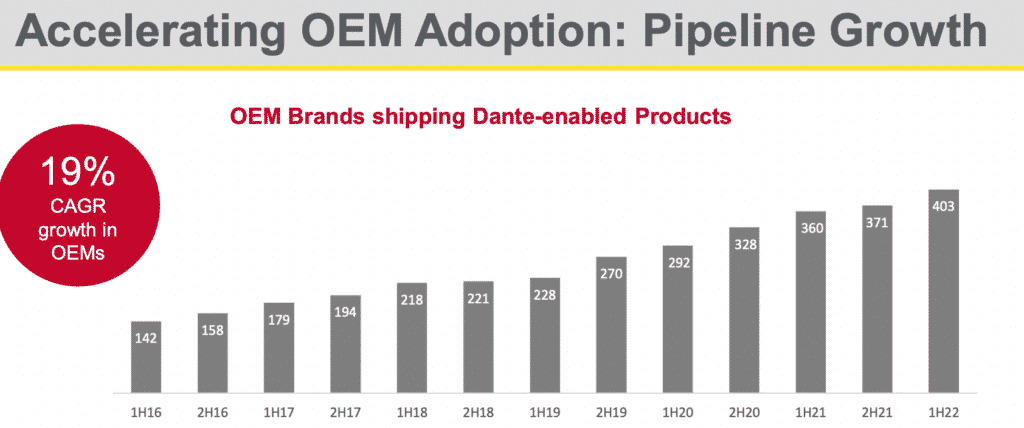

On the other hand, if you look at the bigger picture, it shows that Audinate has pricing power, and that has always been a key tenet of the investment thesis. Of course, in order to flex pricing power Dante will need to have near universal adoption in audio networking.

On the conference call the company said that “revenue for H2 will be constrained by the availability of chips both for Audinate and our OEM customers”, though the good news was that they recently heard they will get more of the chips for Brooklyn than they had previously expected. Of course, if the OEM customers have their own supply hold-ups, then that will still impact Audinate. Management said the supply chain outlook is “undoubtedly rough”, and that may cause short term pessimism around the stock.

Looking forward, it was good to see that the number of OEMs with at least one Dante enabled product continues to increase. This figure is our best view of how well Audinate is creating a quasi monopoly. If Audinate does have a quasi monopoly, then we would expect this figure to continue to grow. Happily, the company says over 90 new customers are currently developing their first Dante enabled products.

Did Audinate Have Good Financial Results?

As a shareholder, I’m a little bit disappointed that cash burn increased and I’m less excited about acquisitive growth than organic growth. In the next report, we should see some impact from the recent acquisition of Silex Insights business. The company has also focussed on increasing penetration of non English speaking markets, and its training and documentation is now available in 8 languages.

With half on half revenue growth moderating and cash burn increasing, it’s hard to argue these are great results, given the high growth expectations implied by the current share price.

Having said that, if you delve into the details, Audinate is showing every sign of having a high quality business model that is actually improving in quality as it becomes more dominant in its main audio niche, as well expanding its opportunity set into audio visual. With a strong balance sheet and strong demand, Audinate is in control of its own destiny, in many respects.

Ultimately, I think these results were uninspiring in the short term, but actually strengthen the long term thesis, by providing solid evidence of pricing power. Overall, they don’t really change my view of the company and I’ll continue to hold the shares I have. I only have a small position (currently less than 1% of my ASX portfolio) due to the high expectations embedded in the share price. I’m not buying more today, but these results suggest to me that Audinate is certainly a high quality business, and I would be interested in buying more shares at a lower share price.

This seems like it’s quite possible, given that most growth stocks are seeing lower share prices as inflation fears increase the probability of interest rate rises.

The author owns shares in Audinate and will not sell for at least 2 days after publication of this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Sign Up To Our Free Newsletter