This morning healthcare and pharmacy distribution conglomerate Ebos Group (ASX: EBO) reported its FY 2022 results and celebrated the centenary of its incorporation as Early Bros Trading Company Limited. The FY 2022 Ebos Group results benefitted from a one month contribution from significant acquisition Lifehealthcare (LHC), which is performing in line with expectations. Revenue was up 16% to $10.73 billion, and profit was up 9.3% to $202.6 million, giving a net profit margin of about 1.89%.

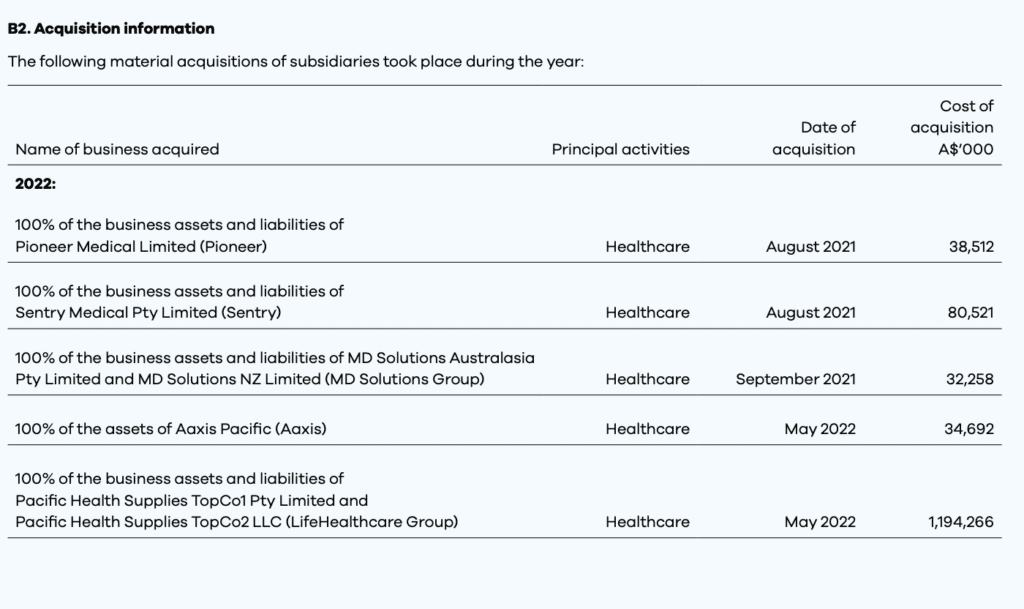

FY 2022 was a year of massive investment for Ebos Group. As you can see below, the company spent almost $1.2b on buying LHC, as well as a number of other acquisitions totalling around $185m.

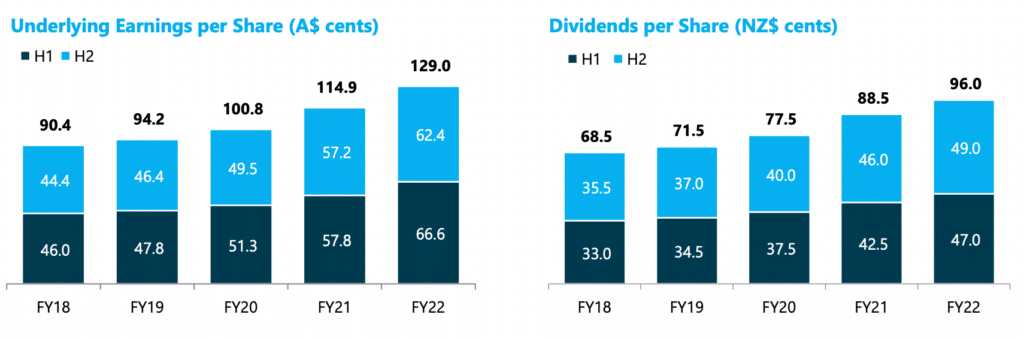

As a result of the significant acquisition costs, and the issuance of shares at around $32.50 to raise capital for the LHC acquisition, statutory earnings per share was flat at 114.5 cents per share. Meanwhile, underlying earnings per share (excluding M&A costs) was up 12.2% to 129 cents per share. When I covered the Ebos half year results, I forecast “at least” NZ$0.96 cents per share “over the next year.”

With the NZ$0.49 final dividend we’ve already reached that goal, putting the company on a notional dividend yield of about 2.5% at the current share price of around A$34.50. Note that in the charts below, EPS is in Australian dollars but dividends in NZ dollars.

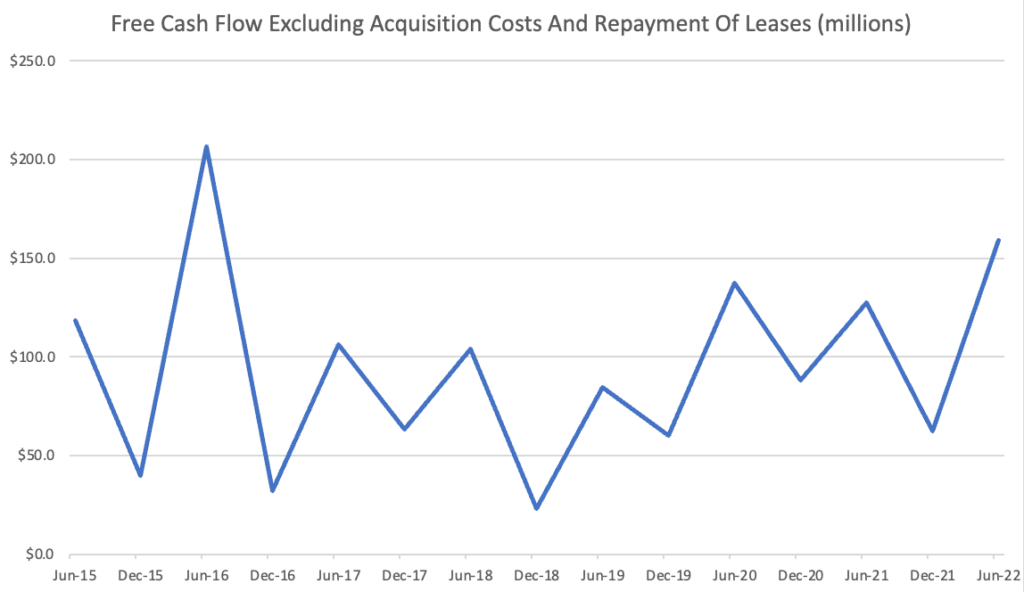

As discussed above, the huge expenditure on acquisitions saw free cash outflow of some $1.15 billion. However, in order to track how the company is managing the operating business, I also look at free cash flow including acquisition costs. As you can see below the second half was a stronger than the first, with both within historical ranges.

Is Ebos Group A High Quality Business?

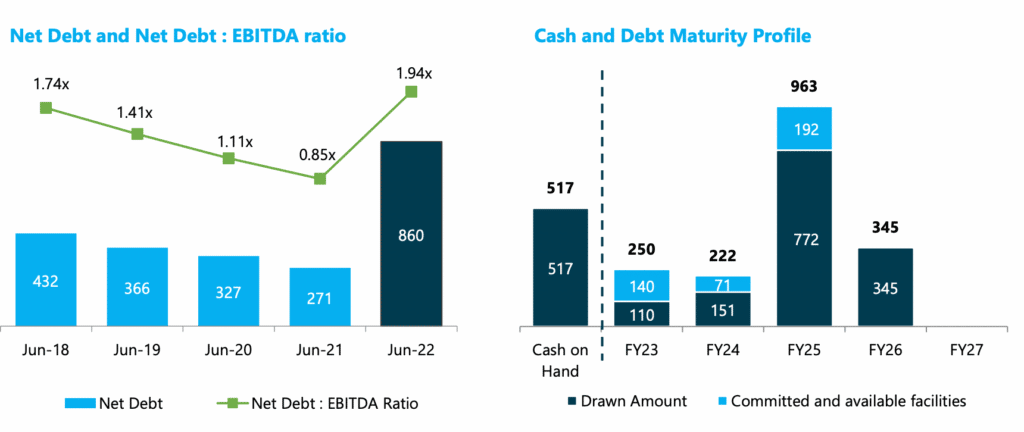

On one view of it, the narrow net profit margin suggests that Ebos group is an unattractive business. When you combine that with $860.5m of net and Net Debt : EBITDA of 1.94x, then it would actually seem somewhat risky. If something happened to reduce EBITDA in some structural or continually worsening way, the debt could become a problem.

However, the very low margins also show how healthcare distribution is a scale game and it is hard for new competition to gain the scale needed, to compete effectively. Ebos group is very much a real world company that needs to spend to build physical assets to grow. For example Ebos spent $30m in FY 2022 on a pet food manufacturing facility, with total spend on the project of being $82.3m.

This is disadvantageous for multiple reasons in an inflationary environment. First of all, the capital intensity of growth makes future growth more expensive. The cost of maintaining physical assets and inventory increases. And rising interest rates impact the cost of debt over the longer term. Therefore, Ebos Group probably isn’t high quality as a business.

That said, the fact that many of its services are so essential, being healthcare distribution, means that it is probably a sustainable business with a competitive advantage of sorts, being its scale. Each of Ebos’ segments are growing, though the Animal Health segment saw weaker second half revenue due to ending a low margin contract.

Should I Buy Ebos Shares?

I have owned Ebos shares since buying under $21 in June 2020. Ebos was a beneficiary from the pandemic (and gave some 20% of the pharmacy vaccinations in Australia). I bought more under the capital raising at around, NZ$34.50, but sold most of those for a quick profit, as I said I would.

Even based on the more generous underlying earnings per share, Ebos Group is on a P/E ratio of about 26.5, which isn’t obviously cheap. I tend to consider Ebos to be a dividend stock, because of its long history of gradually increasing dividends. At present, the dividend is only about 2.5%. 1 year term deposits are now over 3%, and essentially competitive with the fully franked dividend yield.

With Ebos, you get the likelihood of increasing dividends, of course, but you also take on risk. Therefore I do not find Ebos shares an attractive buy at the current prices. I’m happy to hold on to my existing Ebos shares as a long term investment, because I think that there are long term demand tailwinds for large healthcare providers like Ebos, and I think it will increase dividends over the years.

Having said that, the capital intensity of the business is a real negative. The company is forecasting “another year of profitable growth in FY23,” but that “Capital expenditure for FY23 is expected to remain elevated as EBOS embarks upon facility expansions and upgrades to support the growth in the business.” Still, one certainly has to keep an eye on the debt, going forward.

At the end of the day, these results don’t really change my view of Ebos Group and even though I think it’s a decent, defensive, dividend stock, all else being equal I do not plan to buy any more shares, at current prices. In my view the outlook for dividend growth in the next year is probably pretty muted, so my view on valuation hasn’t changed much in these results. In the longer term, if we see reduced debt load and evidence that the LHC acquisition is performing well and able to grow, then I might increase my valuation.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author of owns shares in Ebos Group and will not trade Ebos shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.