Healthcare distribution company Ebos Group (ASX: EBO) reported its half year results for H1 FY2022, yesterday, boasting revenue growth of 12.8%, and a 9.7% increase in half year profit, to $101.9 million. The main reason profit growth was below revenue growth was because the company incurred higher-than-usual acquisition costs, which had a $7.4 million impact on after tax profits. This makes sense, because the company made a few acquisitions during the half, including the particularly significant acquisition of Lifehealthcare.

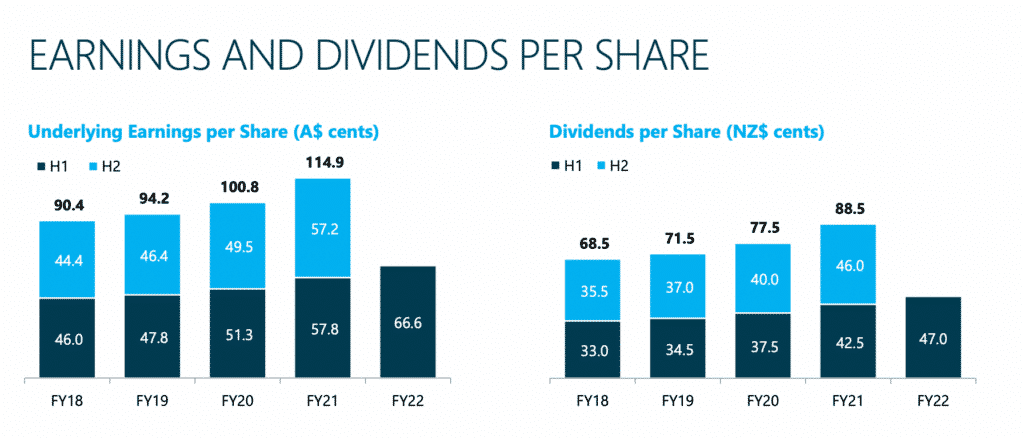

Earnings per share was up 8% to 61.4 cents per share, but underlying earnings per share, which excludes those acquisition costs, was up 15.2% to 66.2 cents per share. This shows that, once you exclude the unusually high acquisition costs, the company is achieving operating leverage as it grows.

Ebos Group (ASX: EBO) runs the Terry White Chemart network of pharmacies and distributes healthcare products to many more pharmacies in Australia and New Zealand. It also produces various products, distributes to hospitals, and distributed animal health products. Therefore, it must invest in the physical assets of its distribution network to continue to grow. That means it has considerable capital expenditure each year.

In H1 FY 2022, the company had “Net capital expenditure for the period was $43.3 million and comprised business as usual capex of $17.3 million and $26.0 million of growth capital expenditure in relation to the new pet food manufacturing facility.” The company expects these levels of capital expenditure (capex) continuing with the CFO noting on the conference call that the company would have full year capex of around $80 million, with second half capex around $40 million. My guess is that due to inflation, capex for the full year will come in somewhere a bit above $80 million.

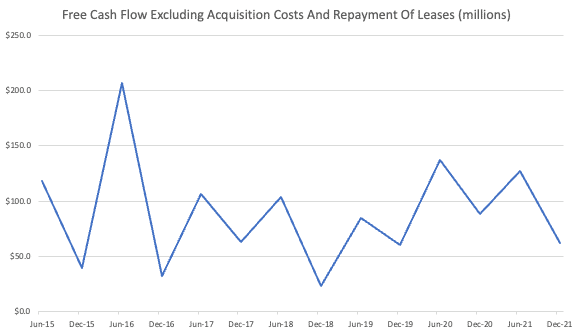

This increase in capex has unfortunately lead to a reduction in free cash flow, which was was roughly on par with the level two years ago. However, we should not read too much into a single half’s free cash flow, since it can be quite lumpy, as you can see in the chart below.

Pleasingly, the dividend payment was increased slightly, to 47 cents per share (NZD) which easily covered by both underlying earnings per share (over 71c in NZD) and also statutory earnings per share, (just under 66c in NZD).

Excluding the recent share placement associated with the Lifehealthcare acquisition, the company had underlying net debt of just over $402 million. Including the net cash proceeds from the share placement completed in December 2021, in connection with the LifeHealthcare acquisition, the Group’s Net Cash balance as at 31 December was $226m. After payment for Lifehealthcare, EBOS anticipates the Net Debt : EBITDA ratio at 30 June 2022 will be less than 2.25x after completion of the LifeHealthcare acquisition.

The net debt to EBITDA ratio has not exceeded 1.5 in the last few years, so this is the most indebted that Ebos will have been in quite some time. However, given the defensive nature of the company’s overall earnings that’s not a major worry. Having said that, as we mentioned when we covered the acquisition of Lifehealthcare, the higher ticket price of the latter’s earnings make it arguably a higher risk business, and so taking on debt for this acquisition does substantially increase risk to Ebos. I don’t think the risk is too bad, but certainly this is the riskiest this otherwise very defensive company has been for years, in my view.

Now as a reminder, Ebos Group divides up its business into animal and human segments.

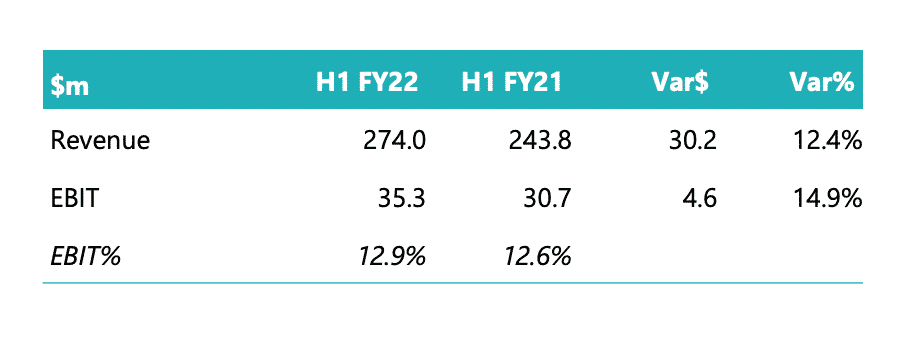

The Animal Care segment is the smallest segment but it is growing quite strongly. Ebos management says its growth has been driven by a large increase in the number of pets due to the pandemic. I expect further growth from this segment once they commission their new pet food manufacturing facility. However, on the conference call the company said that “the full commercial benefits of this investment is not expected until FY24.”

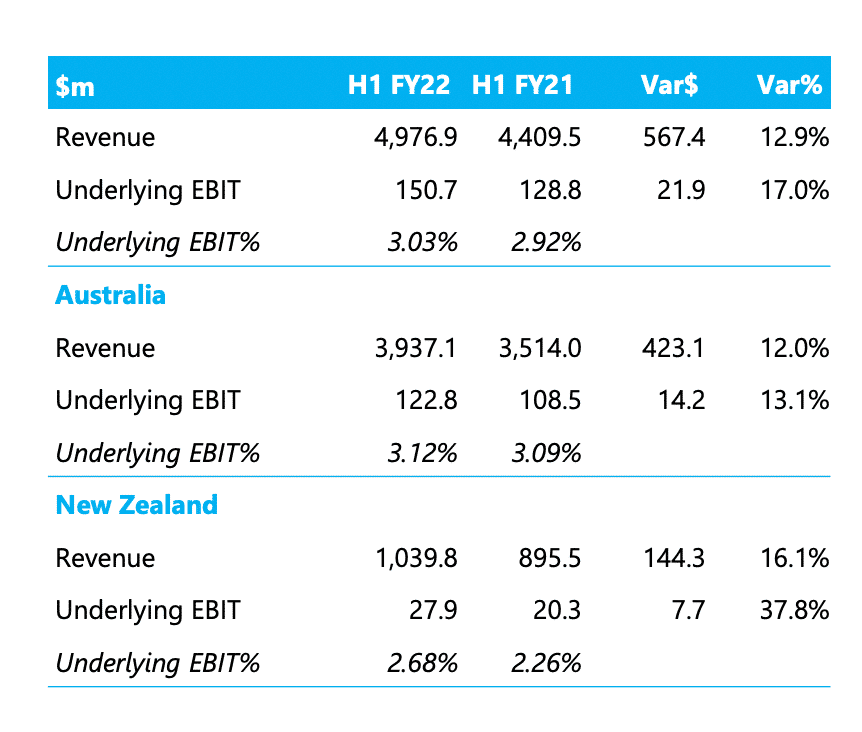

The human healthcare segment is around 5x the size of the animal business, and it grew strongly, as a result of both acquisition and organic growth. The strong growth you see below was driven by very good organic growth in the community pharmacy division, which includes the Terry White chemist chain, but also wholesale operations to other pharmacies such as Chemist Warehouse.

The community pharmacy division grew gross operating revenue (GOR) by 10%, organically. It benefitted from the return of the Pfizer distribution to this wholesale channel, which ironically is what hurt Corum Group (ASX: COO), another stock I own shares in. Corum Group reported that this change only took place part way through the half, so Ebos may see further lift from this in the next half.

The actual Terry White Chemart business grow organically, with like for like sales up 5.6%. Notably, the pharmacies are pulling their weight with regard to covid vaccination.

The institutional healthcare business grew GOR by 25%, though this was acquisition growth, not organic growth. That said, “Symbion Hospitals revenue grew by 3.1% despite the impact of lower volumes from a decline in elective surgery activity due to COVID-19 restrictions.”

Finally, the contract logistics business had a bumper year, with over 37% organic growth. This performance was “attributable to growth in Australia due to an increase in market share, as well as growth in New Zealand with increased demand for protective equipment, testing kits and COVID-19 vaccines assisting our performance.” Therefore, it is unlikely to be repeated in the next year. Having said that, we may see further growth since “Plans for a new distribution centre in Sydney are well progressed with its opening expected during 2023.”

EBOS Group Outlook

On the conference call, the company highlighted that they were very happy with the return on capital employed of 18% which was ““well above our internal target of 15%”. Given the elevated capital expenditure this half (and in the second half), and the large expenditure on Lifehealthcare, we can assume that management is expecting good growth into FY 2023 and FY 2024.

On top of that, the CEO said that “We’re very comfortable with the momentum we’ve got in the business and the investments we are making” and “We are comfortable with current trading conditions”. Clearly, there is some risk around the large acquisition of Lifehealthcare, but I think it’s fair to say management sound quietly confident about the future.

Are EBOS Group Share Attractive?

Personally, I own EBOS as a dividend stock. Over the last 12 months, the company has paid out 93c (NZD) in dividends. I think one could probably assume some growth over the next year, and I’d estimate it will pay out at least 96c over the next year.

Translating that to Australian dollars, that’s about 89 cents at the current exchange rate. At the current share price of $37, that’s a very slim yield of about 2.4%, which is significantly lower than when I purchased the stock. For me at this point, I’d be more inclined to take profits than buy more, but I also think this is a well run, defensive company with decent long term prospects. As a result, I’m currently inclined to just keep holding on for the dividend (and future dividend growth).

The author owns shares in EBOS and will not sell for at least 2 days after publication of this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Sign Up To Our Free Newsletter