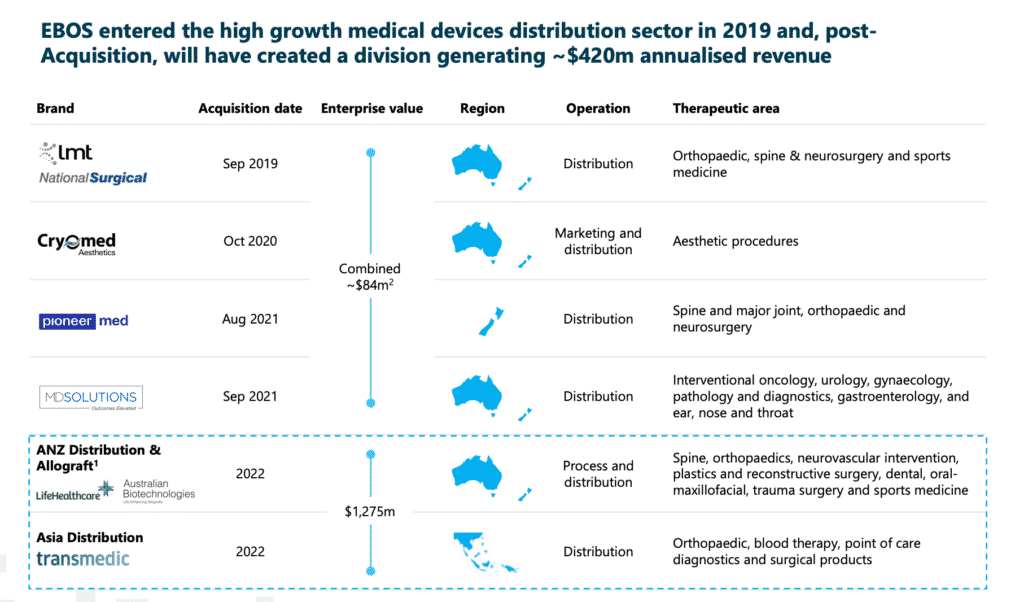

Ebos Group Ltd (ASX: EBO) is a pharmaceutical, medical and veterinary product distribution company which operates in both Australia and New Zealand. In December 2020, Ebos Group (NZE: EBO) announced that it would purchase Australian implantable device and allograft distributor Lifehealthcare, which was previously listed on the ASX under the ticker ASXX:LHC. Along with that, Ebos will buy some shares in Origin Biologics, and a 51% stake in Transmedic, a “diversified, pan-Asian medical device distributors.”

I noted that Ebos group foreshadowed this acquisition when we covered the recent FY 2021 Ebos results.

When it was taken over by Pacific Equity Partners in 2017, shareholders received around 10x underlying EBITDA based on annualising the first half of FY 2018 of $2.8 million. PEP has clearly grown the business, since they are now selling it at an enterprise value 11.5x EV the midpoint of forecast FY 2022 Lifehealthcare EBITDA of A$110 million to A$114 million.

How Will The Ebos Acquisition Of Lifehealthcare Be Funded?

Ebos Group is using a mixture of debt and cash to fund the acquisition of Lifehealthcare. It has already made a placement to institutional investors to raise about A$642 million and it has arranged to borrow just over half a billion dollars in debt. In order to give retail shareholders the same opportunity to buy shares that was offered to institutional investors, EBOS has also announced a retail offer, which is expected to raise about $100m AUD.

What is the Ebos Group retail offer price?

The Ebos retail offer is taking place at NZ$34.50 per share. The price for Australian shareholders will be the Australian dollar equivalent of NZ$34.50 on January 17, 2022.

The company says they want “to provide the opportunity for the vast majority of shareholders to achieve a pro rata allocation (based on the proposed total size of the capital raising) having regard to an analysis of EBOS’ share register, and precedent participation rates in other NZX and ASX share purchase plans/retail offers.”

The institutional and retail components of the raising will add around 23.5 million shares and prior to the raising there were about 164 million shares, that suggests shareholders could expect to receive an allocation of at least 14% of their existing holding. Now we don’t know what the exact AUD issue price will be, but the NZ price of $34.50 currently corresponds to about $32.50 AUD, and the current AUD share price is about $40.

That means there is likely to be strong retail demand for shares, since a shareholder can hypothetically buy shares at $32.50, and sell them at around $40 (assuming the share price remains around the current level, which it may not). In any event, it’s almost certainly good news for shareholders like myself, that we can buy share at a steep 18.75% discount to the prevailing market price.

On the basis of this discount, I have applied to buy enough shares that my shareholding would increase by about 24%, if my entire application is filled. Given that I have applied for more than my pro rata share, I am expecting that my application will be scaled back. However, there is some possibility that it will not be scaled back, especially given that the company has reserved the right to expand the size of the retail offer, should it so desire.

Pros And Cons of Ebos Acquiring Lifehealthcare

Ebos says that the acquisition is “expected to deliver low double digit percentage EPS accretion in CY22 on a pro forma basis pre-synergies.” Unfortunately, this forecast excludes specific amortisable costs so the reality is that FY 2022 will probably include acquisition expenses which may hamper the benefits.

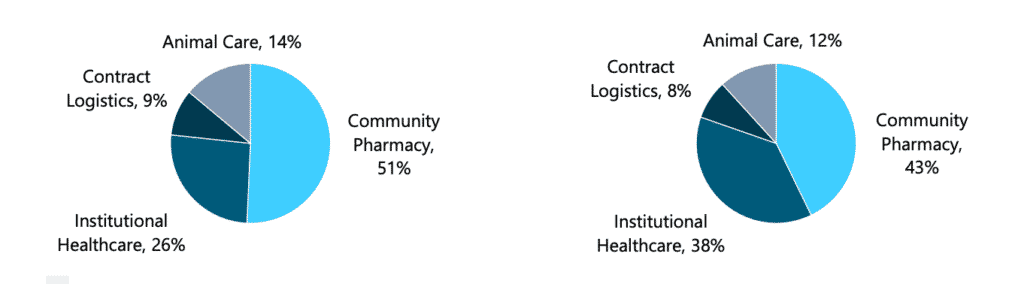

Conservatively we could still assume the acquisition will add at least 10% earning per share growth in FY 2023. Zooming out, the acquisition will change the nature of the company somewhat, by expanding the importance of institutional healthcare (for example selling to hospitals, or to a surgeon in a hospital) relative to retail or veteniary healthcare. The charts below show the gross operating revenue split prior to the acquisition, on the left, and after the acquisition, on the right.

The bad news is that institutional healthcare is more beholden to reimbursement risks, and more likely to be disrupted when covid overwhelms hospitals. Although margins are strong, it takes a specialist salesperson to sell (for example) spinal prosthetics; and each sale is much more significant than a retail sale. Therefore, disruption can see highly paid employees under-utilised, and cause bumpy profits.

Personally, I think the retail pharmacy distribution business is more resilient, and I like that in a dividend stock.

However, the good news is that the acquisition brings meaningful scale to the Ebos medical devices distribution business. In most distribution businesses, scale is a meaningful advantage, especially if you are supplying the same or similar client bases. This acquisition should accelerate the medical devices distribution business as a platform for further (bolt on) acquisitions, and combine well with the company’s exisiting device distributors.

Are Ebos Group Shares Good Value?

I’ve already applied to buy some shares under the retail offer, but the second question is whether I should sell my shares once I receive them, or hold on to my shares (thus increasing my position size).

Please remember that these are personal reflections about a stock by the author, and absolutely not financial advice. You should seek advice from a financial adviser, if that is what you want. I own shares in EBO, and have applied to buy more under the retail offer. I plan to sell at least some of my shares that I will receive under the retail offer.

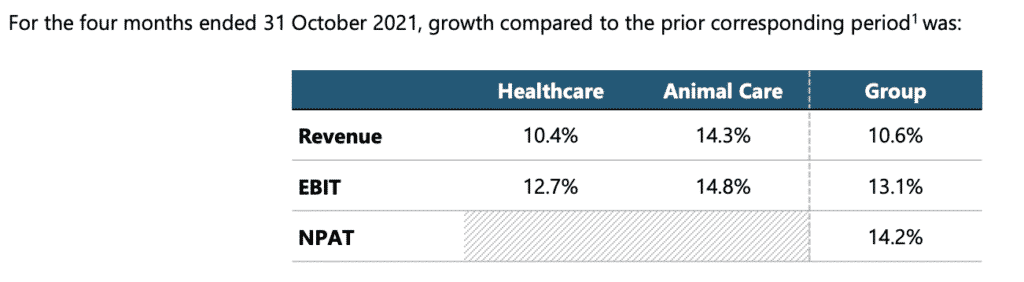

Over the last year, Ebos Group paid Australian shareholders about 74.6 cents in dividends, which equates to a trailing yield of just 1.86%, which was 96% franked. As you can see below, the existing Ebos group business is up about 14% so far this year. That’s good, and this growth will roughly offset the dilution from this acquisition.

FY2022 will only receive a partial benefit from the acquisition of Lifehealthcare, and bare all of the transacaction costs, so judging the company on the FY 2022 result might be a bit harsh. If we look to FY 2023, then we could perhaps hope for a 20% increase in the dividend relative to FY 2021. To be more optimistic, we could project a 25% increase.

Even in that more optimistic scenario, the dividend yield would only be about 2.3%, which isn’t particularly impressive.

Expected to deliver low double digit percentage EPS accretion in CY22 on a pro forma basis, pre-synergies.

After the capital raising there will be about 187.5 million Ebos Group shares on issue which equates to a market capitalisation of about $7.5 billion. Based on the historical earnings of $1.16 per share, Ebos Group is on a trailing P/E ratio of about 34. Clearly, this assumes ongoing organic and acquisition growth; so there is potential downside should the company experience flat results.

This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.

For early access to content like this, join our Free newsletter!