Pharmacy owner and wholesale distribution network EBOS Group (ASX: EBO) today reported earnings per share of $1.13 for FY 2021, up about 13% on last year. However, the second half was slightly down on the first half, with earnings per share of 56.3 cents in the second half versus 56.9 cents in the first half.

The company declared a 46c final dividend giving the company a trailing twelve month yield of about 2.7%, fully franked, at a share price of NZD $32. As a reminder, all figures referred to in this article are New Zealand dollars unless otherwise stated.

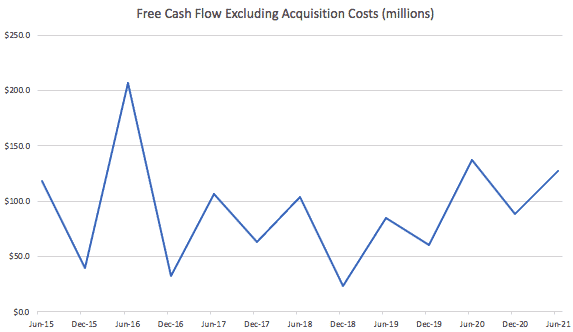

Statutory profit was $185.3 million for the half, and free cash flow (excluding acquisitions) came in at about $127.5 million. Free cash flow is a good measure of the company’s ability to pay sustainable dividends, and service debt, so it was good to see a slight improvement on the first half, as you can see in the long term free cash flow chart, below.

At the end of the financial year EBOS Group had debt of around $440 million, which is only around 2x its annual free cash flow (based on the last year). Considering its cash holding of $168 million, and the defensive nature of its business, it would appear that the balance sheet remains in very good shape.

As a reminder, EBOS operates two divisions; animal healthcare and human healthcare. The larger human healthcare business includes pharmacies, pharmacy distribution and pharmacy products. It grew earnings before interest and tax (EBIT) by about 11%.

The stronger performer this year was the animal healthcare division which grew EBIT by 26%, but is still less than a quarter of the size of the human healthcare division. This division sells pet food and also acts as a wholesale distributor to vets, much as the human healthcare business is a distributor to pharmacies. This includes pharmacies that EBOS Group owns (such as Terry White) and also ones it does not (such as Chemists’ warehouse). It’s probably worth mentioning that distributing to Chemists Warehouse is an advantage, due to scale, but also a disadvantage, given they are a powerful customer that can bargain hard on price.

EBOS To Invest In Growth

One of the most important parts of the announcement today is that the company is making acquisitions in its human healthcare division, and investing in manufacturing its Black Hawk pet food brand. The company said:

“EBOS is investing approximately $80 million in a new state of the art pet food manufacturing facility in NSW, Australia that will facilitate insource manufacturing of Black Hawk as well as accelerate new product development opportunities. The initiative is expected to generate returns over the medium term in line with the Group’s Return on Capital Employed (“ROCE”). In addition, subsequent to 30 June 2021, EBOS has acquired another medical devices distribution business and has a high degree of certainty of executing a further acquisition in the near term that will expand our Institutional Healthcare division. These two acquisitions will have aggregate consideration of approximately $80 million and each will be EPS accretive to shareholders.”

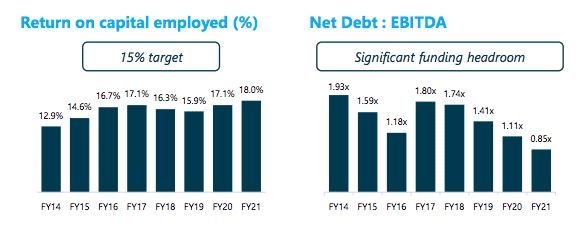

In terms of guidance, the company merely said that, “it expects to be able to generate further growth in FY22.” As you can see from the graphs below, taken from the company’s presentation, EBOS Group has increasing return on investment and decreasing debt load. This puts it in a good position to continue to invest capital for growth; whether by building out its own facilities, or by acquisition.

Just over one year ago I wrote that Ebos Group Is An Attractive Defensive Stock To Own. With these results, EBOS preserves its attractive features and I believe it still has a bright future as a defensive business. However, the share price is up approximately 50% since I wrote that article, and even though I have not sold a single share, I am not a buyer at current prices. The reason I continue to hold is that I believe this is a well run business with a genuine moat. That’s because it is very difficult to build a distribution network from scratch since margins are thin and you need scale to compete. Furthermore, given the fact EBOS distributes essential medicines, it has a defensive nature. On the other hand, it also is investing in premium pet food, which seems like a good idea, given that people continue to spend more on their pets and increasingly consider them almost human; and part of the family.

On the conference call the CEO said that “There continue to be a range of positive and negative impacts from covid 19. On an overall net basis we estimate the impact was slightly positive.” From the comments around investment, it seems likely that the company will be investing heavily in growth over the next couple of years, so I’d be surprised to see free cash flow grow very much. Longer term, the company intends to try to increase its market share over the next few years. When it comes down to it EBOS is a scale player in a competitive industry and continues to execute on a sensible, measured growth strategy combining both acquisitions and greenfield investment.

Please remember that these are personal reflections about a stock by author. I own shares in EBOS Group at the time of writing, and will not sell them for at least 2 business days after publication. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

An aside from me: If you watch Ausbiz, and want to be alerted of interviews I do as they happen, you can follow me on Ausbiz. I do appreciate any follows on that platform, so if you do follow me; Thanks!

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.