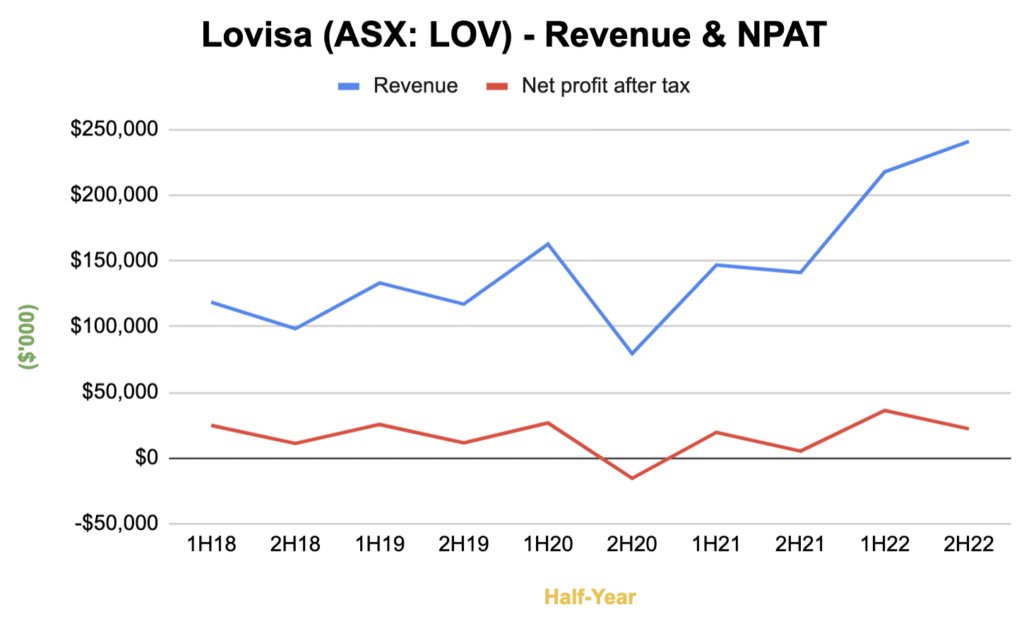

Lovisa Holdings Ltd (ASX: LOV) recorded stellar results for FY22 as revenue surged 59% to $458.7 million and net profit after tax more than doubled by 116.3% to $59.9 million. This is based on a 53-week fiscal year. The Lovisa FY22 results glistened across the top line and bottom line with gross margins lifting from 76.7% to 78.9% and operating cash flow jumping 48% to almost $150 million. Lovisa managed to pass on price increases to absorb the negative impact of rising raw material and freight costs. The fast-fashion jewellery remains financially healthy with $24.2 million in net cash and no debt. Management declared a final 30% franked dividend of 37 cents per share, taking the FY22 total dividend to 74 cents per share.

These Lovisa results showed free cash flow improvement from $50.6 million to $64.2 million. This is based on operating cash flow of $149.95 million and then taking out lease payments of $48.4 million and capital expenditure of $37.4 million. The capital expenditure comprises of $34.5 million in costs associated with the rollout of 104 new company-owned stores.

Store rollouts spearhead growth in FY 2022 Lovisa Results

The number of Lovisa stores went up from 544 in FY21 to 629 in FY22. To date, Lovisa has rolled out another 22 stores, bringing the total to 651 as it entered Canada, Poland, Hong Kong and Namibia.

Lovisa’s expansion across Europe through the Beeline GmbH acquisition, along with growth in the USA, were the biggest revenue drivers. Europe more than tripled its revenue from $40 million to $140 million and the Americas (including one store in Canada) nearly doubled its revenue to $71.96 million. Australia & New Zealand, Asia and Africa all posted solid growth as well.

In my initial deep dive on Lovisa, I identified the US, United Kingdom, France, Germany, South Africa and Malaysia as the largest market opportunities.

Lovisa nearly doubled the number of stores in the US, increasing its store count from 63 to 118.

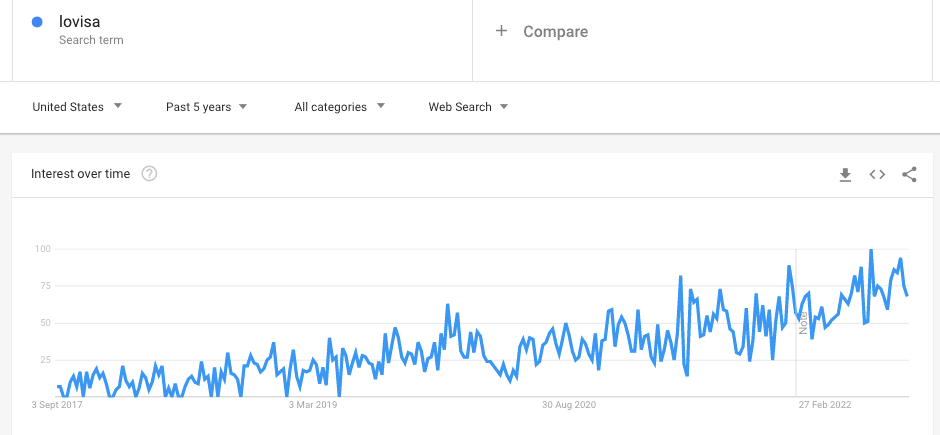

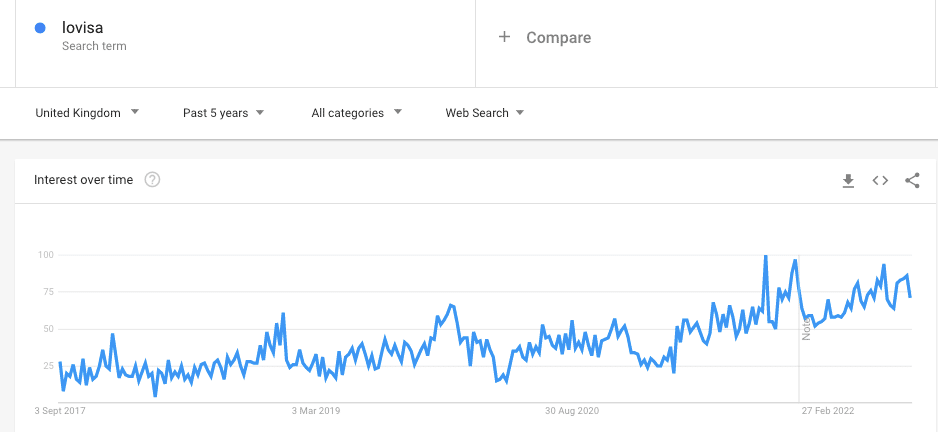

If we look at Google Trends for the US and the UK, google search interest is compounding nicely. The trend rate isn’t accelerating as quickly in South Africa and Malaysia though.

I haven’t included the trends for France and Germany because it’s still too early to develop a trend given Lovisa only acquired the stores in FY21. Also, the trend in Malaysia is less accurate than in other countries because English is not the predominant written language.

On the basis of Lovisa’s FY22 results alongside these google trends, it appears its product offering is resonating across the key growth pillars.

Out of all the new geographies that Lovisa has ventured into recently, Canada is the most exciting prospect in my eyes. Management highly encouraged analysts on the FY22 earnings call to limit their questions to one, so I focused on the opportunity in Canada. The most important factor behind my thesis is Lovisa’s extreme focus on serving a niche segment within the broader fashion and jewellery value chain. Incumbent competitors that are producing similar fast fashion jewellery and accessories can make it challenging for Lovisa to achieve sound economic returns as was the case in Spain. As such, I asked management who they see as their biggest competitor or threat in Canada.

Lovisa CEO Victor Herrero provided the following measured response:

We don’t disclose specific details to the market … but the opportunity … is kind of an evolution from the US market … We opened in West Edmonton and we are pleased with that … we don’t disclose competitors … I think some players like Claire’s are aggressively rolling out in the Canadian market … so maybe they will be one of our competitors.

I was very thankful that Victor disclosed the location of the maiden store in Canada because West Edmonton would be the last place I’d search for a Lovisa store. As you can see from the screenshot of the Lovisa store in West Edmonton Mall, it’s surrounded by familiar names like Swarovski, Pandora (CPH: PNDORA) and rival, Claire’s.

Whilst it’s quite evident that Lovisa’s foray into Canada stemmed from the US experience, Herrero’s comment that it evolved from the US is important. Given Lovisa’s sound execution in the US to date, Canada presents an almost carbon copy opportunity with similar demographics and competitive dynamics albeit a much smaller population at around 38 million. I had a closer look at other boutique jewellery shops and Claire’s appears to be the only competitor that somewhat resembles Lovisa but even then I wouldn’t treat their rivalry akin to McDonald’s and KFC or Nike and Adidas. As long as Lovisa focuses on improving its existing niche product offering with similar shop layouts, I believe Canada provides a long runway for growth.

Based on the data disclosed by the government of Canada, the estimated female population in the age bracket of 15-39 yrs old is in the order of 6.1 million, around a million more than Australia. So the current number of 154 stores in Australia could act as a barometer for the opportunity in Canada.

There was a small hint that Lovisa is thinking about China when Herrero addressed an analyst’s question on why Lovisa is experimenting in Hong Kong. Herrero said it would be an opportunity to use Hong Kong as a way to evaluate China as a market opportunity.

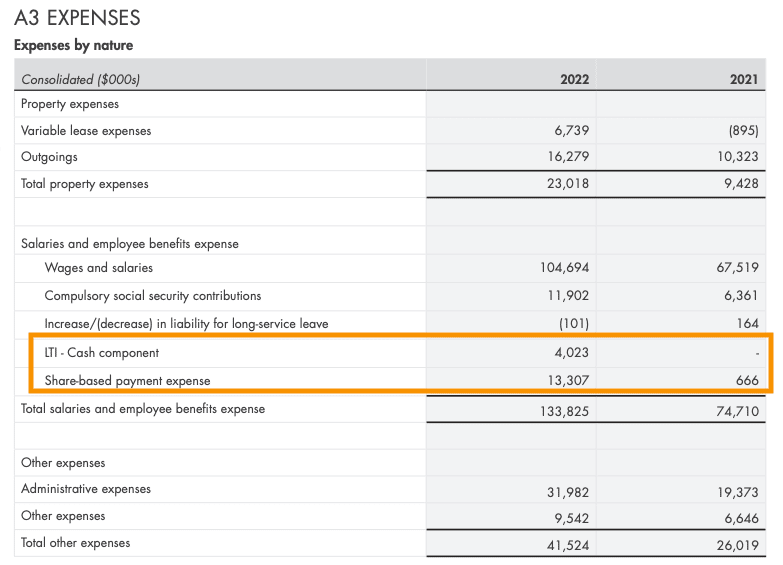

The FY22 Lovisa Results Show Consistent Expenses

Across the board, expenses came in broadly in line with historical figures as a percentage of revenue. The only material difference was due to an uplift in executive remuneration paid from long-term incentive arrangements. As depicted below, $4 million pertained to a cash bonus payment and $13.3 million for share-based expenses. Overall, this represented 3.78% of total revenue.

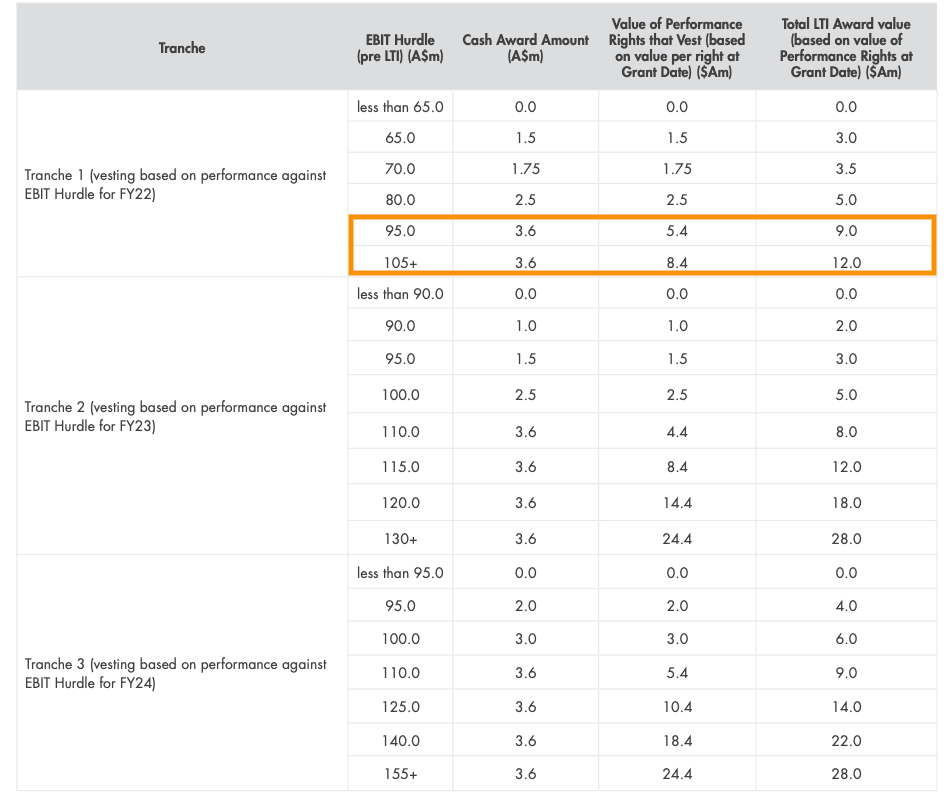

Management provided a breakdown of the LTI for FY23 and FY24 and it shows significant upside potential for the CEO if he manages to hit the highest earnings before interest and taxation (EBIT) hurdle rate as outlined below. Herrero is off the blocks since being appointed in October 2021, already achieving the second highest hurdle rate for EBIT in FY22.

It’s great to see a higher proportion of the LTI benefits being awarded in shares rather than cash, which encourages longer-term thinking. However, the hurdle rates for FY23 and FY24 appear to be on the lower end given Lovisa recorded $101.3 million in EBIT for FY22. If the company keeps performing the way it is now, the CEO stands to still receive a considerable sum in benefits. The big performance carrots for the two highest hurdle brackets could push Herrero harder to reach EBIT of $120 million plus in FY23 or $140 million plus in FY24.

I find the overall LTI structure quite reasonable in promoting long-term behaviour and fostering shareholder wealth creation. The executives and the CEO are rewarding themselves but they are executing well and producing strong results, and $32.5 million was reinvested into store rollouts. For now, I think it’s just an area to monitor because of the material uptick this year.

This is the first earnings call I’ve listened to Herrero speak and his direct and frank approach to answering analyst questions instilled some level of confidence in his ability to focus on the what matters. Herrero wasn’t interested in providing analysts with more information and forecasts, but rather reiterating the strategy of finding optimal locations to execute on its global rollout. Also, when faced with a question about the macroeconomic and external pressures like inflation, labour shortages and freight costs, Herrero bluntly said they’re not going to use these such circumstances as excuses but rather find opportunities to improve the business like renegotiating supplier terms.

Herrero seems to be continuing on Shane Fallscheer’s legacy in fine fashion but it’s still too early to judge his performance.

What Does The Lovisa Share Price Tell Us?

The fast-fashion retailer has historically traded on a P/E multiple of 26x and is currently trading at around 33.5x as seen below.

Considering management has a solid track record of exceeding performance targets, and the market opportunity remains so vast, it’s hard to argue that Lovisa isn’t worthy of such a high multiple for a retailer. Time and time again, management has executed, and is not afraid to hastily pull out of markets if the unit economics don’t stack up. Whilst Herrero is still less than a year into his tenure, management keeps rolling out more stores and coming up with the goods. These are some of the key reasons why I believe the business will likely remain at high multiples. Having said that, the current share price does indicate an expectation of ongoing growth, and so you could argue the share price already reflects the fact that Lovisa is one of the better retail stocks on the ASX.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Disclosure: the author of this article owns shares in Lovisa (ASX: LOV) and will not trade Lovisa shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.