Yesterday, invoice financing and trade financing lender EarlyPay (ASX: EPY) announced that Damien Riley, the CEO, and son of the founder, would be resigning, following from the AGM in November. On top of that, the announcement said that “Beyond November, Daniel will continue as a Non-Executive Director and Greg Riley will be retiring from the Board of Directors at the November AGM.”

We and we only found out that Greg Riley was stepping aside at the full year results. He said:

“Reflecting on my seven and a half years as chairman, I have seen the CEO and Executive Team transform the business from a human resources business into a strongly growing fintech. We have never had a loss making year and pay a fully franked dividend of around 5%. The share price has risen 170% and EPS 340%. The average compound annual shareholder return during that time has been 17% (including franking credits).”

Quite.

The company has already got an internal candidate for the CEO role. The announcement said: “In the interim period, James Beeson, currently Chief Operating Officer (“COO”) and Executive Director at Earlypay, will transition from COO to CEO and Managing Director. Earlypay has also commenced the hiring process to fill the COO role with an experienced finance executive.”

Presumably, the company will be able to find a new COO within the next couple of months.

Ultimately, it seems like this transition process is being handled very well.

Nonetheless, I bought Earlypay shares mostly because I was impressed with the dividend yield.

In that article, I emphasised that alignment with management was important. I showed how both the Chairman and the CEO had millions of shares. I said:

“One gets some comfort from the fact that the leadership is well aligned and the listed entity (previously CML, and before that Careers MultiList) has existed for very many years. That isn’t a sign of success but it does mean that the leaders have stewarded a business for many years without blowing up, defrauding people, or coming into severe disrepute. That is especially valuable given investing in an invoice financing business is to trust the judgment of the people running it.”

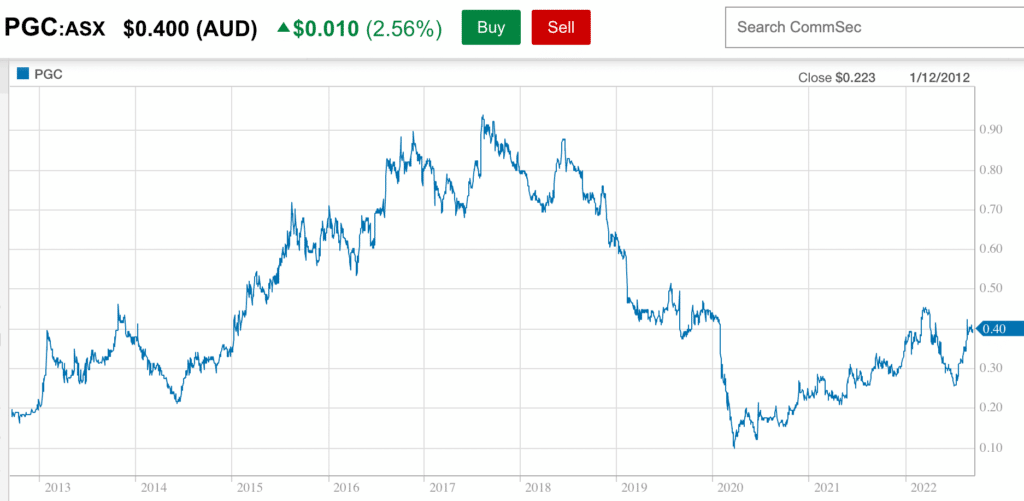

The new Chairman Geoff Sam OAM owns around $1m worth of shares, but he has also been a shareholder of Paragon Care (ASX: PGC) since 2016. In the years since he joined the board, earnings per share have fallen considerably, and so has the share price.

However, the appointment of James Beeson is definitely sensible, as it would be hard to imagine a better candidate. He jointly holds 15,652,453 EPY shares (4,318,989 as consideration for Skippr and 11,333,464 purchased on-market) which represents 5.45% of Earlypay Limited’s issued capital.

On the one hand, I think that this transition has been handled very well, and it doesn’t seem problematic to me. On the other hand, we won’t know if Greg Riley starts selling is 17 million shares, once he leaves the board in November. Furthermore, the actual outlook for the economy isn’t great.

Anyway, I think that this change over looks as innocuous as any, but I also have a general default policy of selling shares when CEOs leave. I do make exceptions to this, but mostly those exceptions turn out badly (for example, Corum Group). Basically, no matter how much I believe in the company, CEO changes are just far too often coincident with negative outcomes. This is not always the case. Hence, I do make exceptions to this rule. But the default rule remains.

In this case, I don’t have enough passion, interest or conviction behind the Earlypay business model to really want to make an exception to my default rule. Now, the actual CEO and Chairman changeover isn’t happening until the AGM, so I’m not too worried about this. But as a matter of default policy, I’m going to sell my Earlypay shares some time after this article, probably sooner rather than later. Please note that the ex-dividend date is tomorrow. Anyone who holds the shares until the end of the day will be owed the 1.8c dividend payable on 7 October.

I’m quite disappointed with this outcome but I don’t want to invest too much energy in a lending business since I don’t think it was going to be a multi-year multi-bagger anyway. For a dividend stock, I just want a good clear track record and a steady hand at the tiller. I would not rule out buying back into EarlyPay shares in due time, as I have nothing against new management. However, selling my shares will act as a re-set. I hope to recoup my purchase price and benefit from the dividend so I will aim to sell at around the current price of 48 cents per share (though may go lower or higher than that, depending on patience and fortune).

Ultimately, I think I would have tolerated the Chairman leaving, or the CEO resigning, but the father and son duo both deciding to leave at the same time seems like the kind of coincidence I never want to see.

Disclosure: the author of this article owns shares in EarlyPay and will not trade EarlyPay shares for 2 trading days following this article (including the day this article is published). Subsequently, the author does intend to sell his shares. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.