Prophecy International Holdings Limited (ASX: PRO) is a software and SaaS company serving both mid to large enterprise and government customers on a global scale.

I wrote an article on Prophecy International back in October 2023 explaining that I held Prophecy shares and arguing that it was “worth further research as a potential hidden gem in the ASX small cap space.” That article is now free to read, so you can check it out now if you haven’t already.

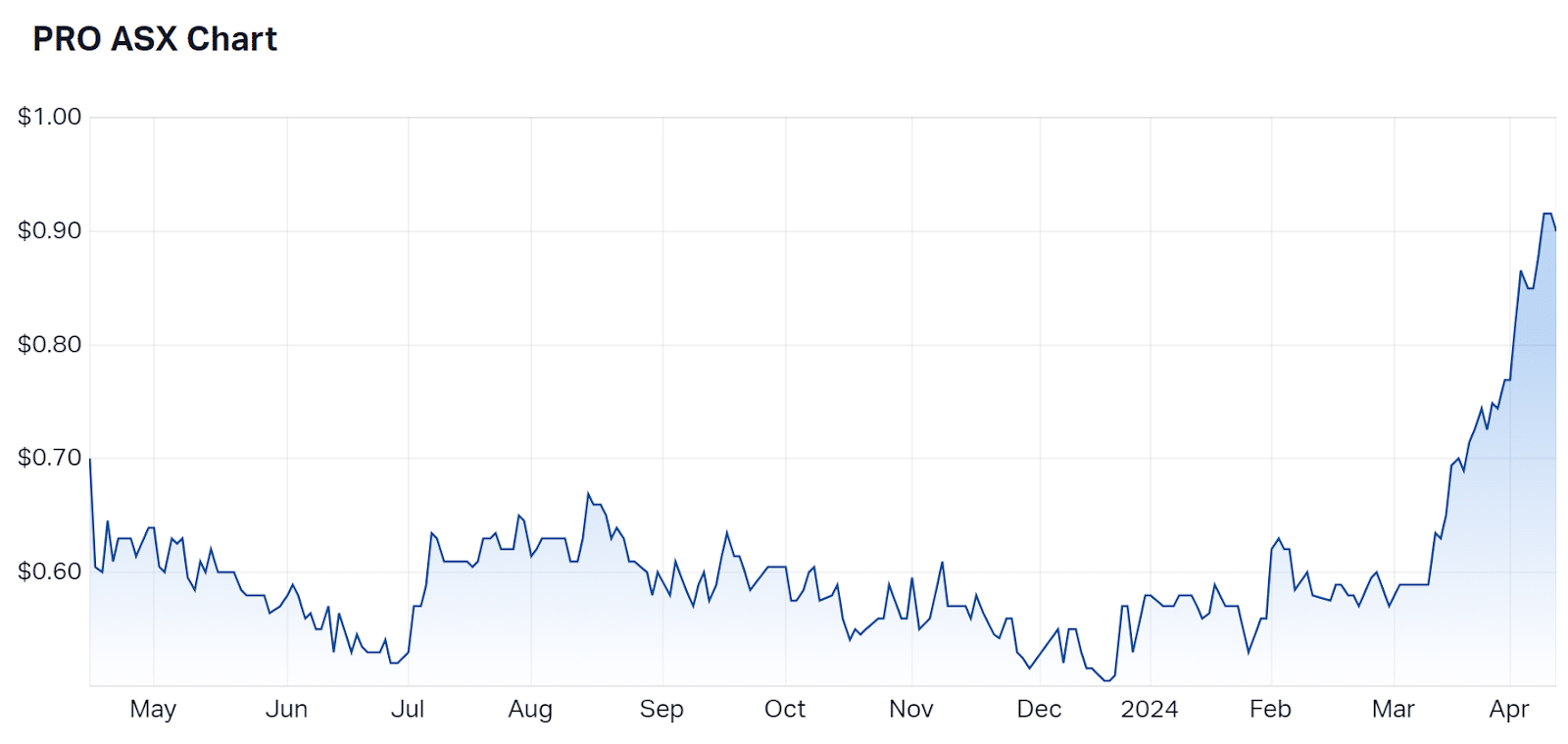

One key argument was that the company was reaching an inflection point and the transition from perpetual licensing to a subscription model for its Snare product wasn’t fully appreciated by the market. On top of that, I was expecting expense growth to slow. The share price traded sideways up until about a month ago and since then it has gone on an impressive run, jumping by over 50%.

So what has driven this growth in share price?

Prophecy International H1 FY 2024 Half Year Results

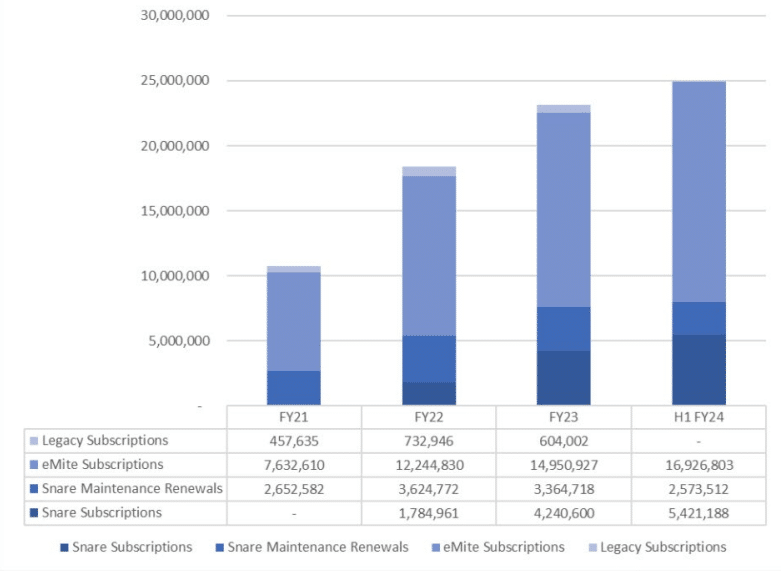

Prophecy had a strong first half report with revenue growth of 27% to $11.4 million compared to the previous half.

The company’s loss for the half reduced to $1.5 million down from $2.1 million. Group annualised recurring revenue (ARR) grew by 21% to $24.9 million. It was a relief to see this improvement as it followed on from a poor ARR update after Q1 2024 where ARR “grew” to $22.56 million despite the reported ARR number at 30 June 2023 of $23.2 million.

At the time management said the 30 June number included legacy revenue which being legacy shouldn’t really be considered recurring. I was unsure how comforting this explanation was, but I am happy to see some genuine growth in the most recent half.

ARR is an important metric to track as a leading indicator of business performance. Prophecy operates under a negative working capital model, wherein customers are billed in advance for a 12-month period. Consequently, any reduction in ARR is promptly reflected when customers discontinue their subscriptions. A decline in overall revenue will only manifest well after the loss of the customer, because revenue is recognised gradually over time.

Source: Prophecy Updated Investor Presentation

The third quarter is historically a strong quarter for the business as a number of large Emite customers are invoiced.

The company is targeting a cash flow positive result for the full financial year. A big factor of this is the Devo partnership discussed below and the quicker it can be rolled out the more likely that this target will be met.

Devo partnership

In January 2024, Prophecy announced a new strategic partnership with US-based security data and analytics company Devo Technology.

As part of the agreement, Devo customers will gain access to Snare Prophecy’s Centralised Log Management and Security Analytics products designed to enable customers to detect and manage cyber threats.

The Devo deal is the kind of deal you hope to see more of. Devo endpoint technology is being shut down and completely replaced by Snare. There is no additional cost to the end user which I believe would result in a lot lower chance of customer churn. Devo pays Prophecy based on the amount of data ingested each month via Snare. The more data collected on the network, the more that can be charged. It benefits the end user as the more data collected reduces the risk and increases the visibility for the customer. The downside for the customer is that data can fluctuate up and down making it difficult to budget what could be charged.

This payment structure varies to previous Prophecy deals whether end users are charged based on the number of servers and end agents in place. According to the H1 FY 2024 earnings call update, which occurred after the Devo partnership was initially announced, there are a number of other potential partners similar to Devo around the world and Prophecy is in early stage discussions with some of those.

Prophecy provided a further update on the Devo partnership, in March, and this coincided with the beginning of its share price run. This announcement noted that if Prophecy successfully migrates all Devo’s existing customers onto Snare, it could result in an increase in incremental ARR of more than $5 million, driving ARR growth over 25%. In any event, Prophecy expects to have added $1 million of ARR through the Devo partnership, by the middle of calendar year 2024.

Is Prophecy still a hidden gem?

Given recent price movements it’s a lot less hidden.

The narrative around the business and what appeared to be stagnating revenues put pressure on the share price. As the transition from legacy licences to a subscription model unfolds perhaps investors are starting to take notice of the recurring revenue streams and higher-quality income. Prophecy is a highly illiquid stock and there is every chance valuation may have outpaced underlying realities as investors seek to establish positions.

With that said, Prophecy’s market capitalisation at the current price of $0.90 is about $67 million. This puts the stock on about 2.7 times its ARR.

Arguably this multiple reflects pessimism about the business, given mining software stock RPM Global (ASX:RUL) trades at around 8 times ARR, and accounting software company trades on around Xero (ASX: XRO) 10 times. If Prophecy can become profitable, it would make a better comparison to these other profitable stocks, and would quite likely appear cheap at the current multiple.

In the near-term, the current share price probably reflects a view that Prophecy will be break-even or cash flow positive for the year; so I expect downside if it does not meet this goal. Not only that, the higher for longer narrative around interest rates will also put pressure on the pool of growing tech stocks, so any miss likely to be punished by the market in my opinion.

On a more optimistic note, while the company is achieving ARR growth, reducing losses, and signing partnership deals like the one with Devo, I am happy to continue holding. Of course, I will continue to keep an eye on management commentary particularly around its financial performance.

Disclosure: The author of this article Nick Maxwell does own shares in PRO. The editor Claude Walker does not own shares in PRO. Neither will trade PRO shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).