Catapult International (ASX: CAT) sells technology designed to track professional athlete performance, and measure vital signs during sporting events. The Catapult share price has been very volatile since listing in late 2014. The FY 2022 Catapult results showed revenue of just over US$77m, up over 50% in a year. However, in FY 2022 Catapult made a loss of US$32.3 million, a whopping increase on a loss of US$8.8m in the year prior. This article will look at Catapult International’s competition.

My love and passion for sport was the primary reason why Catapult caught my attention. I became more enamoured with the sports performance data analytics business when it appeared to provide a mission-critical service in a growing niche segment, and boasted global powerhouse clients like Manchester United, Real Madrid and Green Bay Packers. Catapult has shown moments of brilliance but it has been far from a consistent stock to own. In this article, I take a look at why I think Catapult International’s competition partly explains its mediocre performance as an investment in the last 6 years.

When Was Catapult International Founded?

Shaun Holthouse and Igor van de Griendt founded Catapult in 2006. The foundation technology was built from a collaboration between the Commonwealth Co-operative Research Centre (CRC) for microtechnology and the Australian Institute of Sport. Both founders were project managers at CRC in the early 2000s.

Shaun Holthouse and Igor van de Griendt decided to list on the ASX in late 2014, where Shaun took the reins as CEO and Igor focused more on the tech development and operations as COO. However, the co-founders have slowly distanced themselves from managerial and day-to-day operations of the business in the last five years. They were both executive directors of a board spearheaded by chairman Adir Shiffman for around six years since listing on the ASX. Now, Shaun and Igor are non-executive directors, playing passive roles in the operations of the business.

Why Are Founder Lead Companies Interesting?

As we can see below, founder-led companies outperformed other companies in the index of S&P 500 companies.

Having a founder at the helm is by no means a prerequisite to achieving greatness. But when it comes to Catapult, my concern is its competitors are benefitting from active founders, more closely involved with managing the businesses.

Catapult’s two biggest competitors are Hudl and STATSports. Hudl remains the dominant video software analytics solution for sports around the world and STATSports is arguably the leader in sports wearable devices. Catapult is striving to be the best all-in-one solution in video and wearables to optimise the performance management of athletes. I’ve preferred to see a company focusing on whatever it can become the best at. Lovisa (ASX: LOV) and PWR Holdings (ASX: PWH) are good examples of this. So instinctively, I think its more-focussed competitors may be at an advantage.

When Was Catapult International’s Competition Founded?

Hudl was started by three cofounders while they were studying at Nebraska in 2016. Current Hudl CEO David Graff was working in the sports information department and realised there was a big opportunity to capture video, index it and make it shareable to players in the university football team. Graff teamed up with Hudl Chief Technology Officer Brian Kaiser and Hudl Chief Product Officer John Wirtz to develop a solution that enabled coaches to share video footage, playbooks and messages within the team. Hudl now works with 200,000 teams across the globe in over 40 team sports.

Despite the amazing growth, all three founders continue to drive the Hudl group from the front. And it seems like they’ve recognised where each of their strengths lies, ensuring the best person is deployed in the particular role.

Graff’s passion for sport and entrepreneurial energy was showcased by his willingness to talk to original the football coach, figure out what he needed, and try to provide it. So, it makes sense for Graff to lead as CEO.

Kaiser created the first version of Hudl for its first client, the Nebraska Cornhuskers and operated a computer repair shop in high school, so appointing him as the CTO is only fitting. Last but not least, Wirtz was part of a computer science program and rooming with Kaiser. He started as a developer but then moved on to managing the sales team and is now ensuring that Hudl’s product contains the leading features as CPO.

Hudl’s lineup is impressive, to say the least, and they’ve managed to stick together since 2006, showing their commitment and passion to being the leading sports video solutions provider. It’s rare to find co-founders working together for such a long period of time, which is why I find it a bit daunting when evaluating Hudl as a direct competitor in the video space.

STATsports continues to be run by co-founders Alan Clarke and Sean O’Connor, who are acting as CEO and Chief Operating Officer respectively. The pair have been leading since establishing STATSports in 2008. Clarke completed a mechanical engineering degree and worked in senior roles within the music industry. O’Connor has a sports science background and was lecturing in Newry tech when he spoke with Alan about the business idea.

Despite possessing fewer employees than Catapult, STATSports has managed to secure landmark deals with US Soccer, the Chinese Football Association and the New Zealand All Blacks rugby union team in the past few years. The benefit of having founders leading the business is that they find ways to outcompete bigger rivals. According to LinkedIn, Catapult has 54 sales and 90 business development staff, which dwarfs the 37 sales and 31 business development staff at STATSports.

It’s interesting that STATSports has managed to secure similar sized deals with a more nimble salesforce. In Catapult’s defence, it’s also focusing on its video solution in an attempt to develop an all-in-one platform. Whereas STATSports has the benefit of purely focusing on wearables.

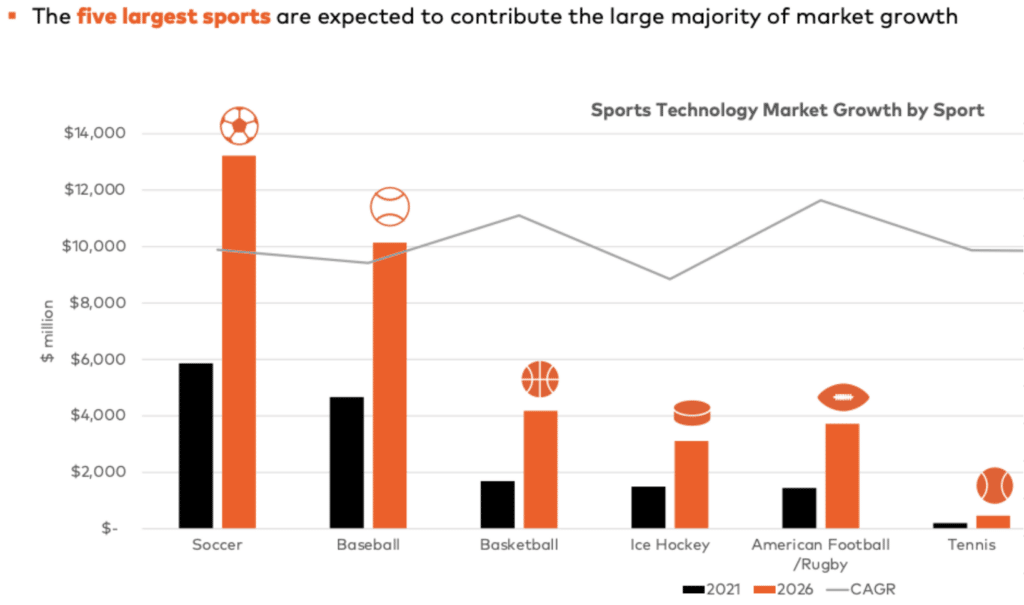

It is worth noting the US and Chinese football deals because they probably represent the biggest growth opportunities. In Catapult’s slide below, we can see soccer as the biggest growth driver compared to the other sports, with the largest forecast increase in market size.

Is Catapult International’s Competition Better Positioned In Soccer?

I initially thought Catapult’s acquisition of SBG Sports Software would be the game changer, enabling it to overpower Hudl and become the dominant video solution in sports. Upon reflection, I think I put too much weight on SBG’s stellar reputation amongst the Formula 1 circuit and top English Premier League clubs. I believe the most independent and accurate way of gauging the importance of SBG’s solutions compared to Hudl is by observing the knowledge required in analyst job postings from football teams.

When I looked at the performance analyst job openings at Arsenal FC and Norwich City FC, both listed a few of SBG’s solutions as desirable competencies in December 2021. However, fast forward nine months and it appears SBG’s software is not as important as I first thought. Below is a list of the recent football analyst or scout job openings and the preferred solution that the football clubs want applicants to have experience with.

- Brentford FC – B Team & Lead Academy Performance Analyst

- WyScout (Hudl), Angles (Fulcrum Technology), RT Tactic Pro (RT Software)

- Arsenal Women’s Football Club – Lead Analyst

- Sportscode & Studio (Hudl)

- Arsenal Academy – Football Analyst

- Sportscode & Studio (Hudl) listed as essential

- Match Tracker & Focus (SBG) listed as desirable

- Others listed as desirable include GameOn Technologies, ChryonHego and CoachPaint

- West Bromwich Albion – First Team Performance Analyst

- Angles (Fulcrum Technology), Sportscode (Hudl), Matchtracker (SBG), Provision (Stats Perform), Coach Paint

- Ipswich Town Football Club – Performance Insights and Methodology Analyst

- Sportscode & WyScout (Hudl) and CoachPaint

- Brighton & Hove Albion Football Club – Performance Analyst (Women’s & Girls’)

- Sportscode & WyScout (Hudl) and InStat

- D.C. United – Video Scout

- Sportscode & WyScout (Hudl) and Spiideo

- Aston Villa – Senior Scout

- WyScout (Hudl) and ISF

Based on my perusal of English Premier League job openings, Hudl remains the preferred solution for football analysts and scouts, with more mentions than SBG. There were also a few solutions like Fulcrum Technology, RT Software and Stats Perform that I hadn’t come across in my prior review of football analyst job openings in December 2021. This is a bit concerning because there appear to be more niche solutions popping up that seem to complement Hudl.

At this juncture, it’s important to remember that Catapult started off as a sports tracking device business with the core focus of helping athletes monitor and analyse their health and performance. Catapult only decided to venture into video analysis when it partnered with XOS Technologies in May 2015 and ultimately ended up acquiring them a year later.

Most of XOS Technologies’ clients were from the National Hockey League (NHL) and National Football League (NFL). Catapult has tried to build its video solutions through acquisitions as opposed to Hudl, doing it from scratch and consistently improving the foundation. Hudl’s core focus from the beginning was to develop the best video analytical solution for sporting teams around the globe, it hasn’t wavered from this overarching goal.

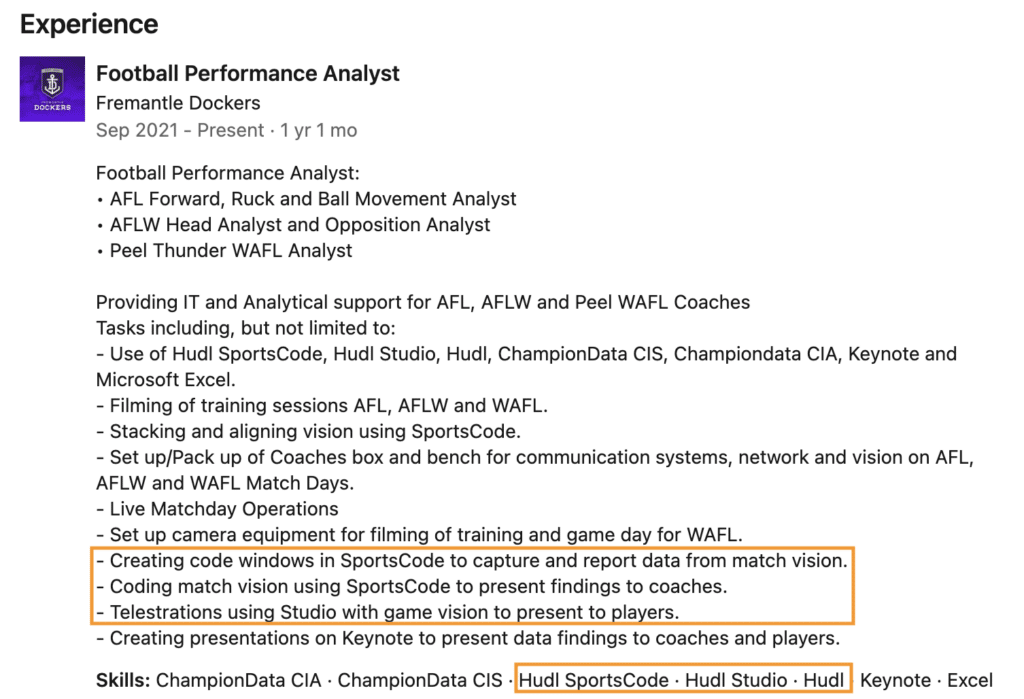

I think I’ve underestimated the power and impact of Hudl’s first mover advantage in the sports video analytics space. I would have thought Catapult had a hometown advantage in upselling its video solutions to sporting teams in Australia but Hudl remains the preeminent video solution in Australian sport. The following LinkedIn resume of a current football performance analyst at the Fremantle Dockers highlights the importance of Hudl.

Also, last week’s Australian Sports Technology Conference highlighted how ingrained Hudl’s solutions are in our domestic sporting teams. The conference was powered and sponsored by Hudl and you can see the below conference agenda that Hudl is a popular solution for Football Australia and the National Basketball League.

Catapult International’s Competition Is More Focussed

My initial excitement was spurred on by the possibility that SBG’s technological edge and reputation could propel Catapult towards stardom and take Hudl’s seat in the video segment. Despite SBG’s solutions being used by the biggest sporting teams in the world, Catapult hasn’t really managed to land many major new wins. I thought the SBG acquisition would become a key driver in bringing in high-margin revenue but Catapult’s progress to date falls short of the entertaining narrative I had in mind.

My previous articles on Michael Hill (ASX: MHJ), Lovisa (ASX: LOV) and PWR Holdings (ASX: PWH) served as important reminders of how powerful a business can become when it focuses purely on what it can become the best at in the world. In this case, I’ve become more wary of what Catapult is up against, so it’s time to take a hard look in the mirror to understand whether Catapult is capable of pulling off a David and goliath victory.

Please note that I am currently a shareholder of Catapult International, and this article should not be read as indicating my future intentions in trading the stock. Indeed, this article focuses on the competitive positioning of Catapult and is not intended as a commentary on the stock price. I will not trade Catapult shares for 2 days following the publication of this article, but reserve my right to acquire or dispose of Catapult shares in the future.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Disclosure: the author of this article owns shares in Catapult (ASX: CAT) and will not trade Catapult shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.