Michael Hill International Ltd (ASX: MJH) expressed some love through its solid set of financial results for FY 2022 as revenue increased 7% to $595.2 million and net profit after tax surged 13.9% to $46.7 million. Gross margins lifted from 62.7% in FY21 to 64.7%. Michael Hill’s cash position grew from $72.4 million to $95.8 million and it continues to be debt-free. Net operating cash flow went backwards from $134.5million to $111.6 million due to a lift in inventory and employee payments. Capital expenditure on property, plant and equipment more than doubled from $6.4 million in FY21 to $15.6 million.

Free cash flow, after subtracting all investing cashflows and lease payments was $48.6m.

The ASX-listed jeweller declared a final dividend of 4 cents per share unfranked, taking the total dividend for the year of 7.5 cents per share. The Michael Hill results also reported that an on-market share buy-back of up to 5% of Michael Hill’s capital will likely commence around September 2022. This will be funded from existing cash reserves.

Michael Hill Results Boosted By Canada

Michael Hill primarily sells traditional jewellery pieces to the 25-50 yrs old age bracket across Australia, New Zealand and Canada. Prouds, Angus & Coote and Goldmark, who are all owned by James Pascoe Ltd, represent Michael Hill’s main competitors, making it an oligopoly dynamic in the traditional jewellery segment. Michael Hill has achieved great success in Australia and New Zealand since opening its first store in a town about 160km north of Auckland, New Zealand in 1979.

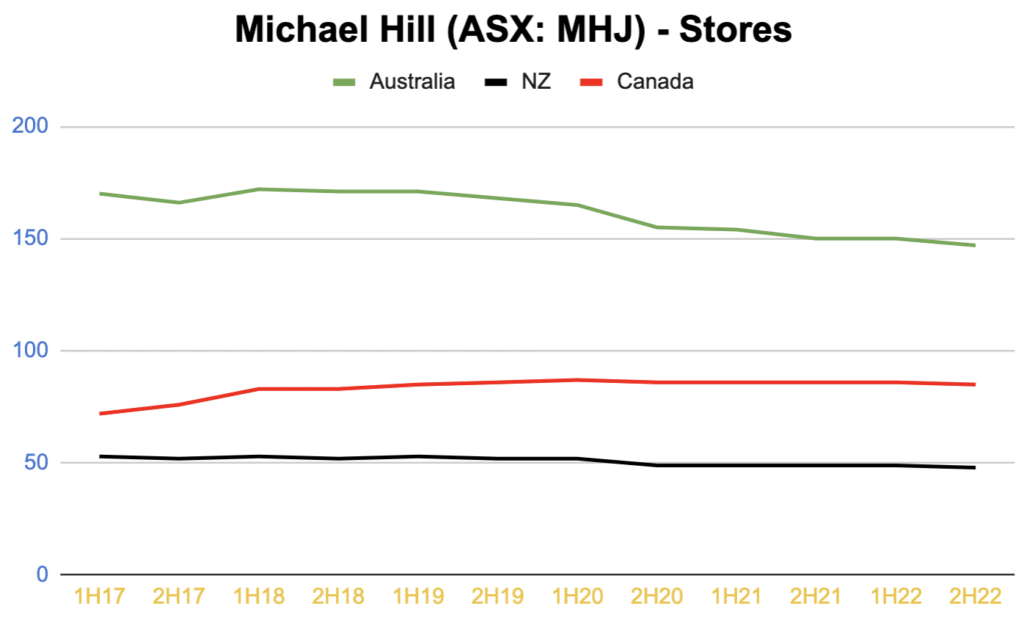

However, past Michael Hill results paint a picture of maturation across Australia and New Zealand as the number of stores continues to drop. The number of stores in Australia reached a peak of 172 in 1H FY18 and for New Zealand, the pinnacle was 53 from FY17 to FY19. The below chart provides the trend of the number of stores since 1H FY17.

It’s interesting to see that the number of stores in Australia (147) currently corresponds with that of Lovisa with 154 stores. Lovisa has oscillated between 150 to 158 stores since FY18, showing signs of potential maturation. New Zealand stores for Michael Hill hasn’t declined as rapidly as Australia but is also showing the same signs of limited runway for growth.

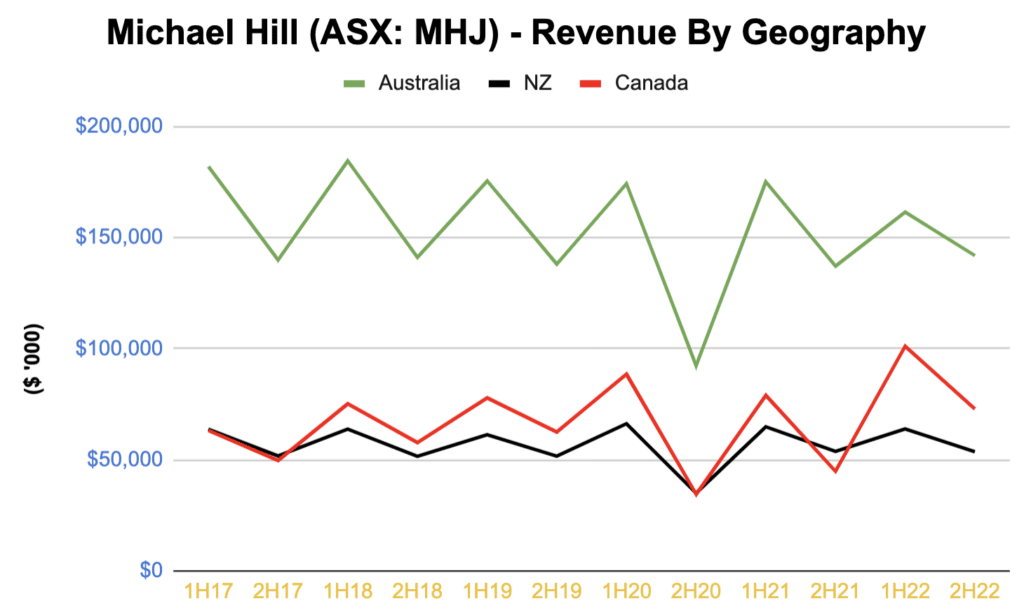

Canada is the only geography that has managed to record consistent growth over the last decade. This is reflected in the revenue trend for each segment depicted below.

Even though Australia and New Zealand are not the same growth accelerators as they once were, management has optimised the profitability of these segments. In FY22, Australia and New Zealand recorded earnings before interest and taxation (EBIT) of $51.8 million and $28.4 million, representing 17.1% and 24.2% of revenue respectively. Back in FY 2013, Australia and New Zealand had EBIT margins of 14.6% and 19.9% respectively. The upward trend of digital sales is likely playing a role in this as digital sales increased by 23.4% to a record $42 million in FY 2022.

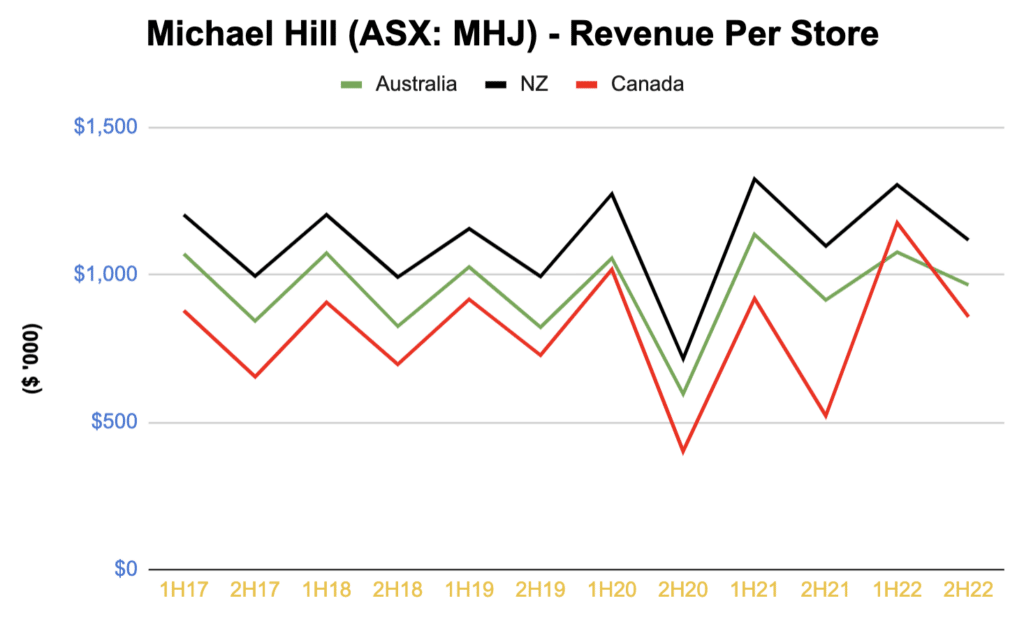

As Australia and New Zealand focus on becoming leaner, Canada revenue continues to gather pace. The EBIT margin came in at 19.6% for Canada, a significant step up from 12.8% in FY21. Canada may become a better version of Australia after briefly surpassing Australia in terms of revenue per store as illustrated below.

As I highlighted in my coverage of Lovisa’s FY22 results yesterday, Canada’s female population aged between 15-39 is estimated at 6.1 million, around a million more than Australia. So, Michael Hill could potentially open up to 150 stores using Australia as a gauge for the total addressable market in Canada.

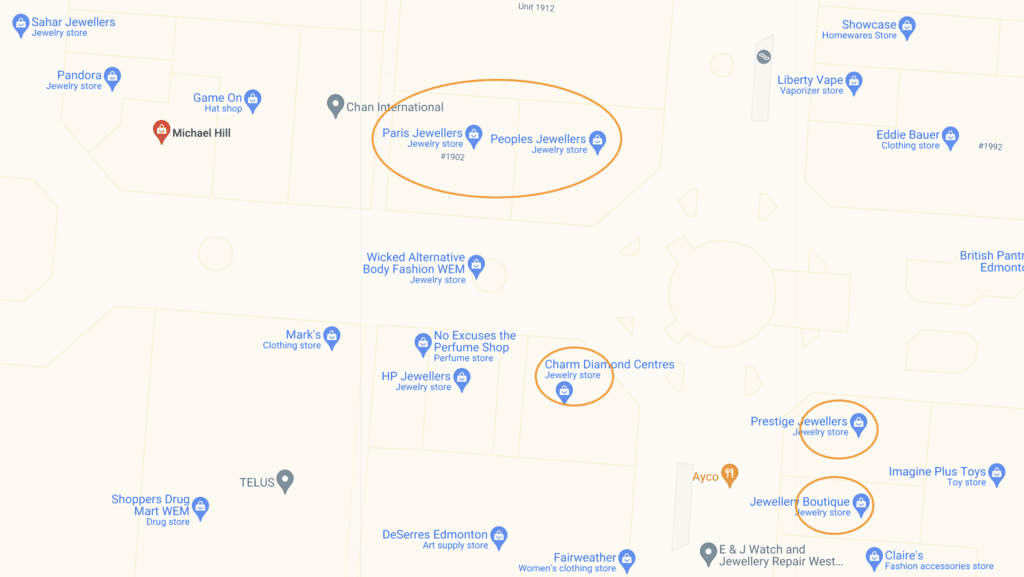

Michael Hill’s gross margins have historically hovered in the range of 60-65% whereas other jewellers like Pandora boast margins of 70-75% and Lovisa with 75-80%. This is likely because Pandora and Lovisa offer more unique product offerings and are targeting more niche segments rather than your staple old-fashioned jewellery pieces. Pandora offers charms as their main attraction and Lovisa focuses on fast-fashion items. Michael Hill also has to compete with boutique and independent stores, just have a look at the battleground at West Edmonton mall in Canada. There are five direct competitors lurching around Michael Hill.

But hey 60-65% gross margins is still pretty good for a business that is competing with so many independent stores. However, CEO Daniel Bracken flagged that whilst he and management remain optimistic about the sustainability of current margins, they can’t say right now whether margin expansion is possible. Margins may be roughly at maturity.

Michael Hill Results Send A Timely Reminder Of Focus

In my initial deep dive on Lovisa, I asserted that a large part of its success is attributed to the sheer focus on harnessing and optimising its core niche of fast-fashion jewellery, nothing else. I also provided anecdotes of past failures who veered away from their core business and started selling other accessories like handbags, sunglasses and phone cases etc. Michael Hill almost fell into this trap as the opportunity in the fast-fashion segment was alluring at the time.

In 2014, Michael Hill attempted to expand its product offering to ‘demi-fine’ charms, bracelets, necklaces, earrings and stackable rings. Pandora and Lovisa immediately spring to mind and at that time, Diva was a leader in this space. The founder, Michael Hill decided to name this new brand after his daughter Emma and his wife’s maiden name, Roe – Emma & Roe.

Michael Hill got a taste of success with this new venture as trial rollouts were launched in Queensland. However, this didn’t last for long as then-CEO Phil Taylor announced the closure of 30 stores and said in the FY18 earnings call that, “we’ve been distracted with, obviously, the US and the Emma & Roe model. So we are now putting all our focus and energy and resource into improving the Michael Hill brand offer to repositioning it, so it becomes a very highly differentiated and unique brand.”

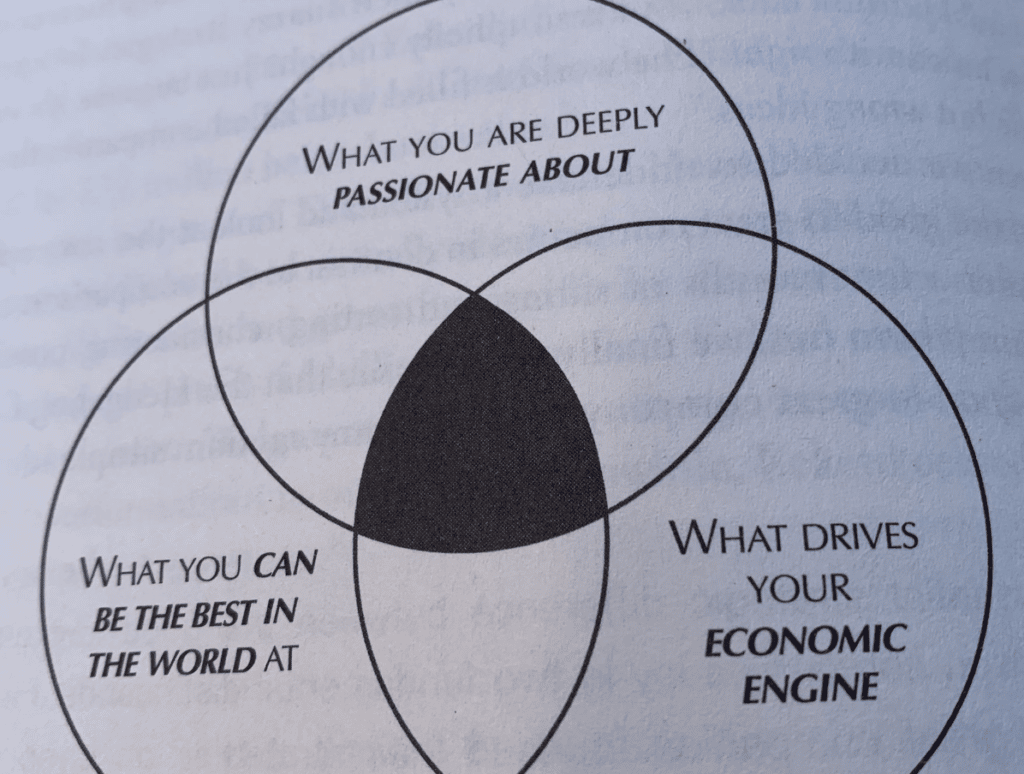

The key word in that statement is ‘distracted’ as Michael Hill ventured outside of its core competency and target market. I recently finished reading Jim Collins’ book, Good to Great and found the following framework to be very relevant in this anecdote.

Michael Hill was one of the best in producing fine jewellery and it was operated by a passionate founder. The jeweller was able to produce sustainable long-term growth by constantly striving to become the best in its core business. So, it’s encouraging that Michael Hill’s revised strategy has re-centred on doing what it does best, delivering quality fine jewellery to its core customer segment. This is reflected by Bracken’s following response to a question about whether there are any planned changes to the company’s strategy. He said on the conference call:

“We do not have any deviations planned, Andrew, from the strategy we’ve talked about. I hope it all felt very familiar to you. 6 of the 7 pillars are the same 6 pillars of our strategy that have been in play now for probably 2.5 years. And as we continue to elevate the brand, which has been in the journey for the last 2.5 years, the results have come along with that journey. So no major deviation, absolutely laser-sharped focus on the strategy that we’ve previously shared and shared again today.”

But then shouldn’t a business try and create optionality to generate more growth in the long-term? For example, PWR Holdings (ASX: PWH) is doing this by branching across other verticals. So what was wrong with Michael Hill’s decision? These are valid and important questions as there is potential survivorship bias and it’s always easy to make such judgement calls in hindsight. But we can at least try to improve as an investor through expanding our mental models.

I believe it’s crucial to understand how removed the new product or service is from the business’s core competitive advantage. Michael Hill built its reputation on quality craftmanship of fine jewellery at reasonable prices but then it was trying to develop completely different types of products, blurring the lines of its brand.

In PWR’s case, its core competency lies in providing cooling solutions, it’s not really rejigging and creating something from scratch but rather harnessing its competitive advantage and applying it to solve problems in other industries.

Apple is another example. Even though it was primarily known for its computer software and the iPod, it decided to expand across to smartphones. On face value, you could argue that Apple was veering outside of its core competency. But what was Apple’s core competitive advantage? I believe it was Apple’s ability to develop consumer technology devices with the best user experience rather than being the best at developing software and a music device.

What Do These Michael Hill Results Mean For Shareholders?

I think there is a lot to like about Michael Hill. given management’s laser-like focus on its core business and the recent growth in Canada. The fine jewellery could face more macroeconomic headwinds with higher interest rates and labour shortages, in particular retail within Australia. This will likely compress margins in Australia and New Zealand. Whilst management appears to be executing well in improving profitability across these geographies, I’d prefer to invest in a business with bigger growth runways like Lovisa. However, I’ll continue to monitor Michael Hill to supplement my coverage of Lovisa.

The current price-to-earnings (P/E) multiple is trading at 10x, which is close to the historical average since listing in 2016. If the Canada segment becomes as big as Australia, the currently multiple will likely prove to be cheap, but a lot of this does hang on growth in this one geography. The (unfranked) dividend yield of about 6.5% at the current share price of $1.14 means Michael Hill is probably best thought of as a dividend stock. It’s probably fair to say the price indicates the market isn’t expecting much growth.

Disclosure: the author this article does not own shares in Michael Hill (ASX: MHJ) and will not trade Michael Hill shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.