This morning healthcare software company Alcidion announced it had won a large contract with the Australian government, worth up to $50 million over more than a decade, and ensuring revenue of $23.3 million over the next 6 years. The announcement said:

“The value of Alcidion’s contract is estimated to be $23.3M over six years. This will cover implementation and a subscription to the Miya Precision platform. Project commencement is planned for December 2021. Further options to take up Miya Observations and Assessments and options to renew up to 15 years creates a possible TCV for the contract with Leidos of around $50M.”

Because some of the contract will be implementation revenue, it’s difficult to know how much recurring revenue comes from this contract, but it seems likely it will be at least $2.5 million to $3 million per year.

Importantly, Alcidion had previously foreshadowed this contract on April 15 this year, when it it said:

“The value of Alcidion’s contract for Stage 1 and 2 of the project is estimated to be approximately

$21M over 5.5 years (68 months). This phase will cover implementation and a subscription to the Miya

Precision platform.”

It is therefore pleasing that the contract will run a little longer than forecast (and include considerable upside potential).

Ironically, after that announcement the stock traded at 40 cents per share, but at the time of writing the stock is trading below 35 cents per share, even after this large contract has been confirmed. That may be due to its weak cashflow last quarter.

Why Did Alcidion Have Weak Cashflow in Q1?

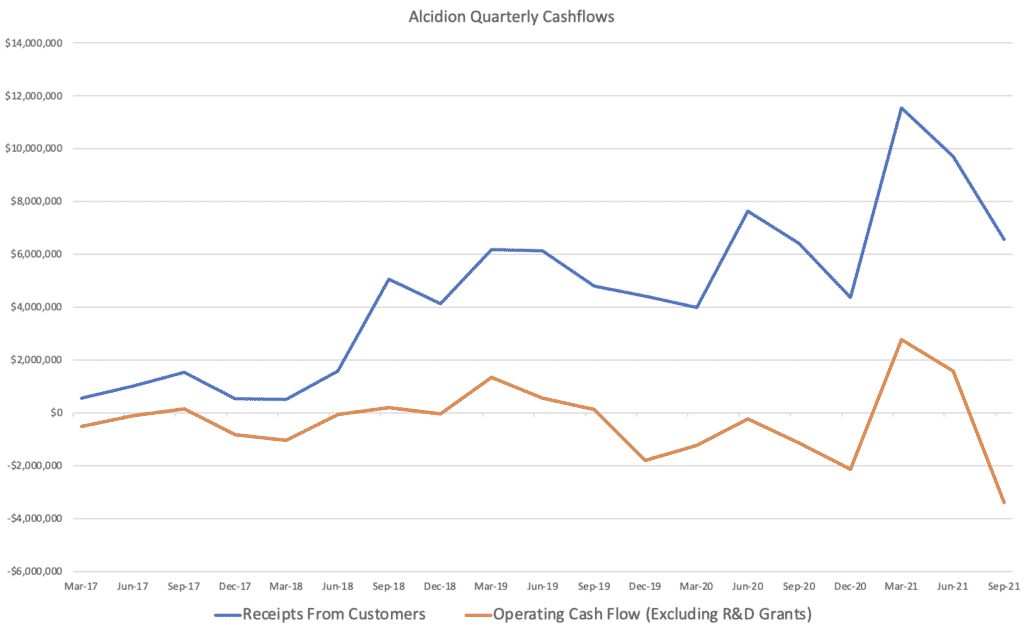

Alcidion has a very seasonal skew to its cash flow. Usually, it has stronger cashflow in Q3 and Q4 compared to Q1 and Q2. You can see in the chart below how Q4 is almost always its strongest quarter (though implementation revenue or acquisition timing can skew this between different years.)

When I last covered Alcidion stock, it was trading at over 40 cents per share, and I said that: “Alcidion is a good quality company with good prospects; and I am certainly not selling any more shares right now, but it isn’t obviously cheap. In fact, arguably there is a very good chance investors will have an opportunity to buy at a less demanding multiple, if growth stocks sell off a bit.”

I further added that, “I have already taken profits, and my position is only small” and further, that “my thinking is that I would be more likely to top up after a weaker quarter, which is more likely to be Q1 or Q2. I’d be more interested in a price below 30c per share, though there are no guarantees Mr Market will offer that to me.”

Well sure enough, Alcidion recently gave its Q1 quarterly report, both receipts from customers and operating cashflow fell away strongly, in what was clearly a weaker quarter, as you can see below:

Is Alcidion Stock Cheap Enough Today?

This contract is very good news for Alcidion, which has seen its share price drop as low as 30 cents per share in recent days. As I write, it looks like it will open at about 35 cents per share, which is a market capitalisation of about $363 million.

Alcidion finished FY 2021 with $16.3 million in recurring revenue and has already contracted around $12 million in recurring revenue for FY 2022, with plenty extra likely to be made up of contracts that will (very likely) renew during the year. At a conservative estimate, this new contract announced today will add around $2.5 million in recurring revenue, taking us to $18.8 million.

At the end of the last quarter, the company said:

“Since the end of the quarter a further $3.1M of revenue has been sold, this includes significant

contracts with Queen’s Hospital Burton (ExtraMed) and Sydney Local Health District (Miya

Precision, virtual care) and a 3-year extension for support and maintenance with Royal Derby

Hospital (ExtraMed).”

Even if we say half of that is implementation revenue (which seems to be an overestimate given it includes an extension), this should add another couple of million. If we stay conservative, I think that the company is very likely to end the year with at least $20 million in recurring revenue, putting the stock on about 18.2x recurring revenue, at the most.

The company has a cash balance of over $20 million having recently raised capital at 32 cents per share.

Importantly, Alcidion has only about 63% recurring revenue, so valuing it on recurring revenue alone is a bit harsh. If we use FY 2021 revenue, then it’s on about 14 times revenue, which has been growing at over 30% per annum, and may well do so again in FY 2022 (in part thanks to the the acquisition of Extra-med).

The lowest revenue estimate for Alcidion in FY 2022 on Cap IQ is $33.8 million, which would imply 31%. It’s likely that the analyst would have included a contribution from this contract which was confirmed today.

For me, the slightly lower price and the confirmation of this very large, very important contract is a significant change in the risk reward. Had this contract fallen through, there was massive downside for stockholders. But that has not happened.

As a result, I slightly increased my position in Alcidion shares this morning and currently have a bid to buy a few more shares at below the current highest bid price. I’m not spending all my ‘dry powder’ all at once, since markets are quite volatile at the moment and Alcidion is still a loss-making growth stonk.

But today’s confirmation of their largest ever contract win (to my knowledge, anyway) certainly makes me like the stock a little more.

Please remember that these are personal reflections about a stock by author. I own shares in Alcidion, bought some today, and may buy some more soon. However, I will not sell my Alcidion shares for at least 2 days after this article is published. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on. .