Today, acute hospital software company Alcidion (ASX:ALC) announced its quarterly cash flow report for Q4 FY2021. The company has generated positive free cash flow of over $1.5m for the quarter, excluding acquisition payments. Its share price traded as high as 41.5c after the news, a rise of more than 16%. Happily, Alcidion recorded positive free cash flow for the full financial year, which is a key inflection point on its journey to sustainability. However, the CEO, Kate Quirke, made it very clear that quarterly cashflow will be lumpy, and that Q3 and Q4 are generally their strongest quarters. Therefore, we would not be shocked if the company burns some cash in the seasonally weaker Q1 FY2022.

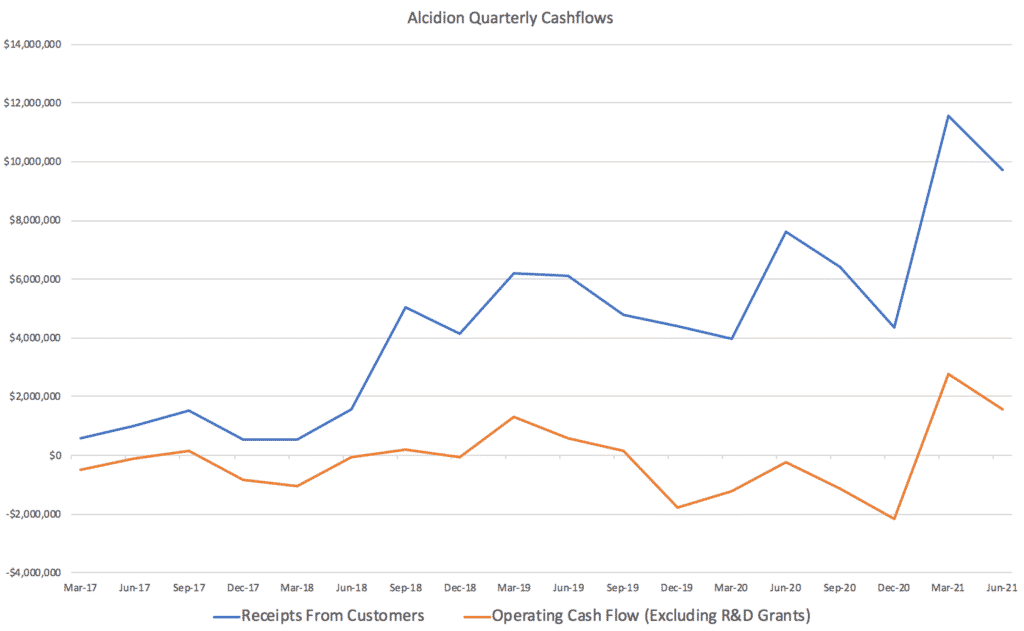

That said, you can see below that while Alcidion’s receipts are generally quite lumpy, they are not obviously seasonal. In any event, the longer term trend is positive.

While it is good to see the company reach cashflow breakeven, it’s important to remember that management is still on-boarding new staff as it invests in growth. It is aiming to achieve approximately breakeven in FY2022, in terms of profitability, before making its maiden profit in FY2023. Meantime, the share price is up over 160% since I outlined the case for Alcidion, in July 2020. As a result, I am not currently buying shares, even though the business performance has been impressive.

A Lot Of Optimism In The Alcidion Share Price

As discussed here I am expecting that Alcidion will end the year with a bit over $16m in recurring revenue, with that figure expected to grow both organically, and via a full year contribution from recent acquisition ExtraMed. At the current market cap of $372m Alcidion trades on over 23 times recurring revenue. Even assuming $4 million profit in FY2023, which I doubt it will achieve, the stock would be on almost 100x FY2023 earnings. Alcidion is a good quality company with good prospects; and I am certainly not selling any more shares right now, but it isn’t obviously cheap. In fact, arguably there is a very good chance investors will have an opportunity to buy at a less demanding multiple, if growth stocks sell off a bit.

Growth Strategy

As is often the case, the CEO took many questions from shareholders during the quarterly conference call. In it, she outlined how the company is looking to win further business from the 145 acute healthcare NHS trusts, and referred to the “growing pipeline in the UK.” Purchase decisions still take 6 to 9 months to sign off on, even though Alcidion is on the relevant panels, so it’s possible her optimism is well grounded. Currently Alcidion has sold at least one product to 27 of 145 acute healthcare trusts, so it has plenty of room to grow.

The CEO said things had been a bit more sluggish in Australia, and the company is not yet banking on its potentially large contract win with the department of defence, which is expected to be determined by the end of calendar year 2021. The CEO would not be drawn on the details at this stage.

Longer term, the company has $25m in cash so it is well funded for both internal projects and moderate acquisitions. The statutory revenue (a significant part of which is not recurring) is expected to come in at about $25.6m. At the current share price of 41.5c, Alcidion has a market capitalisation of about $435m, or almost 17x FY2021 revenue.

Now, I wouldn’t want to sell any of my shares right now, because I have already taken profits, and my position is only small. The stock is popular and has good momentum. With a little luck and good execution, it could be verging on ASX 200 index inclusion in the next few years.

Having said that, nor am I a buyer at current prices. In my opinion the market is being quite optimistic, and Alcidion has historically traded at closer to 10x revenue. Rather, my thinking is that I would be more likely to top up after a weaker quarter, which is more likely to be Q1 or Q2. I’d be more interested in a price below 30c per share, though there are no guarantees Mr Market will offer that to me.

Ultimately, if the company continues to look to buy functionality via acquisitions, then it will continue to issue shares which may make it more difficult for the share price to rise. That said, it was positive to hear the company is working towards release of its Miya Care App, which is a patient facing app aimed at facilitating virtual care, which is when a health organisation (such as a hospital) can monitor a patient from their own home. Finally, it was good to see that the company renewed their Miya contract with Western Health in Victoria. This long standing customer is an example of how sticky Alcidion’s software can be once it is implemented.

Please remember that these are personal reflections about a stock by author. I own shares in Alcidion though I will not trade them for at least 2 days after this article is published. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.