As the dust settled on the pandemic sell off last year, I was searching for any healthcare/tech companies that I could buy at an attractive price. I have followed Alcidion (ASX: ALC) since it listed on the ASX, and have owned shares a number of times (but not continuously, unfortunately). I started writing about Alcidion again in June 2020, and you can see all our Alcidion coverage here. Back in July, I articulated my reasons for holding Alcidion when I wrote the Case For Alcidion, when the share price was about 15c. Today, the stock is around 160% higher.

But is it still worth buying?

Until recently, the main driver of the Alcidion share price has been increasing evidence that they can meaningfully expand their business in the UK. As I wrote in my coverage of Alcidion’s half year results:

“…I am cognisant that “Only two of ~223 NHS Trusts have Miya Precision implemented, highlighting significant opportunity to scale”. This holds out the possibility that the next couple of years could be company-making, and so I’m reticent to sell out on valuation reasons. The largest Miya Precision contract the company has signed is worth over $1.4m per year (including upfront costs).”

“Even if we assume the average NHS trust would only generate $500k in revenue per year, and that Alcidion only gets 20% market share, that would be an additional $20m in recurring revenue. Therefore, for now I am holding.”

More recently, Alcidion announced that it would raise $17.9 million from institutions and retail investors at 32c per share, and purchase a business called ExtraMed. Like Alcidion, ExtraMed sells patient flow software, so you could definitely consider them to be a direct competitor to Alcidion’s Patientrack, if not the more comprehensive Miya Precision solution. Specifically, it has as customers “nine NHS Trusts, six of which are new customers for Alcidion.”

As a result, it’s fair to say that buying ExtraMed is a savvy move to try to maximise the chances of installing Miya Precision in as many NHS trusts as possible. The price paid is $9.6M cash, representing ~3.6x FY22 forecast revenue for ExtraMed. This seems reasonable, given the strategic value of taking out a potential competitor.

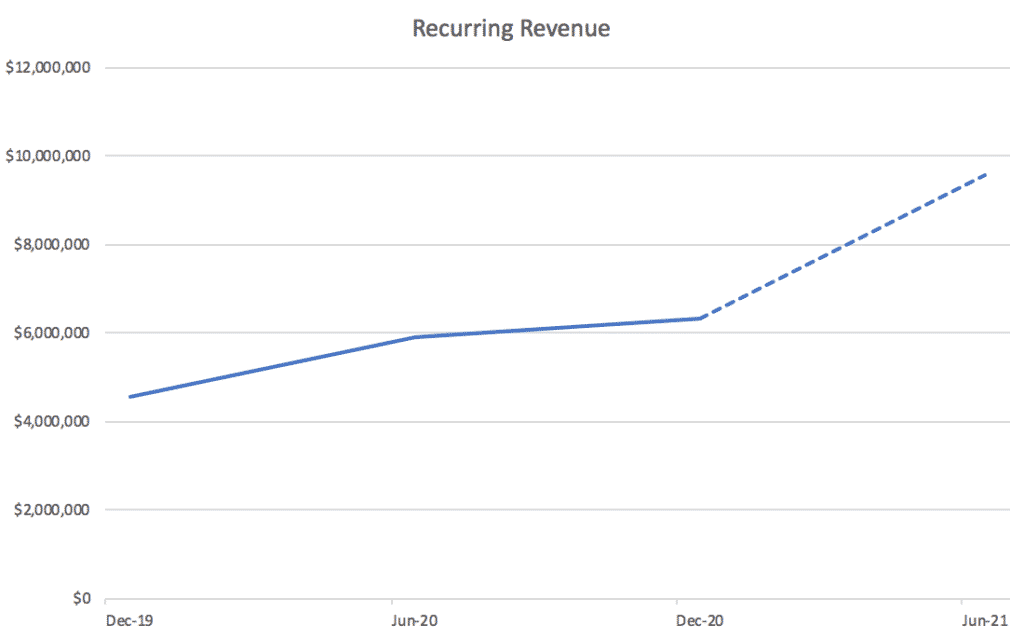

On top of that, Alcidion has given guidance for extremely strong organic growth in the second half of the year. Below, you can see how recurring revenue is tracking based on guidance of $15.9m recurring revenue in FY2021. Note that this excludes the forecast $2.7m in annual recurring revenue from ExtraMed.

On top of that, Alcidion also announced that: “it has been selected as a preferred supplier, as part of a consortium, for a major healthcare IT project to maintain personal health records and support clinical decision making across the Australian Defence Force in all care settings. The initial total contract value to Alcidion of this opportunity is $21M over a 5.5 year period.” Even if we are conservative about the gross profit contribution from this contract, if won, it promises to boost recurring revenue by a meaningful amount, likely well over 10%.

Are Alcidion Shares Too Expensive?

While it is great to see the notable business progress, the market capitalisation of the company has exploded as a result of the share price rise and the issuing of new shares. Under the capital raising, another 56 million to the 990 million already listed, giving us around 1046 million shares, or a market capitalisation of $407 million at 39 cents per share. Now, the company will have over $20m cash after this transaction, and according to its latest presentation, it is now cashflow positive. That means it will likely pursue more acquisitions.

[Please note, the above paragraph has been corrected for a typo in the share count; it is 1046 million, not 1460 million! Thanks to the sharp eyed Reece for pointing this out.]

For now, the combined businesses should be doing about $18.6m in recurring revenue at a minimum, in FY2022, putting the company on on about 31x recurring revenue. Obviously, this is not a cheap price to pay. However, we have seen with other stocks that high quality med-tech companies can trade on very generous multiples of revenue, especially once they become big enough to enter into the mainstream indices such as the ASX 200.

If Alcidion can maintain its current share price, and execute another decent acquisition, I think it could be on a path to inclusion. That would be a huge change, since the company isn’t even in the All Ordinaries at present (thanks to that depressed share price, last year). In that context, I’m reticent to sell too early, even though the current price is way too high for me to want to buy more.

And finally, that leads me to the question of whether to participate in the capital raising at 32 cents. Given the discount to the prevailing share price, my guess is that the share purchase plan (SPP) will be wholly insufficient and shareholders will be lucky to top up their holdings in a meaningful way. My approach would probably be to apply for $1,000 worth of shares in the hope that they give everyone the minimum. Given the circumstances, I don’t think I’ll sell any right now to fund the (uncertain) acquisition.

For me the bottom line is that the Alcidion share price has shot way past where I think there is value, but, having already taken some profits prematurely, I’m inclined to sit back for now, and at least wait another month or so before taking any profits. My hope is that after this capital raising is finished, more small cap fund managers will have their eye on Alcidion, and it will become more of a hot stock among fundies.

For now, a search of the ticker on Livewire reveals just three mentions, compared to (for example) 23 mentions for the similar sized Bravura (ASX: BVS). While I’m not a buyer at current prices, the ideal time to sell is when various fund managers are suddenly discovering this secular growth story — all at the same time.

This post is not financial advice, it is general in nature, and you should click here to read our detailed disclaimer.