When I recently covered the results of Australian Clinical Labs (ASX:ACL) I noted that shares come out of escrow after the next results (for the half year to December 2021). That creates an overhang with downward pressure on the share price. Furthermore, I said that “I don’t think the shares are particularly expensive” but “I will likely look to sell some or all of my shares before this time.”

At the end of August, I said that “For now, with Covid testing volumes continuing to march higher, the short term outlook for Australian Clinical Labs looks positive.” Today, I’m going to check in with this thesis, and explain why I think Covid testing volumes may have already peaked.

What is happening to Covid testing volumes now?

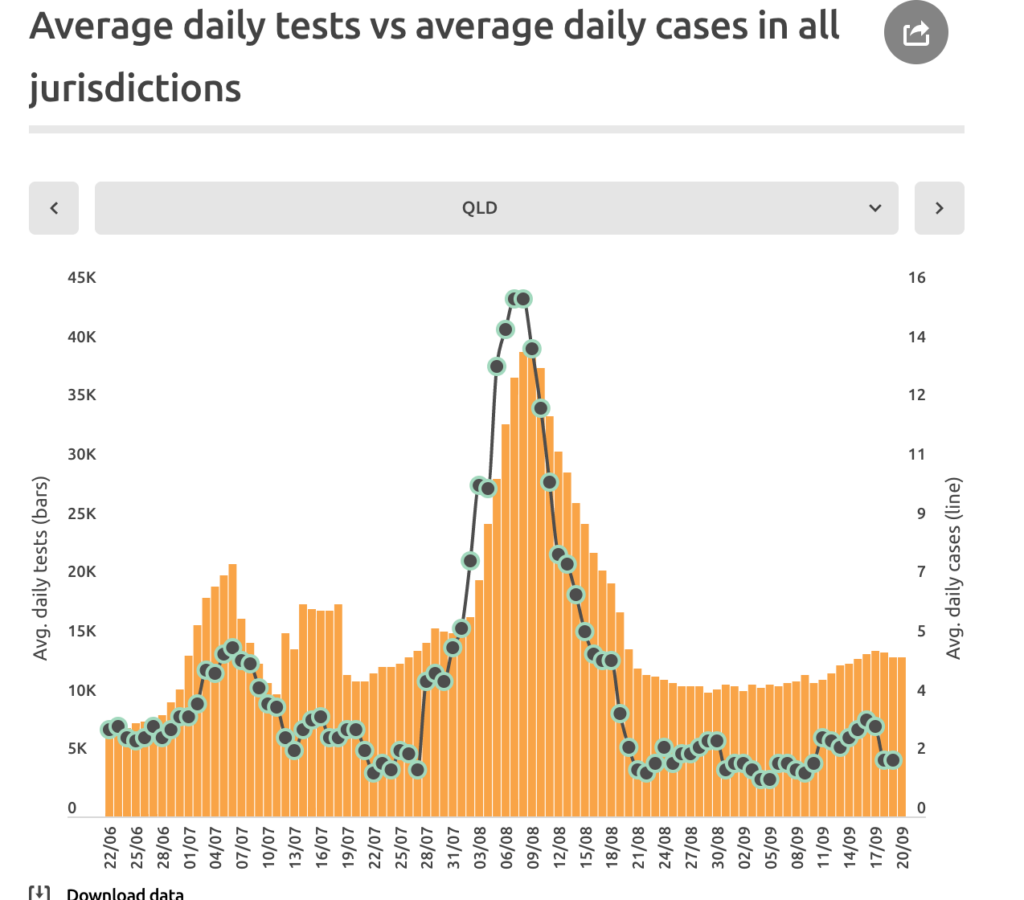

Below, you can see an embedded chart of Australian testing volumes from covid19data.com.au.

If you have a play with the chart above, you can see that national testing per day is about lower as at 20 September compared to 28 of August, when I covered the Australian Clinical Labs (ASX:ACL) results. Now, what I find particularly interesting is that the testing volumes across the country roughly correspond with the increasing risk of getting covid. This is perhaps best (and perhaps somewhat absurdly) illustrated by the graph for ACT below.

ACT is a smaller jurisdiction, so its chart looks quite extreme, but what it shows is that increasing in testing happened dramatically as covid risk increased, but then fell away as covid risk remained at low levels.

Now, this is important because it suggests that only with increasing covid risk will we see increasing testing. You can see the same in Queensland. As covid risk falls away, so too does testing.

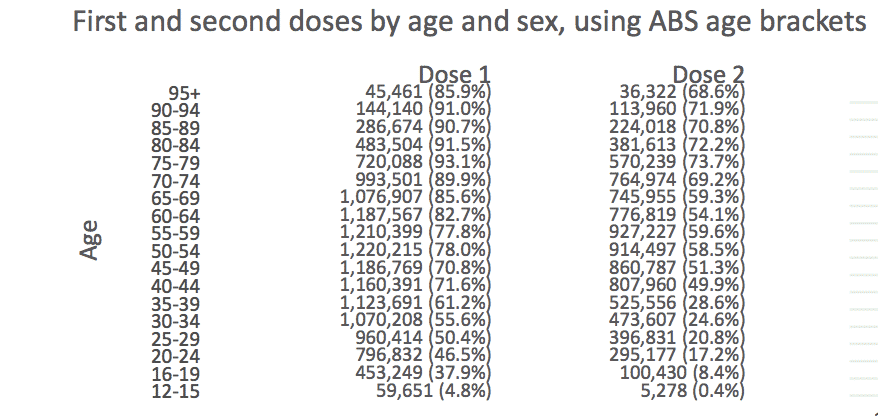

Now, at the moment, NSW and Victoria are still testing at very high levels. However, my guess is that the testing is predominantly by people under 40 years old, who are working (thus exposed to risk) and who are not yet fully vaccinated.

At present, the Australian government says that more than 90% of Australians over 70 have had two doses by September 13. However, for the under 40 demographic, less than 30% have, thus putting them at much higher covid risk… and making it more likely they will get tested.

With mRNA vaccines coming into supply towards the end of the year, I’m guessing that under 40s will reach above 80% vaccinated pretty quickly from here, thus reducing demand for PCR testing.

Can Warm Weather and Vaccines Reduce Covid Outbreaks?

While there is no suggestion that Covid is impacted by the heat itself, in Australia we are currently going into the period when we spent the most time outdoors. In my view, the natural behaviour of going to the beach, opening windows and spending more time outside will help reduce the spread of covid relative to in July and August.

On top of this, we saw in the USA the massive reduction in covid cases as they moved from winter to summer, whilst also aggressively increasing vaccination. My base case expectation is the same will happen here. Take a look at the huge improvements in trajectory of our own outbreaks, despite no further lockdown measures.

Now, there are lots of ways I could be wrong about this, but my guess is that in Australia covid risk actually reduces for the rest of 2021. This could be proven completely wrong in a number of ways:

- Re-opening may see covid soar,

- Schools returning may see covid soar.

- Covid enters Queensland, Western Australia, South Australia, NT and/or Tassie.

However, in my mind the next time when we have bad setting for covid will be early 2022, as it will likely spread during Christmas holidays the spread further when schools return in August.

As a result of all this, I no longer see the short term outlook as being so favourable, so I will probably sell about half my shares today.

As a final note, please don’t interpret this as me saying that we’ve passed the worst. Rather, what I’m saying is that the current cohort of recently vaccinated Australians going about their business in summer with partial restrictions in place are setting the scene for a good few months. Indeed, there is some suggestion that the government may call an election for around Christmas.

The most likely time that covid will get really bad in Australia is, in my view, after Christmas. To a degree, I’m just going to let the data guide this trade. By the time of March 2022, we’ll know what percentage of the population is vaccinated and whether we’ll be rolling out booster shots. If the major cities are 95% vaccinated or more, then it may be we’ve seen the worst of it in Australia. On the other hand, if children are not vaccinated we’re very likely to see a massive resurgence because covid will just spread through schools. For now, though, I think Australia might look quite good for the summer, at least. If so, that signifies the end of the testing numbers trend (for now).

Update, Wednesday 22 September: Motley Fool Extreme Opportunities has just now recommended the stock, pushing it to $4.65. I have sold more above $4.60. Good luck to the company, it seems decent; however, I am largely bringing this trade to a close. Still holding some though, as I write.

Please remember that these are personal reflections about a stock by author. I own shares in Australian Clinical Labs and will likely sell some after publishing this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.