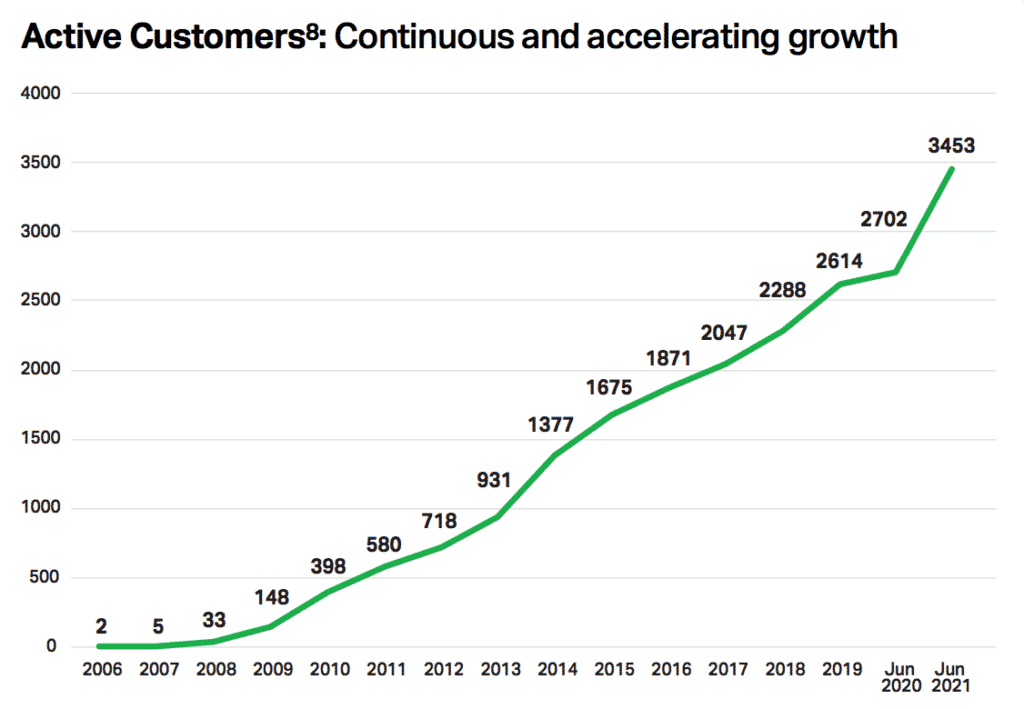

One company that I have been following for a while is deal room software stock Andsarada (ASX:AND). You can see our prior coverage of Andsarada here but suffice it to say that it is one of the more pessimistically valued software stocks trading on the ASX. Today it reported unaudited FY2021 revenue of $33.4 million, and a sharp increase in active customer numbers from 3,020 in December 2020 to 3,453 in June 2021. The company defines active customers as active customers using any product.

You can see the increase in the chart below:

Ansarada has about 90 million shares on issue, giving it a market capitalisation of about $135 million at the share price of $1.50 (including the options that are most likely to be exercised). That means it is trading on only about 4x revenue, which is very low relative to other software companies.

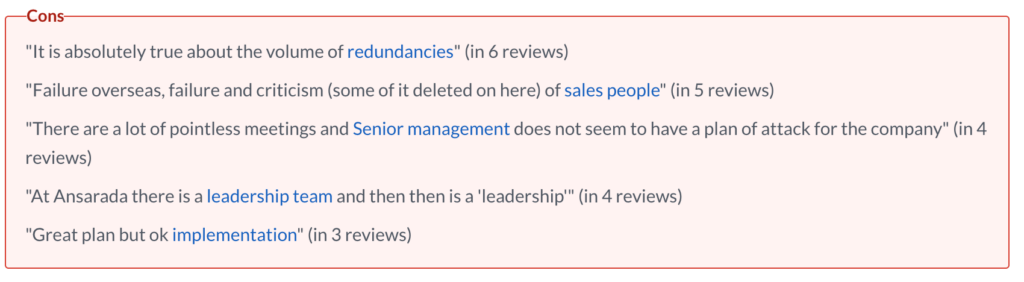

One reason that it’s low may be lack of confidence in management. If the company’s glassdoor reviews talk to a time, prior to listing where the company was running too low on cash and had to let staff go. You can see what I mean in the screenshot below.

Personally, I can definitely see the argument for owning shares in Ansarada, since they are relatively cheap compared to other ASX listed software companies. In the video below from April 9, 2021, I outline the company, and my thoughts on why I owned the stock. You can also see our historical coverage of Ansarada here.

Since this video was published, stock has rallied over 50%, from around $1, to above $1.50, and I sold all my shares (at below current prices). The main reason I sold was to fund purchases in other stocks I find more attractively priced, such as this one that is benefitting from the current delta outbreak in Australia. I still think Ansarada is relatively cheap, and I have to say this quarterly result was a real positive.

Ansarada Achieves Free Cash Flow In Q4 FY2021

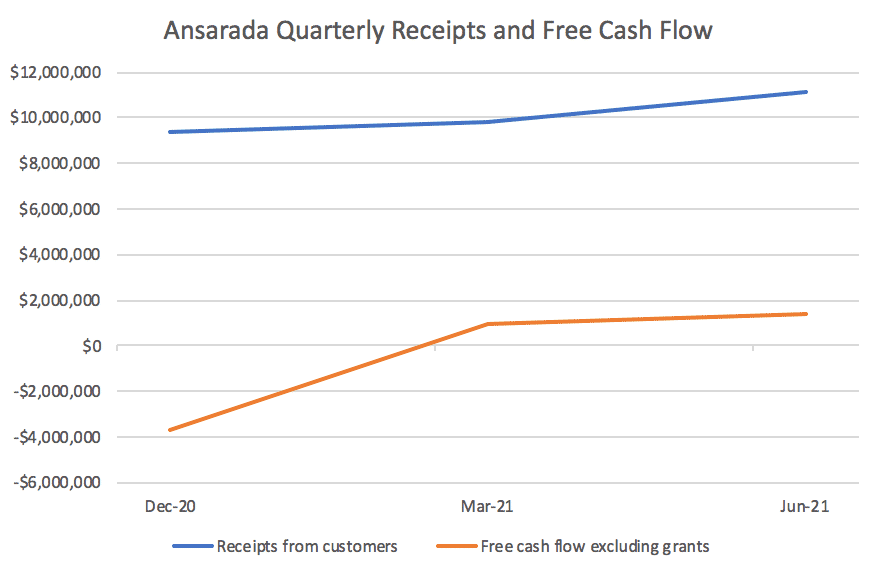

In order to gain more credibility after its cash squeeze in 2018, Ansarada needs to prove it can run the business profitably. That means it must generate cash before the market will be willing to reward it with a higher multiple. On that measure, the most recently quarterly report was certainly heartening.

However, we would not be surprised if Q4 is a seasonally strong quarter for the company. Since two thirds of customers are paying annual subscriptions, it’s possible that receipts from customers will be weaker in Q1 FY2022. When looking at the cashflow chart below, keep in mind that the quarter to December 2020 did not include a full quarter of the combined businesses.

Why Is Ansarada So Cheap?

First of all, Ansarada is cheap because the deal room software is for doing large financial transactions like selling a company. That means the clients only need it for a finite period, and tend to stop paying for it in between deals. For more information on the nature of the business model, check out the video above. That said, many software companies trade for 10x ARR or even 20x ARR. At just 4x historical revenue Ansarada is priced with much lower expectations. We must look beyond the lumpy business model to explain why.

To the best of my knowledge, Ansarada is cheap because the market lacks confidence in management. First, that is a result of the funding squeeze that lead to redundancies. Obviously, this either means that their business is not fast growing and winning, or it is a winning business, but has been mismanaged. Either way, it’s a big fat red flag; and that’s the one of the reasons I chose to sell Ansarada shares when I wanted to fund a more attractive purchase like this profitable, dividend paying stock in an industry that grows profits as a result of covid.

However, I also believe that a big part of the problem is that the company does strangely promotional stuff, such as pre-announcing its (unaudited) profit and loss highlights. This creates the impression that they want the market to focus on the management numbers, rather than the statutory numbers contained in the annual report. This problem is compounded by the fact that the company has presented itself as a software as a service company, even though most clients use the platform on a one-off basis (for a particular deal). In this quarterly report, the company decided not to report on its churn or retention rate, even though it has reported on the figure previously. Generally speaking the practice of not reporting metrics without warning, when you previously had reported them, is a red flag, and undermines trust and points to poor business judgement. If the churn as previously presented was not relevant, they should not have presented it. More likely, the churn was trending up previously, but its trending down now, so the company will come up with a churn metric that excludes certain customers.

In any event, we should assume churn is rather high.

Finally, it is certainly the case that the market is a bit baffled as to why Ansarada merged with thedocyard, other than to avoid the scrutiny of an IPO. This kind of listing is called a “backdoor listing”, because the larger company merges with the smaller listed company; thus avoiding the “front door listing” of an IPO. While the backdoor listing technique does give rise to some real winners (such as Vocus or Alcidion), it generally results in lower trust, given the high numbers of dodgy businesses that list through that technique.

How much is Ansarada worth?

I stand by my comments in the above video and I consider Ansarada undervalued, and I could see myself buying shares again. However, at the moment it is not my favourite idea and I have actually been selling stocks to buy shares in an under-the-radar essential service company, which I estimate is trading on about 11 times earnings. Ultimately, I think I would need a price between $1.00 and $1.10, to want to by Ansarada shares, all else being equal.

I think that Ansarada is a decent business with a bad reputation. The main thing that would make me increase my valuation of Ansarada is if the company can maintain positive free cashflow while growing sales. In 2019, Ansarada made revenue of $36.2m, in 2020 it made revenue of $32.8m, and in 2021 it says it made $33.4m. According to the company, revenue has been somewhat hampered by switching customers from one off license sales to ongoing software as a service charging. It remains to be seen whether the company will actually be better off under the subscription model.

In any event, it cannot be said that the company is growing revenue until it surpasses its 2019 revenue levels. That may happen in FY 2022 since the company is focussing on sales growth. The biggest risk here is that it drops into burning cash again.

I believe that if the company can grow revenue by at least 15% and maintain positive free cashflow in FY2022, then shares will trade higher. The biggest upside is that the company’s new “workflow” module will succeed in making revenue stickier, and also grow the total revenue, rather than simply transitioning transaction-based revenue to subscription revenue. Ultimately, the current price of $1.50 is not a sufficiently good opportunity for me to want to buy shares and so I do not hold any shares.

Please remember that these are personal reflections about a stock by author. I do not own shares in Ansarada. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.