What smart young entrepreneur wants to be in the chemical manufacturing and waste management business? DGL Group Ltd (ASX: DGL) founder and CEO Simon Henry does.

As far as dull and disagreeable companies go, chemicals manufacturing and waste management companies must be near the top of the list. Many investors look for fast growing, exciting companies with new technologies. Because of this, dull and disagreeable companies are more likely to fly under the radar and less likely to be over-priced.

Henry has been on an acquisition rampage since listing, with no signs of slowing down. While this grows top line revenue, it takes skill and experience to integrate and manage acquisitive growth.

After getting off to a flying start to life as a listed company in May 2021, the price pulled back from a high of $4.49 in 2022 to currently sit around $1.35. This has been driven by concerns about the rate of growth and the CEO’s judgment after unwarranted remarks about celebrity chef Nadia Lim, who is involved with meal kit provider MyFoodBag (ASX: MFB).

With the share price now more aligned to future growth, does this present an opportunity for the patient investor?

What does DGL Group (ASX:DGL) do?

DGL Group is a chemicals business that manufactures, transports, stores and processes chemicals and hazardous waste.

DGL has three segments: chemical and industrial formulation and manufacturing; warehousing and distribution; and waste management and environmental solutions.

DGL Group (ASX: DGL) H1 FY23 Results Show Organic Growth

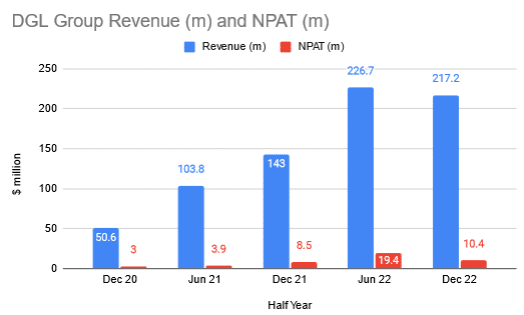

The six months to 31 December 2022 showed revenue and Net Profit After Tax (NPAT) growth. Revenue was up 52% to $217.2 million and NPAT was up 22% on the same period last year, to $10.4 million. Free cash flow for the period was $6.61 million, measured by cash flow from operating activities of $22.46 million minus capital expenditure of $15.85 million.

Revenue and NPAT have been growing organically and through acquisitive activity since listing. During the half, 69% of Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) growth was organic, with the remaining growth coming from recent acquisitions.

Employee expenses rose with wage rates increasing, impacting the underlying EBITDA margin, which was down to 13.7% from 16% in the prior corresponding period. The margin decline was also due to elevated margins in H1 2022, as DGL held more inventory.

Borrowings increased by $34.7 million over the period reflecting a new ANZ term facility (replacing the trade finance facility), plus funding of acquisitions. Lease liabilities increased from $30.9 million to $35.2 million over the six months due to acquired leases. DGL had net debt of $79.8 million at 31 December 22, and held $24.2 million in cash.

What is DGL Group’s Earnings Guidance for FY23?

DGL upgraded underlying EBITDA guidance for the financial year 2023 to include $1.5 million from recent acquisitions. This brings guidance to the range of $71.5 – $73.5 million (EBITDA for 2022 was $65.6 million).

DGL Group (ASX: DGL) is a founder-led company

DGL is led by the founder and CEO Simon Henry who owns 53.1% of the company. He did not sell any of his shares in the initial public offering and has also made several on-market share purchases, the most recent being a parcel for $100,247 in early March.

High equity ownership by management aligns their interests with those of shareholders. Founders also often have more of a long-term mindset than a salaried CEO.

Henry’s judgement was called into question when in May last year he made unwarranted comments about celebrity chef, and part owner, Nadia Lim being used to hype the IPO of MyFoodBag (ASX:MFB). I won’t go into detail on that issue as it has been covered in this bearish rticle on DGL, by A Rich Life editor Claude Walker. Walker took a different view to myself and chose to sell his holdings in the company after losing faith in Henry’s judgement based on this and other incidents.

[Editor’s note: since I wrote that bearish article more than a year ago, the DGL Group share price has dropped from $2.80 to $1.29. That changes my view of how attractive DGL stock is, since some of the risks I talked about are now better reflected by the share price].

While Henry’s comments were concerning, he was right to call out MyFoodBag for the fact it used little of the float proceeds to grow the company and that founders and private equity sold large portions of their holdings into the float to Mum and Dad investors. These investors have since seen the share price lose ~ 87%.

Henry is good at setting investor expectations. He cautioned investors not to get too excited when the company increased profits due to the urea shortage which led to higher AdBlue prices. He advised that the growth rate would flatten after FY22 and told investors not to expect a dividend anytime soon. This contrasts with some CEOs who are always hyping their company’s prospects.

What are DGL Group’s (ASX: DGL) Acquisitions Since Listing?

There were six acquisitions in H1 FY23 alone: Flexichem, Aquadex, BTX, Acacia Ridge, Container Park, Clarkson Freightlines and Chempac NZ, which cost a total of $37.7 million. This takes total acquisitions since listing to 21! (including property purchases), plus Chempak, which was acquired just before listing. The acquisitions were mostly funded with a combination of cash and equity in DGL.

In April DGL announced they have entered into an agreement to purchase pesticides manufacturer and supplier Triox for $5.5 million in cash at 4.6 times EBITDA.

The below table shows the acquisitions since listing with price and the multiple of EBITDA paid. Acacia Ridge, Aquadex, BTX and Clarkson were smaller acquisitions and were announced at the same time and the announcement just stated: “We expect these businesses to contribute approximately $7m of EBITDA earnings on a pro-forma basis.”

| Acquisition | Date | Paid$ (m) | Description | Price |

| Nightingale | Jan 23 | 18.2 | Transport | 3.7X |

| Chempak NZ | Dec 22 | 3.15 | Chemicals | – |

| Acacia Ridge | Nov 22 | 5.0 | Waste | – |

| Aquadex | Oct 22 | 7.0 | Chemicals | – |

| BTX | Oct 22 | 7.25 | Waste | – |

| Clarkson | Sep 22 | 6.75 | Transport | – |

| Flexichem | Sep 22 | 6.2 | Chemicals | 4.6X |

| Temples | May 22 | 3.50 | Storage | 2.2X |

| Total Coolants | May 22 | 2.47 | Coolants | 2.7X |

| RMA Polymers | Apr 22 | 4.51 | Polymers | 4.1X |

| ALM | Mar 22 | 1.24 | Transport | n/a |

| Rocklea site | Feb 22 | 11 | Property | n/a |

| Austech | Dec 21 | 26 | Chemicals | 5.6X |

| Shakell | Nov 21 | 8.90 | Transport | 7.3X |

| AUSblue | Oct 21 | 15.3 | Chemicals | 4.3X |

| Aquapac | Oct 21 | 8 | Chemicals | 5.4X |

| Profill | Sep 21 | 7.65 | Chemicals | 4.5X |

| Opal | Sep 21 | 8.6 | Chemicals | 5.1X |

| Storage Facility | Jul 21 | 2.45 | Property | n/a |

| Derrmiu Property | Jul 21 | 5.5 | Property | n/a |

| Labels Connect | Jul 21 | 1.54 | Labels | 3X |

Importantly for a company making many acquisitions, DGL is also growing organically. The acquisitions also appear to align with DGL’s goals of: providing customers with the full chemical supply-chain service; Owning property in good locations (which increases efficiency and enables more control over the safe storage and transportation of materials); and increasing DGL’s presence in sectors such as water treatment, building, and the automotive sector.

Long-term I think the goal of owning properties in strategic locations is a good one, but this means in the short-term the cost of developing manufacturing sites is high. DGL currently owns a portfolio of eighteen properties, valued at $152.5 million, covering 270,000 sqm.

Who Are DGL Group’s Customers?

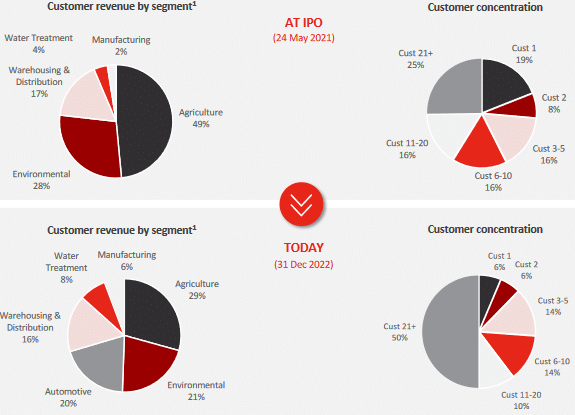

DGL now has a more diversified customer base. At listing in May 2021, its biggest customer accounted for 19% of revenue. But it accounted for just 6% of revenue as of 31 December 2022. DGL made clear when listing they wanted to reduce the reliance on their biggest customer and they have delivered.

Customers are from a range of industries including agriculture, water treatment, mining, construction, automotive, food, pharmaceutical, recycling, manufacturing, and other chemical suppliers.

The recent acquisitions have provided more customer and industry diversification.

What Are The Main Risks to DGL Group?

With this many acquisitions in a short timeframe, there is always the risk they do not integrate well, or there may be unforeseen problems within acquired companies. In the current interest rate environment, financing costs are higher. DGL has increased borrowings to fund acquisitions, as well as acquiring leases with some of the acquisitions. The big increase in employees also brings higher wage costs with a rising wage price index.

I think Australian investors generally have a negative view of roll-ups (where multiple small companies in the same market are acquired and merged). There have been a number of high-profile blow ups in recent years (such as law firm Slater and Gordon, and child care centre operator ABC Learning). Many roll-up ‘failures’, however have been in the professional service sector, where roll-ups generally do not work as well, or occurred where companies branch into sectors that are different from the main business.

DGL Group’s CEO’s judgement could be viewed as a risk but I think he is genuinely passionate about his company. Much of his wealth is tied to the share price so he should be well aware now of how his comments and behavior can adversely affect the share price.

While DGL does not appear to be threatened by competition, Australia’s largest chemical company Redox is looking at a possible ASX listing. While there is little public information available at this stage, if they decide to use capital raised to fuel acquisitive growth this could increase competition for acquisition targets DGL may wish to acquire in the future. Henry may be aware of this, which may possibly account for the rapid rate of acquisitions.

My view on DGL Group Shares

I own DGL Group shares because it is a growing company that is reasonably priced with high barriers to entry due to regulations around manufacturing, storing, and transporting dangerous chemicals. DGL is focused on and will benefit from a growing need for environmental solutions.

Poor sentiment has driven the DGL Group share price down too low in my opinion for a company growing organically and through acquisitions,that is currently trading on a P/E of around 12.5, on trailing earnings. Coupled with the fact that chemicals are necessary for many businesses, DGL is better placed than many in other sectors to increase prices to keep up with rises in input costs in this current period of higher inflation.

It is likely DGL will continue to make further acquisitions and spend on manufacturing capabilities in the coming years, and it may be a while before it pays a dividend. Long-term I think DGL offers good growth prospects for patient investors.

Editor’s note: One of the stocks Chris has previously covered on this website recently had a guidance upgrade, which you can read about in this article on 2 Stocks With Recent Guidance Upgrades.

Sign Up To Our Free Newsletter

Disclosure: the author of this article owns shares in DGL and will not trade in DGL shares for at least 2 days following the publication of this article. The editor of this article, Claude Walker, does not own shares in DGL and will not trade shares for at least 2 days following this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.