Atomos (ASX: AMS) develops video technology hardware products and software solutions for video content creators. The FY 2022 Atomos results contributed to the downward trajectory of the Atomos share price, which is down more 80% in the last six months.

This morning, Atomos announced that at the request of its auditor Deloitte, it “has recognised certain revenue one month later than presented in its Appendix 4E”, released on August 30. The company advises this change “relates to a pre-approved change to shipping terms for some customers which took place in June 2022”. As a result, FY 2022 Atomos revenue has been revised from $82 million down to $73.3 million.

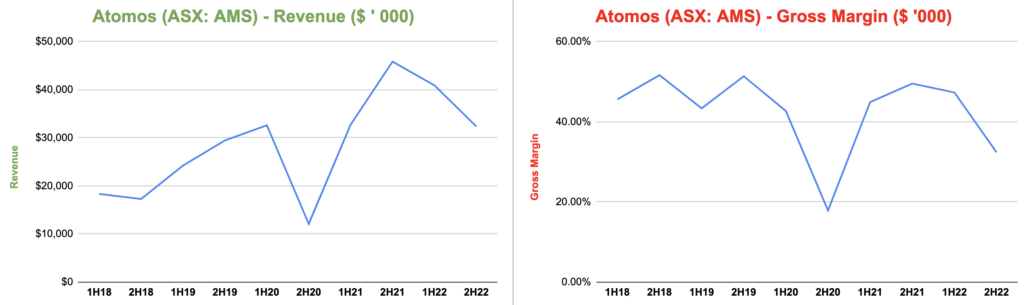

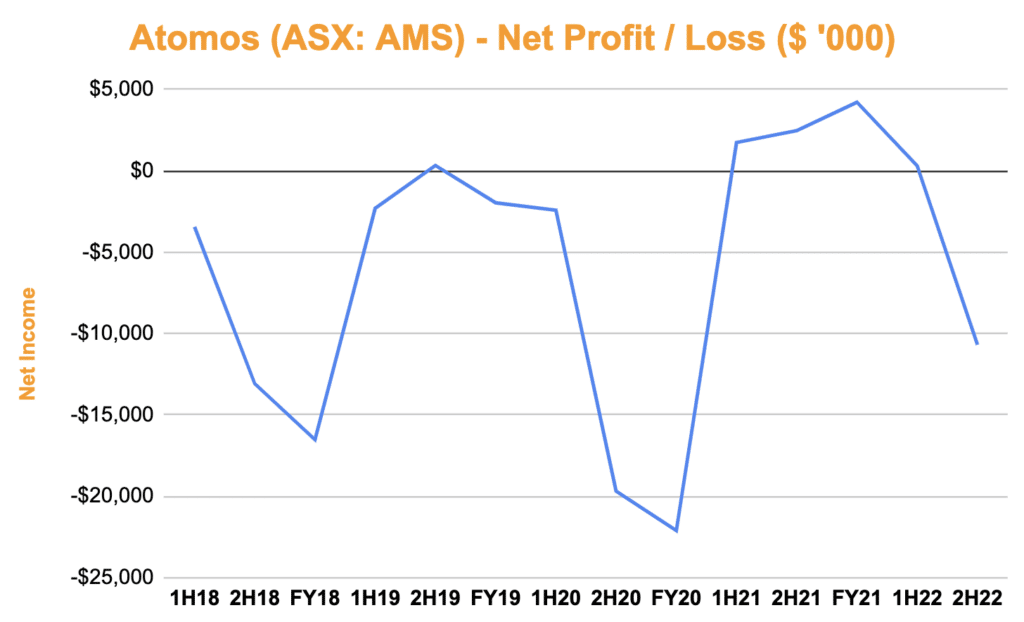

Rather than recording an increase of 4% in revenue as per the initial, incorrect results, Atomo therefore suffered a 6.78% drop in revenue. Atomos succumbed to inflationary and supply chain pressures with gross margins dropping from 47.6% in FY 2022 to 39.3% in FY 2021. The bottom line took a significant backward step, with a net loss of $10 million compared to a net profit after tax of $4.2 million in FY 2021. Operating cash flow was hit hard as a result, plummeting from $9.8 million in FY 2021 to a negative outflow of $26.5 million.

Atomos was forced to use debt as it replaced its prior debt facility of $5 million with a new one for $12 million. It currently possesses long-term debt of $9 million and has a current cash balance of $5 million. Just when Atomos showed signs of scalability after posting strong FY 2021 results, a smog of pessimism has been cast over its outlook due to first, the departure of the founder and former CEO Jeremy Young and second, allegations of misconduct and improper behaviour were filed by former CEO Estelle McGechie. Amongst all these negative factors, there hasn’t been much talk about the deterioration in Atomos’ gross margins, which I think is the bigger concern.

Is Blackmagic Design A Better Company Than Atomos?

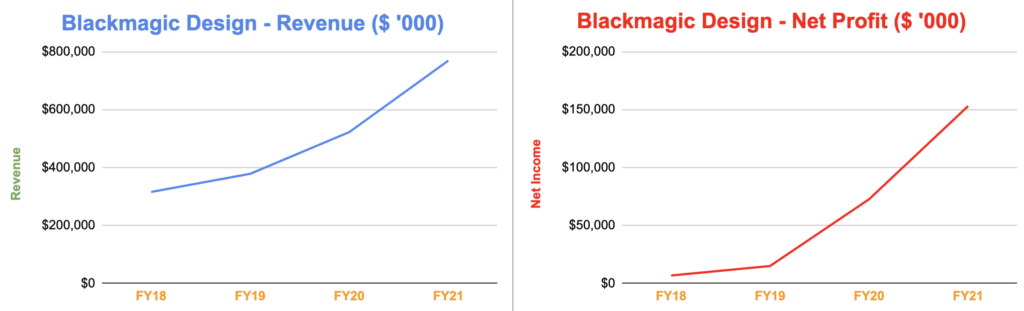

In Atomos’ prospectus dated December 2018, the business advised its competitors included the likes of Blackmagic Design, Video Devices, Convergent Design and SmallHD. Blackmagic Design has weaved its magic to become the dominant leader in video technology. Its tech has been used in around 80% of Hollywood movies like Men In Black, Fast & Furious, Captain Marvel and The Lion King as well as the former blockbuster TV show, Game of Thrones. As sustainable profitability becomes a more challenging target for Atomos, Blackmagic Design’s profitability has stormed away.

Source: Figures based on multiple articles published by the Australian Financial Review

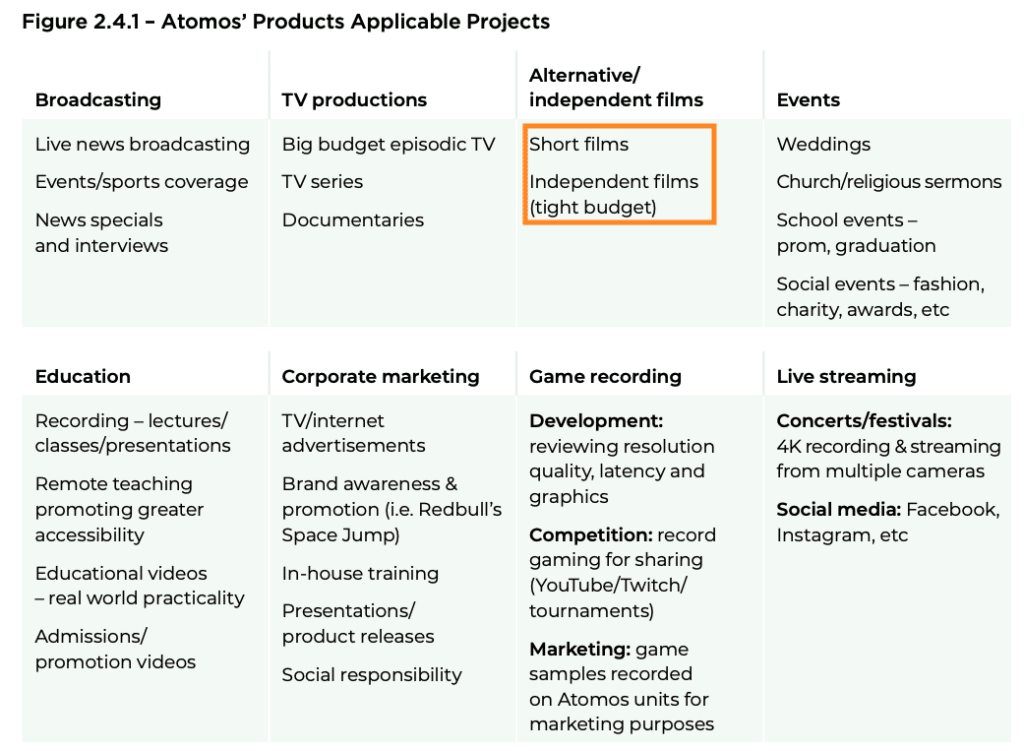

The stark contrast in performance between the two is likely attributed to the difference in the type of clientele. Blackmagic Design has already built a stellar reputation within the biggest movie and TV production circles whereas Atomos is striving to become the leader in the middle to lower market, which poses a risk to achieving strong returns on capital over the long run.

As you can see from the kind of customers that Atomos serves, they tend to be smaller clients relative to Blackmagic Design. The big concern I have with companies that are caught in the middle is that these customers possess lower budgets and are more economically vulnerable. A smaller customer base stifles Atomos’ ability to negotiate higher prices and we can see this playing out with lower gross margins as inflation and supply chain issues kicked in.

Many current ASX darlings like Pro Medicus (ASX: PME), Objective Corp (ASX: OCL), and PWR Holdings (ASX: PWH) all locked away the biggest customers before gobbling up the smaller fish within their respective markets.

In the earnings call for FY 2022, Atomos CFO James Cody explained that they had to bring back the price of some of the older products, further highlighting the difficulties with sustaining price levels. The other major concern stemming from the rise of Blackmagic Designs is that it is making inroads into Atomos’ target market by developing high-end products at affordable prices for Youtube producers. The founder of Blackmagic Design, Grant Petty, is aiming to democratise access to high-end video equipment, levelling the playing field for up-and-coming video producers.

Petty seems to have a strong focus on optimising the business for the benefit of shareholders and all stakeholders. In this AFR article, Petty described private equity firms and venture capitalists as ‘monsters’ and “would prefer to list on the stock market where you can have a wide range of investors and people that can make decisions on whether they’re into you or out of you“. He also appears to possess a conservative nature in capital allocation, which is reflected in the following quote from an AFR article covering the possibility of listing on the ASX.

“We don’t need to raise money. We don’t have any debt, we don’t have any investors. But we’re funding all of this ourselves, and the time has come to reduce our risk, and to be able to call on the market if some problem arises. It feels like we’ve just got through a very risky period, but you never know. The world is a dangerous place.“

Atomos Faces a Fierce Competitor

There is a lot to be wary of with respect to Blackmagic Design. After all, it is founder-led, there is no debt on its balance sheet and profitability is accelerating. Blackmagic Design is in a strong position to leverage its reputation across Atomos’ market. There are evidently other issues with Atomos at the moment, but I think Blackmagic Design’s capabilities trump them all, and will likely have the biggest impact on Atomos’ bottom line.

Atomos Results Reflect The Tough Environment For Tech Hardware Businesses

When I think of tech hardware companies, reputable brands like Apple (NASDAQ: AAPL), Canon (TYO: 7751), Sony (NYSE: SONY) and GoPro (NASDAQ: GPRO) immediately come to mind. Other than Apple, these companies have struggled to maintain consistent gross and net profit margins.

In order to inform this article, I consulted a table listing the return on invested capital (ROIC) ranges for each industry in 2015-2017 from Measuring and Managing The Value of Companies (7th Edition) by Mckinsey & Company. Based on exhibit 8.8 of that publication, technology hardware looks like a reasonably attractive industry on a relative basis. However, the detail is that bigger, large scale players like Apple were responsible for driving the total ROIC to almost 70%, versus a median of 27% in 2015-17.

The lesson is that many technology hardware manufacturers struggle to earn consistently high ROIC, though the average is skewed by a few very successful ones, usually the dominant competitor in any given niche.

The big reason why most tech hardware companies generally achieve lower ROIC is the difficulty in maintaining a competitive edge based on product innovation. Atomos along with Blackmagic Design are constantly innovating and creating better products with better features, which can be replicated. This is similar to the landscape of digital cameras back in the day when brands were constantly releasing new models every year. Blackmagic Design and Apple have managed to take the lion’s share of their respective markets because they set the industry benchmark, resulting in much higher ROIC relative to the rest.

Some ASX-listed tech hardware companies with a focus on the medium-sized customer segment that haven’t performed too well include EROAD (ASX: ERD) and Catapult (ASX: CAT).

If Atomos is to have any chance of getting out of its current slump, it needs to push significant capital towards developing the best video technology for the biggest clients in the market, rather than potentially shrivelling away in no man’s land.

In saying this, today’s news of the accounting restatement will only heap more cautionary pessimism over the business. One could be forgiven for thinking management would have been in a good position to figure out the correct accounting when the results were first released in August. If the FY 2022 results were not enough to signal challenges ahead, then today’s news will surely undermine confidence in the Atomos board of directors.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Disclosure: the author of this article does not own shares in Atomos (ASX: AMS) and will not trade Atomos shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.