AV technology provider Audinate Group Ltd (ASX:AD8) released their full year 2023 financial results today with US dollar revenue growing 40% to $46.7 million driving a net profit before tax of AU $1.4 million up from a loss of $4.4 million in the prior period. You can read up on the preview to this result here as well as the past coverage of the business via this link.

The previously flagged gross margin decline continued to 72.1% down from 74.7% in the prior year and from 76.6% in the 2020 financial year. However, the ever easing supply chain issues that created significant headwinds throughout the pandemic continued to improve in the second half with gross margin lifting by 90 basis points compared to the first half hinting at a 75% margin shaped light at the end of the tunnel, according to management.

Audinate showed impressive cash conversion. Of the AUD $69.7 million in revenue, receipts collected were $71 million up from $43 million in the prior period. While free cash flow was $6 million, it was masked by an $11 million term deposit redemption in the first half. Excluding this, and some other minor movements free cash out flow for the year was $4.2 million, while still negative was a significant improvement on the $11.7 million cash burn in the prior year. Audinate had a little over $40 million in cash and term deposits at 30 June 2023. Therefore, if the company can continue to improve its free cash flow it still has a number of years before it would need to consider raising cash, and indeed may never need more cash, as it is progressing towards breakeven.

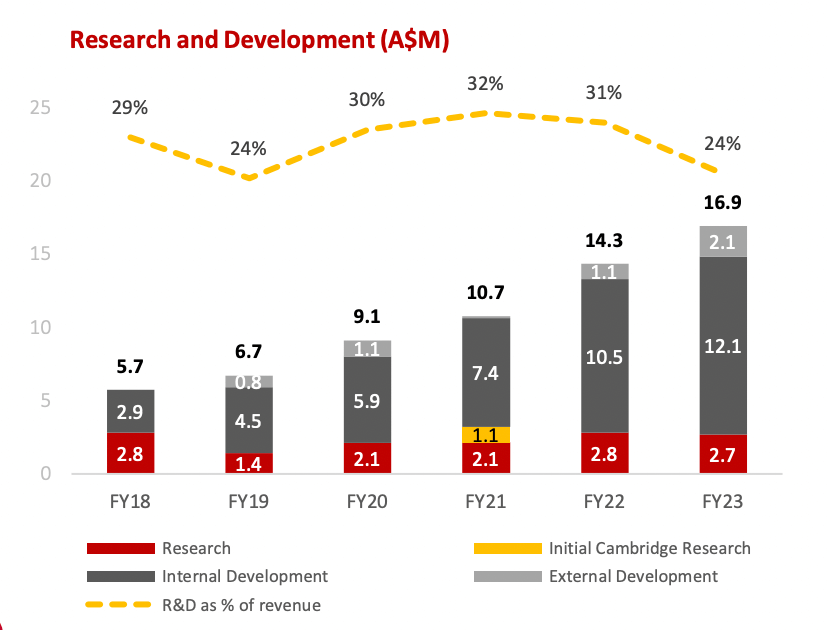

As is always the case with Audinate there was significant capitalisation of software costs which increased by 27% to $14 million. While this was a decent increase in the amount invested, Research & Development activities dropped as a percentage of revenue from 31% in FY22 to 24% in FY23.

As we’ve previously discussed, the capitalisation of software costs significantly improves the earnings per share of the company which rose from negative 5.80 cents in 2022 to positive 13.59 cents per share. This massive EPS result was driven by a significant one off $7.6 million recognition of prior year deferred tax loss, just part of an overall $9.3 million tax benefit for the year. Notably this benefit won’t be recurring. I believe a better per share metric to consider for Audinate is the cash flow per share which is negative, but moving in the right direction.

To access all our subscriber only content, join the waitlist to become a supporter, via this link.

Audinate Video Segment

Audinate achieved its FY23 goal of 10,000 video products shipped and US $3 million in revenue.

Having stated in the first half that the company had shipped 6,000 video units and $2 million in revenue the achievement comes as no surprise but nonetheless I believe I sensed the excitement in founder Aidan William’s voice. When asked about the progress in video and a comparable stage with audio, Aidan noted that it took many years for the audio business to get to where video has found itself already. The existing Dante brand strength and reputation has evidently helped spur faster growth in video, than when the then relatively unknown company launched its audio products.

The video business is symbolic of a transition from legacy Viper boards to a software based virtual Application-Specific Standard Product (ASSP) model. The Viper board inherited as part of the Silex acquisition was a white label turnkey option with higher revenue and lower margin. With the transition to the virtual ASSP model, margins are expected to improve.

Audinate Units Shipped, Revenue per Unit & Design Wins

Design wins grew by 13% following a significant year of growth in 2022. The increase in design wins in the prior year was partly due to chip shortages as customers were required to update their products to address shortages. This made the 2022 comparable difficult to beat.

One concern I had and raised on the call was the slight drop in OEM brands with products in the market, decreasing from 410 to 400 after a number of years of growth. While Aidan wasn’t overly concerned he did mention it was obviously a metric they pay attention to and part of that drop off was a bi product of the above mentioned chip shortage and OEM’s discontinuing with certain products.

Interestingly, revenue per unit featured in the first half presentation but was omitted for the full year.

A quick calculation dividing the 46.7 million in revenue by the 1.06 million units shipped worked out to be around $44 in revenue per unit, down from $49 per unit in the first half. Growth in revenue per unit in the first half was driven by an increase in the higher revenue but lower margin Brooklyn 3 and Viper Boards. I would think the main driver of the decline in revenue per unit would be the stated recovery in the Ultimo chips which tends to be a lower revenue per unit product but higher margin. This would also be supported by the improved second half margin result.

Audinate (ASX: AD8) Valuation

After a significant share price boost Audinate shares were at one stage above $12 trading at over 12 x revenue; remarkable in an era where most unprofitable tech stocks are trading well below that. Given its growth and the tax adjustments I don’t see the PE metric as the best measurement for valuation and would continue to look at a cash flow per share metric going forward. Using operating cashflow of $12.4 million, a vague proxy for EBITDA (which was $11 million) Audinate is trading on around 65x operating cash flow at the current price of $11.67, which corresponds to a market capitalisation of around about $807 million. The multiple would be even punchier if you used EBITDA.

Audinate FY 2024 Outlook

A significant backlog remains and while management expects gross profit in US dollars to grow at historic rates, orders particularly in the first half may reduce as that backlog is worked through. The continued easing of supply chain issues means a ‘return to business as usual’ per management. I hope this will lead to an improved gross margin complemented by the increasing proportion of software revenue which in turn shareholders will be hoping leads to an improvement in free cash flow.

Overall, the FY 2023 Audinate results were very impressive, and it is no surprise to see the Audinate share price up some 13.3%, at the time of writing. Given the current valuation, it is fair to say the market is expecting big things from Audinate. Having said that, I’m not inclined to sell based on valuation alone just as I am more inclined to pull out weeds, not flowers, in my garden.

The strong revenue growth certainly supports Audinate’s excellent competitive positioning and the progress towards sustainable free cash flow continues.

Sign Up To Our Free Newsletter

Disclosure: The author of this article Nick Maxwell owns shares in AD8. The editor Claude Walker does not own shares in AD8. Neither will trade AD8 shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.