Over the past year the Mader share price is up 80% from a Mader share price of $2.71 to the current Mader share price of $4.88.

Mining and infrastructure maintenance services company Mader Group (ASX: MAD) recently reported growth of 59% to $155.6 million for Q3 FY 2023 on a quarter-on-quarter (QoQ) basis. North America was the most significant driver, clocking in a 149% QoQ rise in revenue to $34.4 million for the quarter.

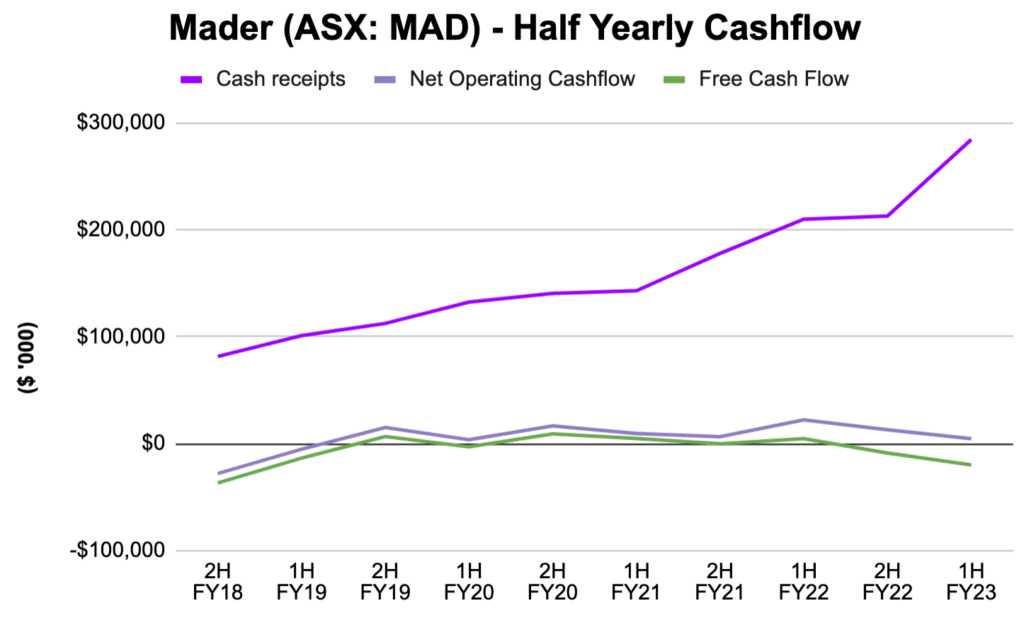

On top of this, Mader reaffirmed its guidance of revenue of at least $580 million and a minimum net profit after tax of $37 million. Despite such resounding results, free cash flow has gone backwards as depicted below.

The stark contrast could leave investors wondering whether profits will eventually manifest as free cash flows.

The other elephant in the room is the eye-watering price-to-earnings multiple of 30x, which is closing in on its prior record high of 35x. Therefore, it makes sense to take a look at Mader’s growth opportunity and capital expenditure requirements.

The Mader Group (ASX: MAD) Growth Runway

In the presentation of the Mader results for 1H FY2023, the below slide colourfully highlights the potential market opportunity, listing the current sites and the potential sites.

Source: 1H FY2023 results presentation

The number of operational sites that Mader could target in North America is around 3,160 sites, but if you zoom into the USA Expansion Update slide from September 2019, Mader notes the overall US target market is about 80% the size of the Australian addressable market.

Source: FY19 results presentation

Management may well have upgraded their estimate given it’s been more than three years since the above slide. However, I would keep a close eye on these numbers. Mader has experienced stellar growth in revenue per site as outlined in the below table (noting that the numbers below are in thousands).

Source: Author’s calculations based on data disclosed in MAD investor presentations

I couldn’t find the number of sites engaged for FY19 hence this is excluded. As you can see, Mader is on track to reach new highs for revenue per site, flexing its ability to extract more money from existing clients.

Revenue per site plays a key role in evaluating the reasonableness of the revenue growth rates implied at the current Mader share price. More on Mader’s valuation later.

Top-line growth is fantastic but what costs need to be incurred to capture this upside?

Mader Needs More Wheels To Chase Growth

Mader operates a labour-hire business model and its key competitive advantage lies in its ability to offer a flexible workforce at scale. Customers like BHP and Rio Tinto want the most reliable and fastest service to get their equipment and infrastructure back up and running.

However, unlike most labour-hire businesses like healthcare and construction workers, there is significant additional capital expenditure required when a new customer comes aboard. Nurses or doctors essentially take their knowledge and skills to the new hospital, similar to construction workers using the tools provided by the developer. In Mader’s case, additional service vehicles need to be purchased to serve additional sites.

Mader’s foray into North America has meant new service support vehicles have needed to be purchased. Unlike Australia, where a Toyota Hilux would suffice, Mader needs bigger vehicles like the Ford F-550 or Dodge Ram 5500 as highlighted by Mader CEO Justin Nuich in the 1H FY2022 earnings call. Such vehicles cost between 1.5-2x more than a Toyota Hilux.

In addition, Mader has invested heavily in crane trucks which generally cost between $200k-$300k depending on the lifting capacity required. As you can see below, management has ramped up capex in anticipation of strong future growth in North America.

I previously highlighted the higher EBITDA and EBIT margins in North America relative to Australia, but it seems like there is also a higher capex requirement. This seems to be one of the key expenses holding back Mader’s free cash flow generation.

Mader won’t need to spend at such elevated levels every year, but the service vehicles will need to be replaced over time, and given it is still early days in North America, capex investments will likely continue until the business becomes more mature (and slower-growing).

It also appears that management is finding it challenging to forecast capex in future years.

In its initial prospectus issued in September 2019, the capex forecast for FY2020 was $9.7 million but this ended up being $13.9 million. In the FY2021 earnings call, Mader CFO Paul Hegarty estimated FY2022 capex to fall between $15-17.5 million, but this came in at a record high of $39.4 million. In the FY2022 earnings call, Hegarty advised capex would be between $25-30 million for FY23, but Mader has already incurred $24.5 million for the first half of FY2023.

Given the significant discrepancies, I would take extra care in using management’s capex estimates as guideposts. On the other hand, exceeding capex estimates could imply that growth prospects are better than initially expected.

Is The Mader Share Price A Buy at $4.88?

As I’ve already mentioned, a quick PE multiple would lead one to believe Mader is expensive. And I do think this is the case based on my rough discounted cash flow model.

I imagine something along the lines of the following would need to eventuate for the Mader share price to jump to $6 per share.

- 8% discount rate and terminal growth rate of 3%

- Revenue per site in Australia to grow from $863k in FY22 to $1.4 million by FY27 and remain at that level until FY31

- Revenue per site in North America to grow from $716k in FY22 to $1.5 million by FY31

- The number of sites for North America reaches 600 by FY31, much higher than management’s initial estimate of around 400 as mentioned previously

- Gross margins to stay at 20%

- Capex to remain at 5% of revenue

A slight increase to a harsher discount rate of 10% quickly drops the Mader share price to $4.43 per share, even if management executes on everything else. Given capex could be much higher than average and demand could very well slow down as the mining cycle reverses, the downside risk might be higher than the upside potential. On the other hand, if capex requirements are below expectations, that would be a positive for free cash flow.

Mader has performed incredibly well since listing in late 2019 and continues to flex its might over competitors that have inferior cultures and value propositions. However, the current Mader share price appears to factor in a lot of positive potential, but not so many risks. I’m also mindful that Mader possesses debt of $40.1 million, which will could impose growing interest costs, if interest rates rise.

It may be a great business but doesn’t look like a great investment at the moment.

Sign Up To Our Free Newsletter

Please note this article expresses the view of the author and not the view of this publication. A Rich Life does not have a house view and every author is free to express their own opinion.

Disclosure: the author Raymond Jang does not own shares in any of the companies mentioned and will not trade shares of these companies within 2 days of publication. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.