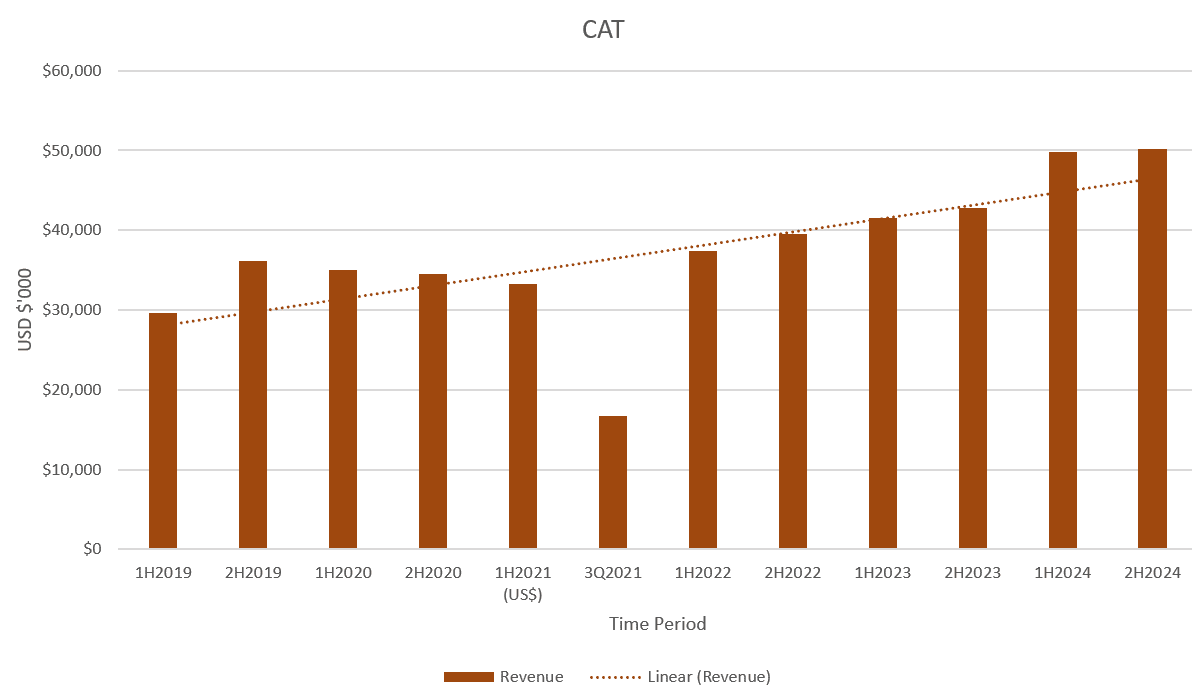

In my previous article on the Catapult turnaround, I emphasized the importance of Catapult’s (ASX: CAT) FY24 results in validating the thesis that new management could steer the company toward sustainable free cash flow. Now, with the FY24 results published, it’s clear that the management has indeed delivered improved cashflow, as promised.

For FY 2024, Catapult revenue was up about 20% to US$100m, and it produced a loss of around US$16.7m, down from US$31.4m last year. This follow-up blog delves into the specifics of these results and what they mean for Catapult’s future. The Catapult International share price is up about 10% on receipt of these results, topping off a year during which the Catapult International share price has increased more than 50%.

Overview of FY24 Results

Catapult’s FY24 financial results reveal a company that has not only stabilized but is also positioned for future growth. The most significant highlight is the achievement of positive free cash flow, a milestone that investors have been eagerly awaiting. This accomplishment is a testament to the effective strategies implemented by CEO Will Lopes and his team. The chart below shows the free cash flow (I have calculated free cashflow as Net increase/decrease in cash and adjust for loan drawdown/repayment and cash received for share issues – but I haven’t factored in the impact of Employee share-based payment expense for this graph). According to my calculations, free cash flow comes at around US$ 616K for FY24 (and $1.2m in 2nd half).

Revenue Growth and Segment Performance

Catapult reported revenue of $100 million USD for FY24, reflecting a 20% year-over-year growth.

If you look at the segment performance, the Performance & Health segment has done the heavy lifting. As you can see below, revenue from the tactics and coaching segment is normally skewed to the 1st half.

Balance Sheet Strength

At the end of FY24, Catapult’s cash balance is roughly US$11.6m and US$11m in debt.

Catapult has renewed their revolving loan facility worth US$20m and it now matures on May 31, 2027. The loan balance associated with the facility has therefore been classified as a non-current liability. This result reduces the risk that the company will need to raise capital to fund its operations in the near term.

Earnings and Profitability

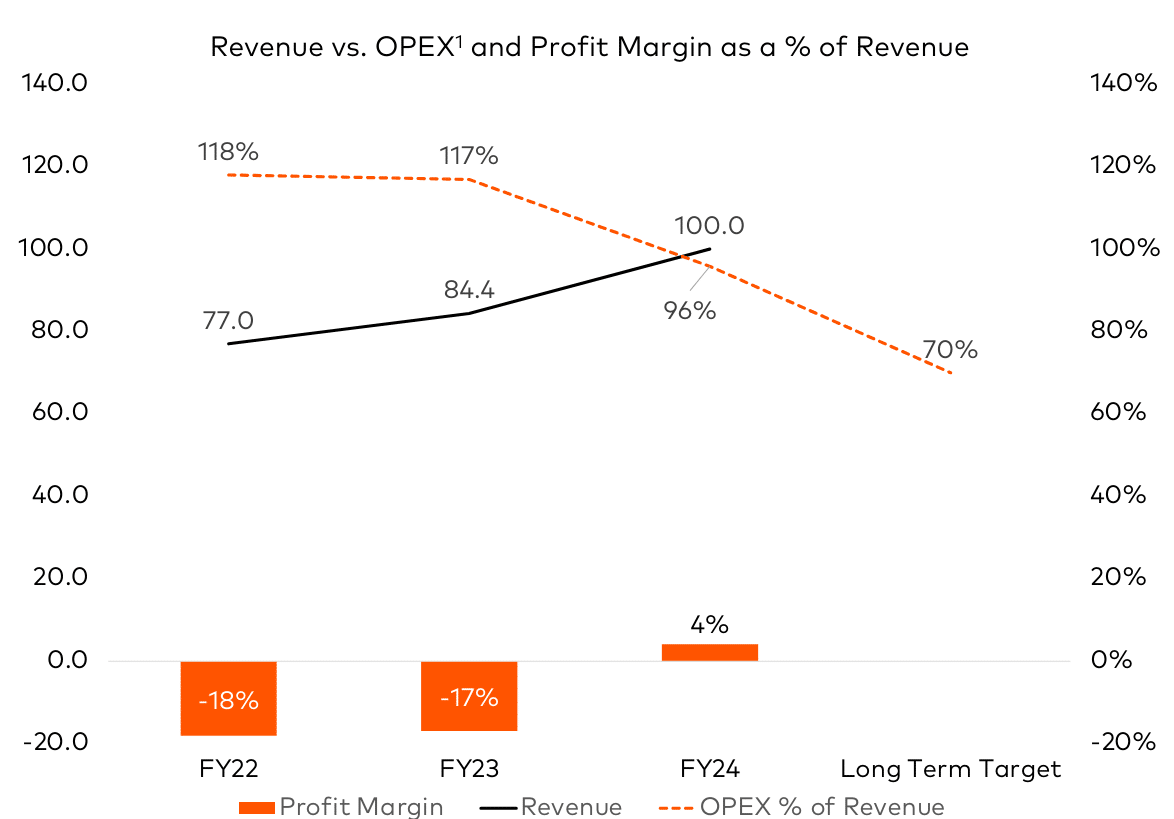

While Catapult has not yet achieved profitability, the FY24 results indicate progress toward this goal. The company’s EBITDA is positive, but it is loss-making, and its EBIT is still negative.

Future Outlook

Catapult is guiding towards continued revenue and cash flow growth in FY25, around the same as historical growth (which is roughly around 18% to 22% range for revenue). Will Lopes mentioned that one of the deals they made is in the range of their top 10 deals, and it hasn’t been reflected in this result. This bodes well for FY25.

Market Reaction and Valuation

Following the release of the FY24 results, Catapult’s stock price rose to around $1.70, reflecting the market’s renewed confidence in the company’s strategic direction and financial health. This brings Catapult’s market capitalisation to roughly AUD $445 million. For FY24, its revenue stands at about $152 million AUD. Therefore, its market capitalisation is approximately 3x revenue. While this offers a quick back of the napkin check on the relative value on offer.

Over the last few years, Catapult has traded at or below 2x revenue. However, in the heady days of 2021 it traded as high as 5x revenue. This shows that sentiment is improving towards the stock as a result of the improved cashflow situation and reduced loss.

Looking ahead, there are two key areas to keep an eye on that management highlighted in their presentation:

- Profit Margin as a Percentage of Revenue: The long-term target is 30%, as illustrated in the graph below.

- Incremental Profit: In FY24, Catapult saw $6.2 million of incremental profit from $14.4 million of increased revenue, equating to a 43% margin.

These aspects will be crucial in assessing Catapult’s ongoing financial health and strategic execution.

Disclosure: The author of this article owns shares in CAT. The editor Claude Walker does not own shares in CAT. Neither will trade CAT shares for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter