Preparing For The Omicron Wave

The new Omicron variant is not causing me to panic, but I am tweaking my portfolio a little to prepare for (likely) harder times ahead.

The new Omicron variant is not causing me to panic, but I am tweaking my portfolio a little to prepare for (likely) harder times ahead.

A confluence of factors make Nearmap well worth watching.

Building a brand new portfolio offers a tantalising fresh start right at a time when stocks are looking wobbly. Here’s the plan…

The Alcidion share price is up around 10% after it confirmed its largest ever contract win, worth at least $23 million.

Claude Walker, Matt Joass, Andrew Page, and Kevin Fung discuss Nanosonics stock and the impact of omicron on investors.

Eroad has excellent growth prospects and trades at an attractive valuation, but its actual growth is disappointing, and my confidence in management is reduced.

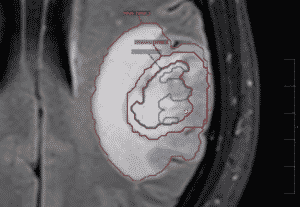

Pro Medicus (ASX:PME) revealed significant progress with its AI Accelerator at the PME 2021 AGM and a strong contract pipeline.

We discussed the company’s mission, strategy, and how the CEO thinks we should measure its performance going forward.

The 2021 Nanosonics (ASX:NAN) AGM saw the Nanosonics share price drop a little, and re-iterated 2022 guidance.

Owen Raszkiewicz, Anirban Mahanti, and Claude Walker sit down to chat Pro Medicus (ASX:PME), Damstra (ASX:DTC), Tesla and Peloton stocks.

Kip McGrath Education Centres (ASX:KME) stock may have struggled through the pandemic but the company is still being run for the long term.

It was growing before the pandemic and I will not be surprised if it keeps growing after the pandemic set-back.

Claude Walker joins Andrew Page from Strawman, and Matt Joass and Kevin Fung from Maven funds in a casual but thought-provoking new ASX podcast.

Sometimes mature software businesses can still grow profitably via acquisition…

These three growing small-caps have all shown they can generate positive operating cashflow quite recently…

A couple of years ago MSL looked very messy. But new management and a couple of acquisitions have transformed the business.

Ansarada is growing cash receipts, while Control Bionics is only growing expenditures…

These growth stocks are still losing money, but seem to be heading in the right direction.

My position is under review and I’m going to start by selling half my shares. Mea culpa, mea maxima culpa.

The Dicker Data share price is up 12% today after reporting strong demand and record year-to-date profit before tax.