3 Green ASX Stocks Our Supporters Are Watching

One is overhyped and (possibly) very overvalued, one is a mature dividend payer, and the other is high risk, but also offers high potential rewards.

One is overhyped and (possibly) very overvalued, one is a mature dividend payer, and the other is high risk, but also offers high potential rewards.

The Camplify quarterly result was very resilient in the face of lockdowns, and the share price has popped in response.

Eroad continues to grow but at a slower rate than it had thought…

The Whispir (ASX:WSP) share price is up over 10%, reporting ARR of $56.8 million at the end of the quarter.

These five stocks all have very high quality businesses that I want to buy more shares in, if only the market would offer a slightly better price.

At one point I was up almost 100%, but now I’m down almost 50%. And new information about management has come to light.

It’s always sad when the thesis breaks but it is best to acknowledge it.

These 4 small cap stocks are relatively unknown, despite all making an operating profit, and growing those profits considerably.

These three little businesses are all valued under $15 million, but seem to have potential to be worth more than that.

What are the best ASX dividend stocks to buy? I don’t know, but when I look for dividend shares I prefer to buy growing dividend stocks.

The market responded to Energy One’s acquisition of a competitor by bidding up the Energy One share price.

The market likes Damstra’s acquisition of TIKS, pushing the Damstra share price up 10% at the time of writing. But arguably, it does increase risk as well as potential rewards.

Austalian Clinical Labs shares are expected to rise as the company has announced yet another earnings upgrade due to high covid testing.

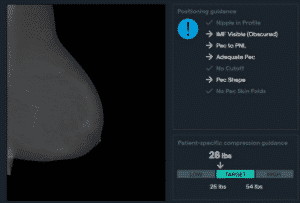

Volpara is on a mission to increase early detection of breast cancer.

The recent approval of Eisai’s Aduhelm has got the market’s attention, because it translates into higher profits for Cogstate.

Some stocks have high multiples and higher growth rates, others have lower multiples and lower growth rates. Here’s how I decided which one to choose.

The covid situation is always changing so it’s time to check in on this trade thesis.

IntelliHR (ASX:IHR) have damaged their own reputation by acting in a way that favours stockbrokers over its own retail shareholders.

One has director buying, the other has revenue growth well over 100%, but neither of them are much talked about by small cap fund managers (yet)…