Upcoming Virtual AGM Links

We’ve listed the company name, time of the meeting, and the link for you to join or register, below. Ask a question!

We’ve listed the company name, time of the meeting, and the link for you to join or register, below. Ask a question!

Claude Walker joins Andrew Page from Strawman, and Matt Joass and Kevin Fung from Maven funds in a casual but thought-provoking new ASX podcast.

Sometimes mature software businesses can still grow profitably via acquisition…

These three growing small-caps have all shown they can generate positive operating cashflow quite recently…

These growth stocks are still losing money, but seem to be heading in the right direction.

The Dicker Data share price is up 12% today after reporting strong demand and record year-to-date profit before tax.

One is overhyped and (possibly) very overvalued, one is a mature dividend payer, and the other is high risk, but also offers high potential rewards.

The Camplify quarterly result was very resilient in the face of lockdowns, and the share price has popped in response.

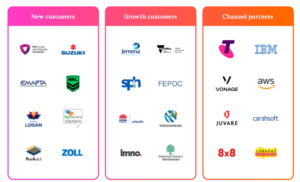

The Whispir (ASX:WSP) share price is up over 10%, reporting ARR of $56.8 million at the end of the quarter.

These five stocks all have very high quality businesses that I want to buy more shares in, if only the market would offer a slightly better price.

It’s always sad when the thesis breaks but it is best to acknowledge it.

These 4 small cap stocks are relatively unknown, despite all making an operating profit, and growing those profits considerably.

What are the best ASX dividend stocks to buy? I don’t know, but when I look for dividend shares I prefer to buy growing dividend stocks.

The market responded to Energy One’s acquisition of a competitor by bidding up the Energy One share price.

The market likes Damstra’s acquisition of TIKS, pushing the Damstra share price up 10% at the time of writing. But arguably, it does increase risk as well as potential rewards.

Austalian Clinical Labs shares are expected to rise as the company has announced yet another earnings upgrade due to high covid testing.

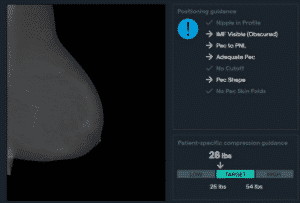

Volpara is on a mission to increase early detection of breast cancer.

The recent approval of Eisai’s Aduhelm has got the market’s attention, because it translates into higher profits for Cogstate.

Some stocks have high multiples and higher growth rates, others have lower multiples and lower growth rates. Here’s how I decided which one to choose.