Yesterday, luxury goods e-commerce distributor Cettire (ASX: CTT) reported spectacular top-line growth in its 1H FY 2024 results. Compared to 1H FY 2023, revenue climbed 89% to $354.3m and net profit rose 65% to $20.1m. Such immense growth invokes disbelief and perhaps scepticism. However, investors appear more than excited by the Cettire result with the Cettire share price soaring by 25% on the day. But let’s tale a closer look.

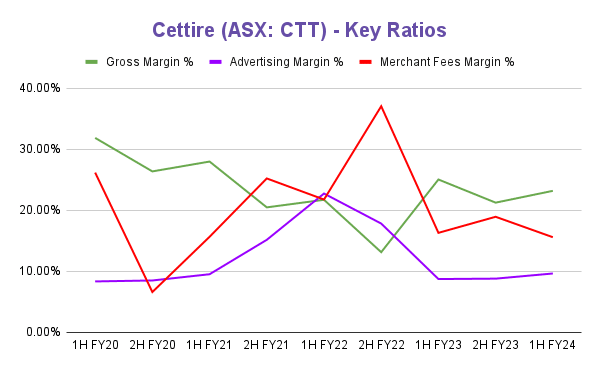

In my coverage of the Cettire Q1 FY 2024 results, I highlighted the importance of gross margin and two key operational expenses; advertising and merchant fees. Long-term value creation largely depends on Cettire’s negotiating power over suppliers being household luxury brands and merchants like Mastercard (NYSE: MA) and Visa (NYSE: V) which possess enviable pricing power. In the chart below, the gross margin has risen and the merchant fee margin declined but the advertising margin increased.

Source: Cettire ASX announcements

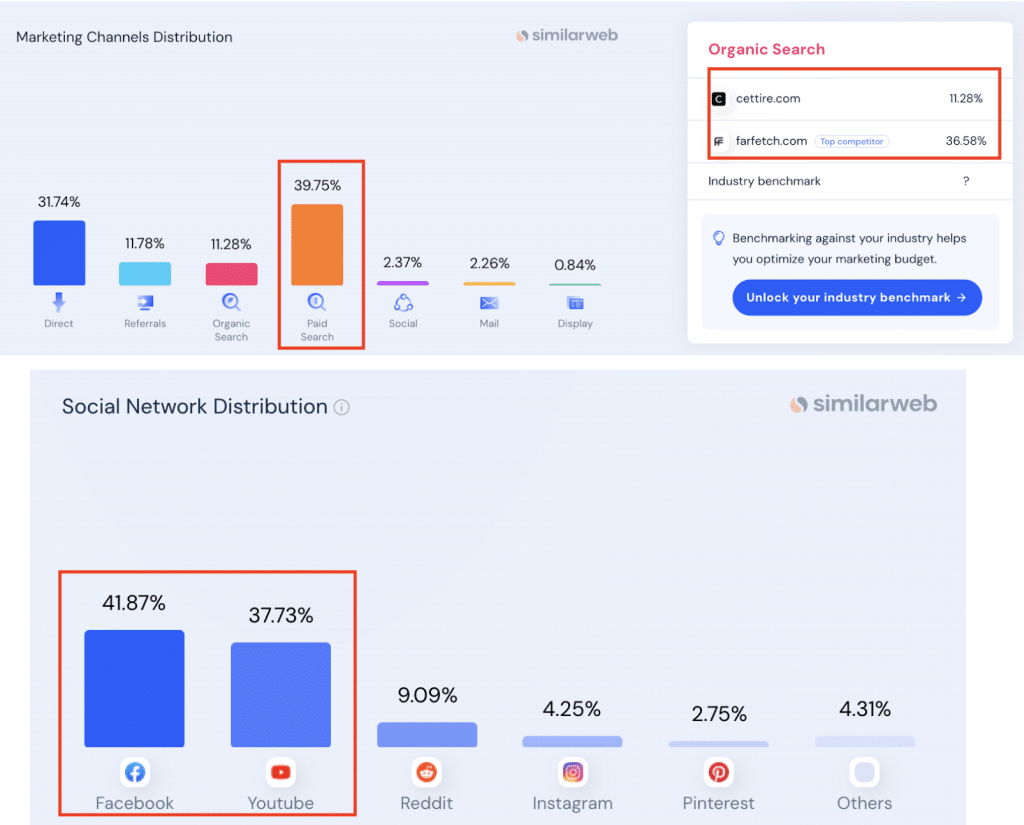

One positive is that gross margin increased in H1 FY 2024. One negative is that Cettire remains reliant on paid advertising through Facebook and YouTube rather than organic traffic.

Source: Similarweb on Cettire.com

I was unable to find any e-commerce luxury goods businesses that have achieved sustainable profitability. Cettire’s biggest global competitor Farfetch Ltd (OTCPK: FTCH.F) has reported negative operating margins ranging from -40% to -20% since FY 2016 according to Tikr. Closer to home, The Iconic has never made a profit in Australia and recorded a loss of $11m in the 2022 calendar year. Cettire’s net profit margin of 5.7% is similar to retailer JB Hi-Fi (ASX: JBH), which seems very good for its sector. On the flip side, these margins may not be sustainable.

Unlike JB Hi-Fi, Cettire is competing for every online consumer in the US so it doesn’t enjoy physical foot traffic. Due to its online nature, Cettire needs to pay more for advertising and has no local advantages relating to an established store. It also seems that Cettire has less brand power, given the high proportion of traffic that comes from paid advertising. So in my view, the net profit margins of JB Hi-Fi are easier to view as sustainable than the net profit margins of Cettire.

At a current market capitalisation of around $1.53bn, I think investors are paying a lot for a secret sauce that may not prove enduring. But given Cettire holds $100m in cash, carries no debt, and continues to grow, it could very well prove me wrong.

Disclosure: the author of this article does not own shares in Cettire. The editor of this article does not own shares in Cettire. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.