Value investors, look away now.

Almost exactly 6 months ago, we realised that the Fed was committed to making the rich richer and would do just about anything to pump stocks. And so we published this list of “14 Moon Star Rocket Cloud Growth Stocks” and promised to yolo some cash into them. Sadly, this simple meme-post remains one of our best performing for 2020. So much for sophistication…

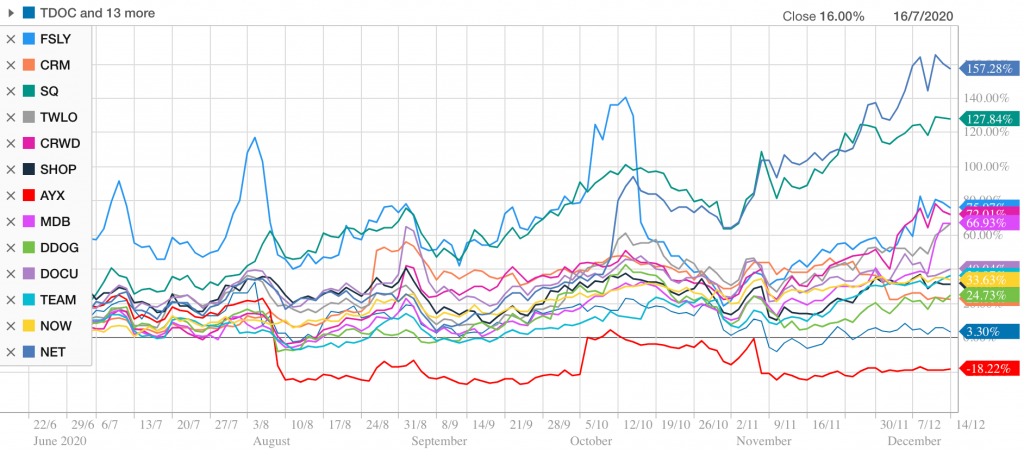

Happily, though, the stocks have performed really well since that time. Appallingly, just randomly selecting 14 of the most popular high growth cloud stocks produced an average return of 53.35% in just half a year. That’s a whole lot better than most fund managers did.

As you can see, the returns have ranged from a loss of about 20% on Alteryx, to a gain of over 150% on Cloudflare. The average is market-thumping.

So my tip for 2020 is this. Beware long only fund managers who have been underperforming the market for the last 3 years or more. As far as I can gather there has never been an environment so easy for long only investors, and so difficult for short sellers.

It did not take a genius to see that money flows would end up in stupidly priced meme stocks and it did not take a genius to find out what they are. One day, I believe, the current flood of dumb money will abate, and many of these stupidly priced growth stocks will fall hard.

But the average gains are so high in just half one year that I think we can now declare the Moon Star Rocket Cloud Growth Strategy to have worked. If you aren’t a long term investor, you could sell these stonks for a hearty profit right now.

Game over.

You win.

Personally, though, I’m keeping most (but not all) of mine, for the long term. I have taken some profits, and I will take some more profits, but I currently hold positions in 8 of the 14 companies mentioned in the original article, and I intend to hold shares in at least some of this list of high growth cloud stocks for many years to come.

This post is not financial advice, and you should click here to read our detailed disclaimer.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 2 months free and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!