During the last week of July many small cap stocks report their quarterly cashflow, ahead of the full year results in August. These reports don’t give us the full picture of the company’s performance, but often still provide a useful update on the company’s progress (as well as a peek at part of the upcoming full year results). The deluge has well and truly started, so I thought I’d share some quick notes on three interesting companies that reported their quarter cashflow appendix 4C today.

Clinuvel Pharmaceuticals Limited (ASX: CUV)

Clinuvel (ASX: CUV) is a profitable ASX listed pharmaceutical company that nonetheless puts out quarterly cashflow statements. Clinuvel sells SCENESSE (afamelanotide 16mg), which is used to treat a rare genetic disease characterised by severe intolerance of the skin to light, called erythropoietic protoporphyria (EPP).

Current CEO, Philippe Wolgen, took the helm in 2005 and helped focus the company on addressing light-related skin disorders including EPP. By 2016-2017, the company was able to reach profitability based on sales to certain European countries. The vast majority of patients treated with SCENESSE continue treatment beyond the first year and some patients in Switzerland have received treatment for over a decade. After several years of commercialisation, the drug would appear to be safe and effective.

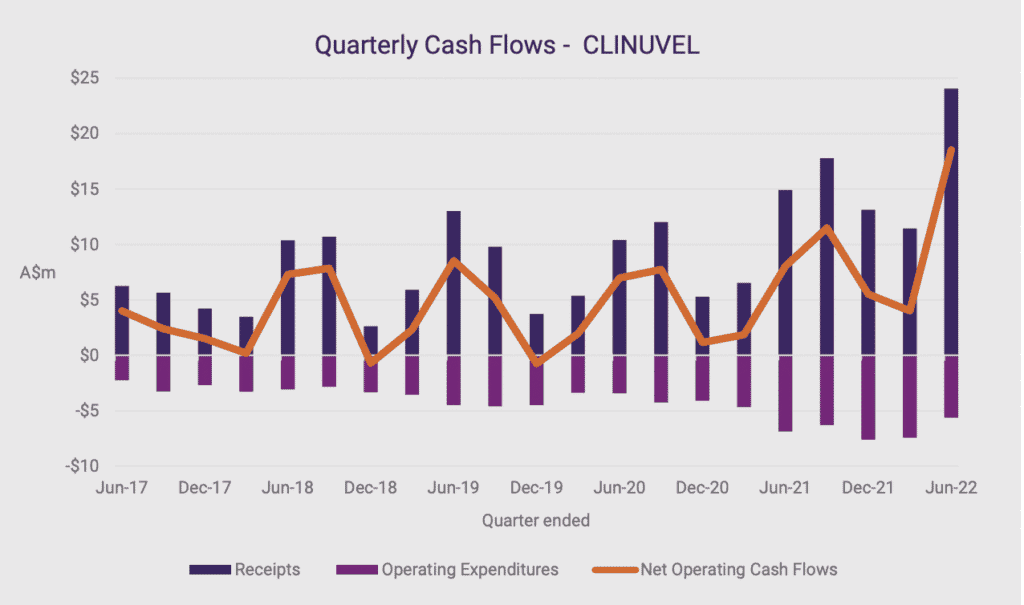

The most recent quarterly showed an absolute bumper record quarter for Clinuvel, which produced receipts from customers of $24m in the quarter to June. This constitutes about 36% of the total receipts for the year, being about $66.4m. For the quarter, free cash flow was about $18.4m, and for the full year it was $39.4m. In FY 2022, free cash flow was close to half that, so I have to acknowledge the strong free cash flow growth! However, as the chart below shows, Clinuvel’s cash flow is generally quite lumpy from quarter to quarter.

In other news, one of the directors of Clinuvel has recently sold shares “to meet personal tax commitments” and the CEO seems to be disappointed with the share price decline from highs over over $44 to below $16. He recently wrote, “As bitterly cold winds blow, CLINUVEL fortifies its financial fur, and as current sentiments ebb, the overall strategy may well be recognised.”

In that letter, the CEO referenced that “four years ago we made public our objectives to be achieved by the end of 2023” but despite reviewing some company announcements I couldn’t figured out what they were. (I will email the company to ask, and will update this paragraph accordingly.) However, the good news is “realisation should be within reach.”

At the current Clinuvel share price of around $15.54, Clinuvel has a market capitalisation of about $832m, which is around 21x FY 2022 free cash flow. The company has over $120m in cash and plans to grow via organic drug development (and approvals) as well as potential acquisitions if appropriate.

I previously commented on Clinuvel’s corporate governance and quoted an article from the Australian Financial Review. The company has contacted us to ask me to retract my comment. The company noted that, “It is disappointing that you have chosen to source information from gossip columns, rather than seeking to clarify unfounded conjecture with the Company directly.”

I therefore retract the statement, as I did not realise what I quoted was contentious and believed it to be correct at the time of publication.

I will look forward to reading the Clinuvel full year results in August.

Camplify Holdings Limited (ASX: CHL)

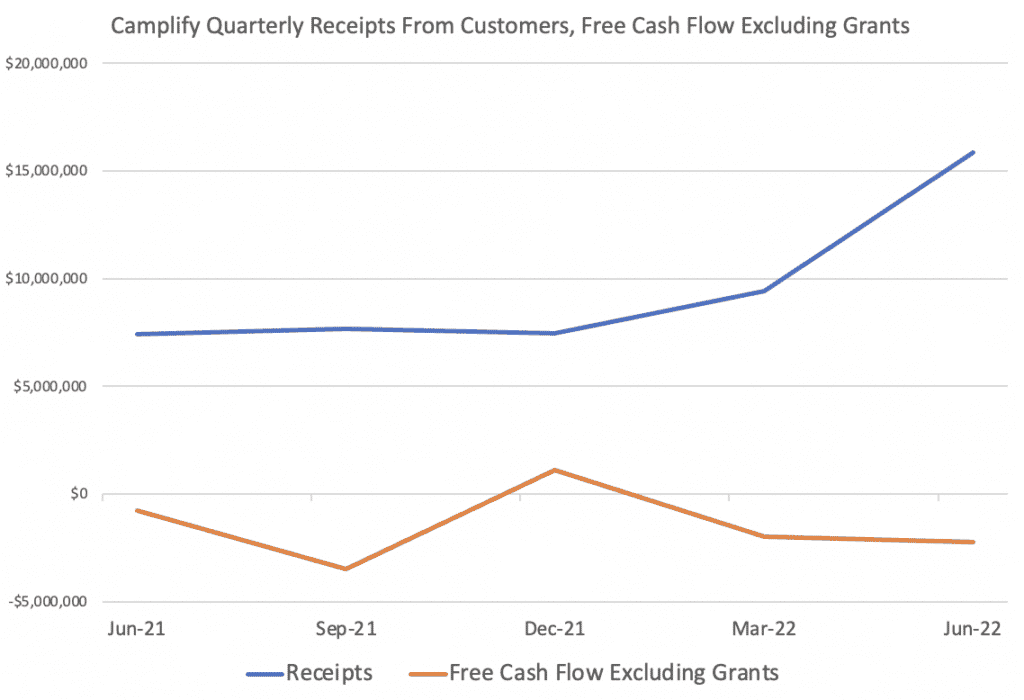

This morning, Camplify (ASX: CHL) reported its Appendix 4C cashflow report, showing receipts from customers of $15.9 million and negative free cash flow (cas burn) of $2.2m for the quarter. In the full year, receipts from customers were $40m and negative free cash flow (cash burn) was about $6m. Camplify has about $15m in cash so while it has enough money, for the moment, its current trajectory implies it will need to raise capital again in around a year.

Importantly, this quarter is the first quarter that benefitted from the recent acquisition of Mighway and SHAREaCAMPER, which completed on May 2, 2022. You can see a chart of Camplify’s quarterly receipts from customers and free cash flow, below.

Long story short, the acquisition has helped them gain scale, and receipts from customers, but free cash flow hasn’t really budged quarter on quarter.

Arguably, the main game for Camplify is just to make sure it benefits from the network effect. We’re yet to see if it can really own the market (and exert pricing power), but the indications are that it is well on track to be the number one campervan and trailer hiring website in Australia and New Zealand. Although I sold my shares in February, I continue to think Camplify has a compelling proposition and can definitely take market share. It would not surprise me if the company is one day worth much more than its current market capitalisation of around $96 million, at a share price of $2.40.

However, the first question on my mind is how much of its cashflow is actual booking revenue. You see, the revenue Camplify makes from actually facilitating a transaction on its platform is the best measure of the health of its network and the popularity of its business proposition (which is to provide a nearby campervan for domestic nature holidays). Less than half Camplify’s total revenue is booking revenue and we have to wait until the annual result to get that information.

The second question on my mind is whether the company will need to raise capital again. Based on the approach of growing by acquisition and organically, it may well need to. For me, the attractiveness of the business will depend on the booking revenue growth and also whether it can reduce its cash burn in the coming quarters, or not. Finally, if there is another big “risk-off” sell-off where cash burning companies get smashed, I think Camplify could get to an interesting price. Although it is far from proven I generally think that this businesses fundamentally deserves to exist and will likely be bigger in the years to come, as it should be able to create value for hirers and van owners alike, by helping to monetise an idle asset.

I look forward to reading its upcoming results in August.

Whispir Limited (ASX: WSP)

Whispir (ASX: WSP) sells software that allows company to help automate digital communications such as the texts you get from Australia Post when you have a package arriving for texts from Qantas telling you your flight has been cancelled. At the beginning of the pandemic I made the stock a large shareholding, as I expected demand to benefit from the situation. However, I subsequently sold some Whispir shares at a profit after I explained why I planned to take profits on Whispir by August 2020, then ditched my final shares after explaining to readers why I would be selling my all my remaining Whispir shares.

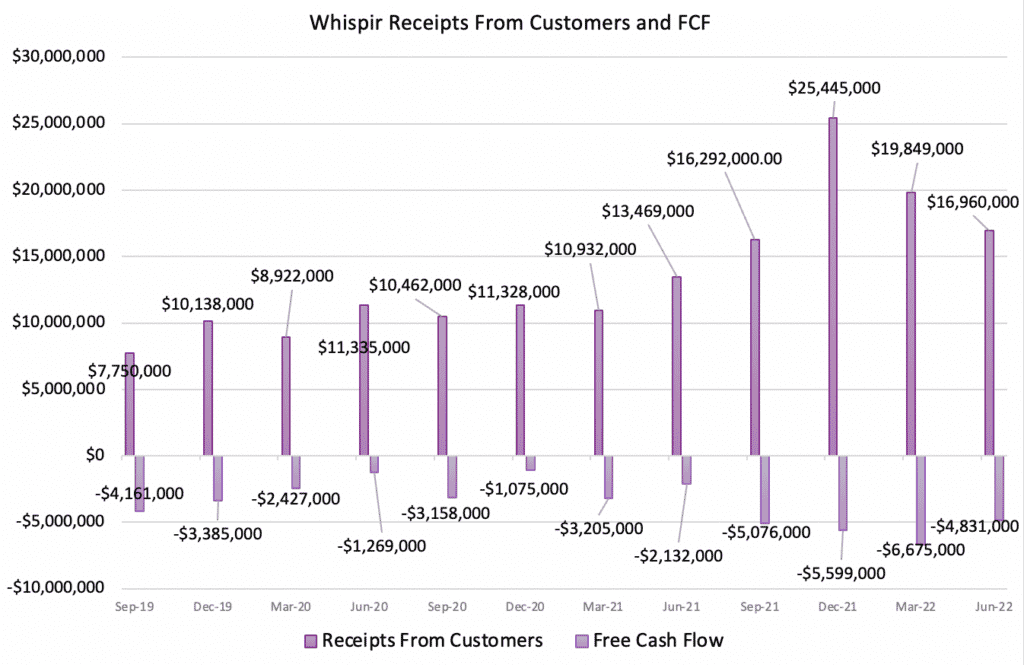

In the fourth quarter of FY 2022 Whispir generated receipts from customers of just under $17m and cash burn of about $4.8m. After raising capital at $3.75 in March 2021, Whispir has $26m in cash so it can afford this level of cash burn for at least another year. As you can see below, this quarter saw lower receipts from customers than the preceding two quarters, but was about 25% better than the prior corresponding period.

In the announcement, the company said “The decrease in cash burn was evident across all areas of the business, but notable in administration which fell by 17.9% ($0.40 million) to $1.83 million and staff costs (including capitalised staff costs) which fell by 4.7% ($0.57 million) to $11.60 million2 for the Quarter.”

While this result is hardly particularly impressive (imagine thinking it was wise to burn ~$20m per year leading into a recession), it does at least show that the company understands that if it continues to spend relentlessly then it will need to dilute shareholders again.

That’s a real positive, compared to the quarterly report released in April 2021 (for example), in which the company said “Our successful capital raising during the Quarter ensures we are able to fast-track our product development and increase our sales and marketing capability to scale the business faster, particularly in Asia and North America…”

For me “fast tracking” product development usually means burning a lot of cash for an uncertain pay off. If Whispir can reign in its spending, we may get a view of the value that the cash spend has created. However, if the expenditure has failed to create much value, then we will likely just see increasing cash burn as the company spends more to spur revenue growth (but without actually proving an ability to make a profit.)

The Whispir business model has much lower gross margins than most software companies because it isn’t just delivering software, but also reselling connectivity. This isn’t a bad thing long term, since it means Whispir can profit from more usage of its services. However, it means that Whispir’s revenue is less likely to be profitable than a higher margin software company. It will be an interesting one to watch over the next few years.

The company says “current plans provide for cash reserves to be more than 12 months of cash burn at all times throughout FY23.” That implies that cash burn should reduce over the coming quarters, providing a potential inflection point for Whispir stock.

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author does not own shares in any of the companies mentioned and will not trade them for at least 2 days after publishing this article. This article is not intended to form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives. Any statements considered advice under the law are authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.