This morning, the brain health monitoring software company Cogstate (ASX: CGS) saw its share price gain more than 50% on the news that Eisai’s Alzheimer treatment drug Lecanemab “met the primary endpoint and reduced clinical decline… by 27%.” This is big news for Cogstate, because Eisai uses Cogstate’s software to monitor and diagnose the cognition of its patients.

In order to understand why the Cogstate share price is up today, it is necessary to understand what the company actually does. Cogstate earns money by selling a cognitive testing tool called Cognigram, which is used both to diagnose Alzheimer’s disease, and also to test whether new drugs (like Lecanemab) actually help treat it.

Prior to today, the most advanced treatment for Alzheimer’s disease was Aduhelm, which was a rather contentious solution, given some questions about its effectiveness. I started buying Cogstate shares last year, because, as I explained at the time, “the approval of one drug, especially one that supposedly may not be very effective, would stimulate an increase in new clinical trials.” As small cap growth stocks sold off this year, Cogstate was one of the few that I bought more shares in, as disclosed here, at the time.

Why Are The Lecanemab Results Good News for the Cogstate Share Price?

As you might have guessed, I’m not the only person who has cottoned on to the potential for advances in Alzheimer’s treatment to drive demand for Cogstate’s software. In fact, I have paid close attention to Matt Joass, the founder of Maven Funds, who has helped me understand the opportunity. In a recent note to his fund investors, dated 31 August, 2022, he wrote:

“If Lecanemab is successful however this would be the most valuable since Cogstate is partnered with Eisai to develop a cognitive testing software product called CogMate. Although the two are not technically linked together, Eisai will have a lot more motivation to get that test into as many hands as possible once it has a successful Alzheimer’s drug of its own on market that it is promoting.”

In my view, the fact that the results for Lecanemab are quite positive, is driving up the Cogstate share price precisely because it implies that Cogstate’s long term prospects are now strengthened.

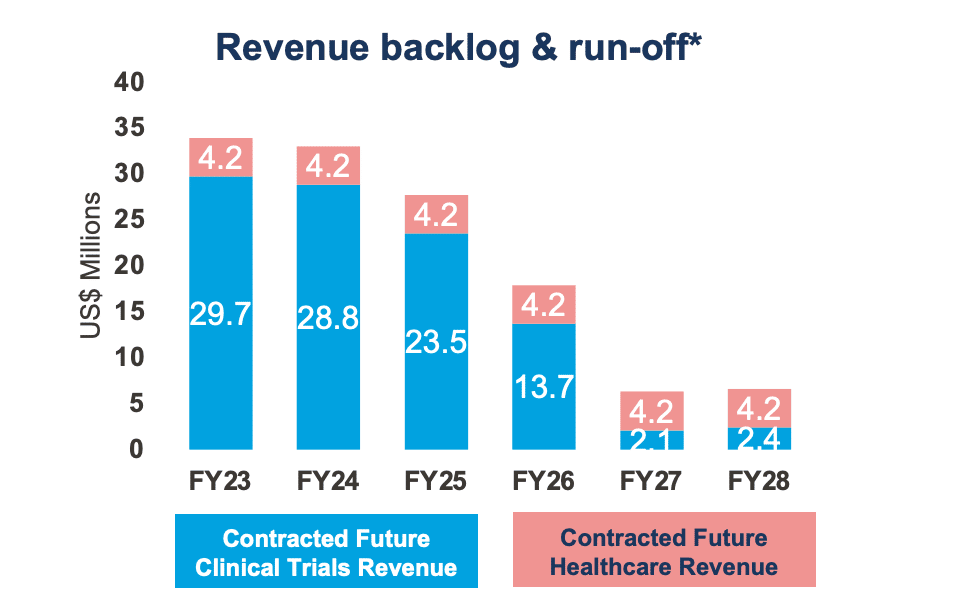

Even without these results, Cogstate has a strong opportunity to make money from drug development. For example, Roche is developing Gantererumab and Lilly is developing Donanemab. Drug development programs like these contribute to Cogstate’s pre-contracted clinical trials revenue, as you can see below.

However, as you can see, Cogsate also makes money from its “healthcare” segment which is essentially a license agreement with Eisai, announced back in 2020. Importantly, the “contracted future healthcare revenue” pictured above is based on agreed minimums. Fortunately for Cogstate, the agreement states that Eisai will:

“pay Cogstate a royalty, determined by reference to a range of factors including retail market price (after allowance for customary rebates, discounts and/or sales taxes) of Cogstate technology in all regions, or calculated on a per user basis, and which will be no less than the minimum royalty…”

Therefore, one of the best possible things that could happen to Cogstate would be for Eisai to succeed in commercialising Lecanemab. While nothing is guaranteed, if Lecanemab turns out to be a viable solution for Alzheimer’s disease, then Cogstate is poised to clip the ticket on the huge numbers of cognitive tests that will be performed, in order to identify potential patients.

Before today, I owned shares in Cogstate because of the potential for it to make money as the main, best accepted coginitive testing software for diagnosis of degenerative brain diseases. In my opinion, if other companies such as Lilly or Roche have success with their drugs, it would make sense for them to try to use the existing Cogstate tests to diagnose patients. However, given Cogstate had signed a distribution agreement with Eisai, there is no guarantee that Lilly or Roche would use Cogstate systems.

According to Reuters, “Analysts, such as Salim Syed at Mizuho Securities, have said the results would be considered a “win” if lecanemab slowed the rate of decline by around 25%, and that shares of both companies could jump on the news.” Given Cogstate’s pre-existing relationship with Eisai, it is no surprise that the Cogstate share price is flying due to the fact that the Lecanemab slowed progress of the brain-wasting disease by 27% compared to a placebo, meeting the study’s main goal.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Disclosure: the author this article owns shares in Cogstgate (ASX: CGS) and will not trade Cogstate shares for 2 days following the publication of this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.