Talking Stocks: Damstra (ASX: DTC), Pro Medicus (ASX: PME), Tesla and Peloton on the Rask Invest Podcast

Owen Raszkiewicz, Anirban Mahanti, and Claude Walker sit down to chat Pro Medicus (ASX:PME), Damstra (ASX:DTC), Tesla and Peloton stocks.

Pro Medicus (ASX: PME) is a radiology software company founded in Melbourne in 1983 by friends and fellow wine connoisseurs Sam Hupert and Anthony Hall.

Pro Medicus (ASX: PME) was listed in 2000 during the tech bubble at a Pro Medicus IPO price of $1.15. The Pro Medicus share price was languishing until it acquired Visage Imaging from Mercury Computer Systems in 2009, selling just part of the acquired technology for a profit, not long after.

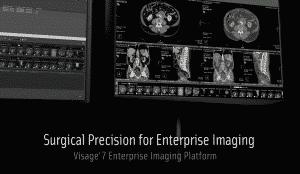

Visage Imaging has benefitted from ownership by Pro Medicus. Long serving General Manager of Visage Imaging, Malte Westerhoff lead the team of developers in Berlin, to develop Visage 7 viewer, which counts won the business of top notch US teaching hospitals like Mayo Clinic.

Owen Raszkiewicz, Anirban Mahanti, and Claude Walker sit down to chat Pro Medicus (ASX:PME), Damstra (ASX:DTC), Tesla and Peloton stocks.

ASX superstar stock Pro Medicus (ASX:PME) has reported record results for FY2021, but how does the future look?

The company seems in great shape but the market is starry-eyed.

The Pro Medicus share price fell today (ASX: PME), despite stronger profits and record revenue, with volumes bouncing back as covid recedes.

It’s easy to say that the Pro Medicus share price is very optimistic, but is it high enough to warrant selling some shares?

While the Pro Medicus share price is arguably very optimistic, the business itself is very interesting and worth learning about…

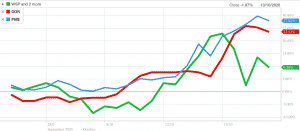

Whispir, Pro Medicus and Dicker Data have seen share price gains off recent announcements. So are they still worth buying?

The Pro Medicus share price may see weakness as the pandemic has impacted second half profit. Is this an opportunity to buy?

Reflections on the volatility and a stream of consciousness rumination on 5 stocks I like now.

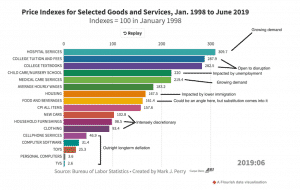

The current macro-economic settings makes it easy for bad creditors to borrow, and even easier for resilient well-run businesses with secular demand tailwinds.

Pandemomomania – noun – an enthusiasm for stocks that are going up during a pandemic…

Removing a few companies and adding 6 more…

Why I like them, the expected impact from the coronavirus, and my target buying range…

While top line growth of 15% might seem underwhelming, the real story is the fast growing Visage 7 viewer in the USA, and the strong free cash flow…

I would say for the average investor (whether retail or professional), neglect of the quality framework is extremely common.