Radiology image storage and visualisation software company Pro Medicus (ASX:PME) today reported profit of $30.85 million for the full year, with full year revenue of $67.9 million, up 19.5% on last year. The full year profit result was up 33% on last year. Pro Medicus generated profit of $13.54m in the first half, and its second half result was $17.31m, a significant half on half improvement that was aided by a currency headwind in the first half, which turned into a benefit in the second half.

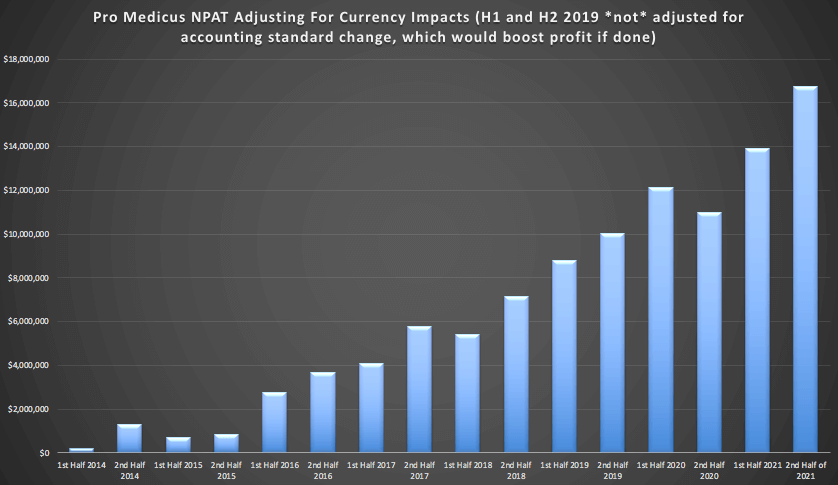

While Pro Medicus does experience impacts from currency hedging overall it benefits from a lower Australian dollar because so much of its revenue comes from overseas. Notably, the company said that “on a constant currency basis, the revenue would have been $73.98m (up 30.2%) and the underlying profit before tax would have been $46.93m” compared to the actual underlying profit before tax of $42.6m. In any event, in FY 2021 Pro Medicus produced a record profit for Pro Medicus, and the second half was the most profitable half ever, as you can see below.

The Pro Medicus Business Model

Pro Medicus has five main products. The Australian radiology information systems (RIS) software, which includes worklist functionality, the vendor neutral archive (VNA) for storing images, and the Visage 7 image viewer, for actually reading the radiology images. The latter product is where the company has built its competitive advantage, through an ability to stream large numbers of large image files more quickly and in greater detail than competitors. Importantly, all these products charge on a usage model to varying degrees so Pro Medicus benefits as its customers grow.

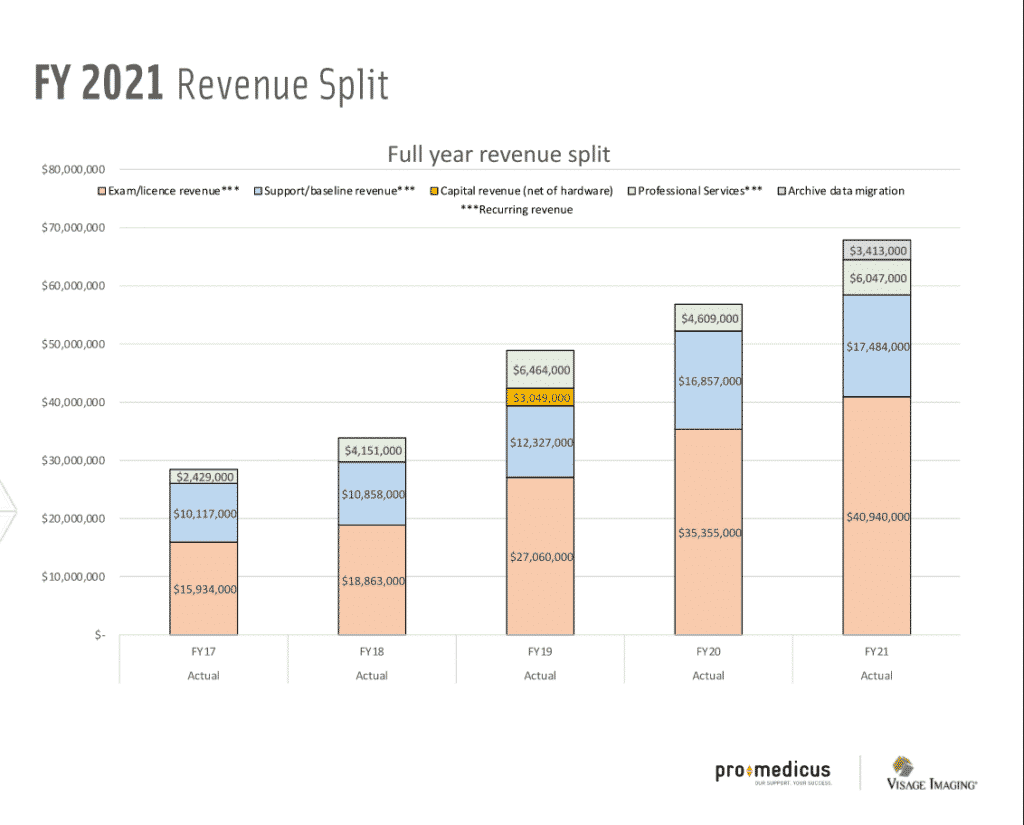

As you can see below transaction revenue grew strongly in FY2021, but the company also benefitted from signifcant implementation and data migration revenue (which is not really recurring in nature).

This in turn has allowed the company to win major teaching hospitals in the US as clients. This includes Partners Healthcare, where Harvard students train, Yale-New Haven, where Yale students train, the UCLA and UCSF hospitals, as well as the Mayo Clinic. At the current share price of $56.50, Pro Medicus is trading at about 87 times revenue. In order to even begin to conceive how Pro Medicus could justify its share price, we have to think about its positioning in its industry.

Pro Medicus is the premier tool that top notch radiologists are being trained on. Its niche is visualisation, but it maintains a side business (mostly Australian) in RIS and has expanded vertically in its tech stack by also providing vendor neutral archiving. Some years ago, it was normal for one provider (for example Fujifilm) to provide the entire tech stack from the X-ray machine to a dedicated station to view images on. As this model gave way to deconstructed systems where different components were provided by different companies, Pro Medicus established itself as the best viewer, enabling high paid radiologists to be more efficient. This allowed high pricing, since the software leverages the ability of very high earning radiologists.

Furthermore, Pro Medicus has used its position to act as a platform on which machine learning algorithms can automate parts of the radiology process. This requires the maximum number of radioligsts in top hospitals using the platform.

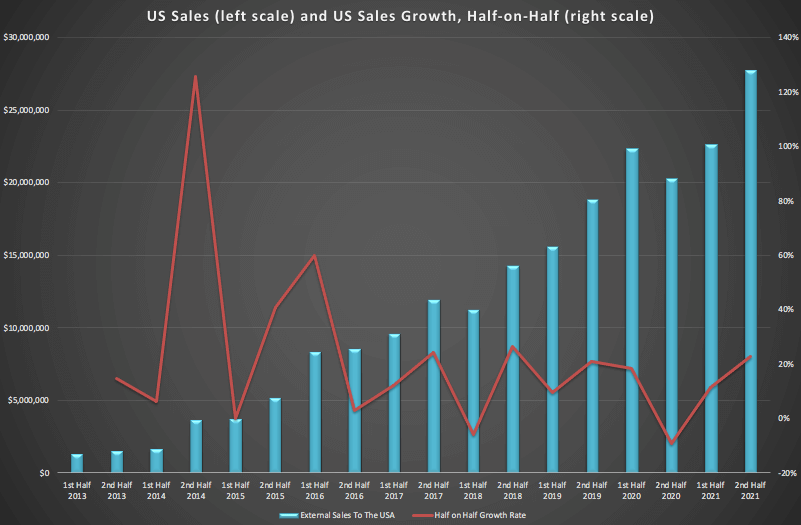

So in many ways, the revenue from North America is a good gauge of the company’s success. You can see its long term growth, in the chart below.

Importantly, the second half was a record half in terms of revenue from North America. This would be a result of full half contributions from recent contract wins such as NYU Langone Health, but also as a result of scanning volumes recovering now that fewer hospitals are drowning in covid cases. These issues may arise again in the future, but this half’s recovery should give confidence that Pro Medicus transaction based revenue will rebound from any short term disruption.

Pro Medicus Records Strong Free Cash Flow In FY2021

One of the pleasing aspects of this result is that Pro Medicus recorded free cash flow of about $31 million, excluding the “investment” in “fixed-income securities that enhance our returns on available funds.” We note that the company saw an increase in receivables, which the CFO put down to increasing revenue plus a large amount of implementation revenue invoiced towards the end of the half. We have seen receivables fluctuate before and given the quality of the company’s clients, I’m not too concerned about this.

The company now has cash of $42m and fixed income investments of about $19.8m. Based on comments from the CEO, I understand that the general prioritisation is to use cash to invest in R&D, then use it to enhance shareholder returns via dividends and buybacks, then finally to use it on M&A should the right opportunity arise.

Although R&D expenditure remained fairly steady at about $7.5m this year, the company has said that it will establish a new R&D hub in New York City to maximise its partnership with NYU Langone which it believes “will help generate new products that we can offer to the market.” It also announced a research collaboration with Mayo Clinic which, it says is a “significant piece of our AI strategy, one that has the potential to develop innovative AI solutions that meet well defined clinical goals and ultimately lead to better patient outcomes.” This makes sense, but shareholders should be prepared for a measured increase in R&D expenditure in FY 2022.

What Does FY 2022 Look Like For Pro Medicus?

One of the standout features of this result was that Pro Medicus achieved an earnings before interest and tax (EBIT) margin of over 63%, a huge improvement on the 53% it achieved in FY2020. I emailed the CEO to ask if this was sustainable prior to the call, and on the call he stated that in FY2022 “Margins will be somewhere between where they are now and where they were last year”.

This makes sense, because Pro Medicus actually saved money through lower marketing and conferencing costs during the pandemic, as well as a successful switch to remote implementation. My guess is sustainable EBIT margins are between 57% and 59% in the near term. (Note, this is EBIT margins, not NPAT margins, which will be a bit lower because of tax).

In fact, one of the learnings from the pandemic for Pro Medicus was that it is most efficient to implement the software via a hybrid remote and in-person process. On top of that, Visage 7 is an ideal solution for radiologists in a work from home environment because it allows radiologists to instantly read large radiology scans from their personal devices, using standard commercial internet. I missed the exact phrasing on the call but the CEO commented that he did not believe competitors can offer the same capability. He points out that even in a post-Covid world “being able to work from home seamlessly is a huge plus”.

Speaking of the scan streaming competitive advantage, the CEO commented on the call that the streaming is the easiest part to explain because it’s like Netflix for radiology (as opposed to downloading the entire file). But there is a lot of other technology included because you can’t have any jerkiness. Since bandwidth keeps changing every half second or so, you need special technology to make experience smooth and usable for radiologists, who do not want to miss anything. While he did concede the situation could change, he also commented that competitors have tried to replicate the suite of technologies without success.

Moving on to the pipeline, the company presentation said that it “continues to grow strongly” and “we’ve had new opportunities come into the pipeline and opportunities progress”. On Ausbiz the CEO mentioned that they have a lot of inbound inquiries. When I asked if they had lost any tenders the CEO confirmed that there have not been any contracts that they’ve competed on that they lost to a competitor. However he did note that “there are some opportunities that we don’t get a look at, thankfully they are not many.” While that’s not ideal, the main point here is that Pro Medicus has a fantastically high success rate “where we have had the chance to do demonstrations to the radiologists.” While they have lost a couple of tenders over the last decade I view the extremely high win rate as evidence that their product certainly remains the best on market.

Over the last few years Pro Medicus has had a number of growth initiatives. We’ve already seen great results from its vendor neutral archive product, and the latest addition seems to be Visage Worklist, which has the “same DNA” as the Australian RIS product, but is a new product. There are 4 clients using the Worklist product, the largest being Intermountain Healthcare, which is important, as it is a large flagship client. This shows how the company can use its positioning with the world-beating image viewer product to sell new products.

Looking to the next couple of years, the company is hoping to sell Visage into non-radiology departments, and we may see revenue from this as soon as FY2023 (though no guarantees on that).

Clearly, the most exciting developments are the AI research and the cloud competence. With the recent Medstar implementation, Pro Medicus can boast the “largest cloud based PACS implementation anywhere in the world,” and with 50% of the Pipeline interested in cloud implementation, up on 0% a few years ago, its clear that the company is positioned on the right side of this trend with its native cloud offering. Looking further into the future, the approach of having the viewer act as a platform for third party AI algorithms is exciting, but it’s likely to be a couple of years at least before the company sees revenue from this kind of product. Their breast density algorithm is currently undergoing testing with one client.

Based on the most recent profit result, Pro Medicus is currently trading on a price to earnings multiple of just over 190. Essentially, that means the market expects the company to more than quadruple its profits over the next few years. To provide upside from here, we need to believe its growth initiatives will find success. I believe that will happen, and I’d be an enthusiastic buyer of Pro Medicus shares at lower prices, but I do not intend to buy at current prices, even though I thought these results were very good. In fact, I recently took some profits at slightly below current prices (regrettably). At the time of writing, the stock is still my largest shareholding (largely as a result of holding since a share price of around $1, but selling along the way).

Valuation aside, I maintain my view that Pro Medicus is the highest quality business on the ASX, with the most potential to make a profound impact on a global scale. It is well run by a skilled team and great bench depth, its shareholder communications are excellent, its business is an adaptive enabler, its management are aligned and it is perfectly positioned to play a profitable role in the advancement of medicine through technology.

See our previous Pro Medicus coverage here.

Please remember that these are personal reflections about a stock by author. I own shares in Pro Medicus at the time of writing, and will not sell them for at least 2 business days after publication. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

An aside from me: If you watch Ausbiz, and want to be alerted of interviews I do as they happen, you can follow me on Ausbiz. I do appreciate any follows on that platform, so if you do follow me; Thanks!

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.