The ASX-listed vehicle online marketplace business Car Group (ASX: CAR) has set its sights on becoming a global heavyweight, shedding its famous Australian name Carsales.com and replacing it with Car Group Ltd. So it should, given Car Group now owns 100% of both Trader Interactive (USA) and Encar (South Korea) along with a 70% stake in Webmotors (Brazil). The Car Group growth narrative seems centred on international expansion, but I believe a few under-appreciated structural tailwinds exist.

Hertz Offloads Tesla Electric Vehicles

American rental company Hertz recently announced its dumping 20,000 Tesla electric vehicles due to weak demand for these vehicles it offers on rent and high repair costs. Inadequate infrastructure and recharging being relatively more expensive than refuelling appears to be dissuading people from renting EVs. Hertz cited the lack of expertise in addressing EV repairs and challenges in getting the replacement parts make EVs expensive to repair. A majority of owners of EVs share the same problem with 79% of surveyed owners confirming they had more problems than conventional cars.

For now, that means that the used-car market for EVs is less active than it could be in the future, since the risks of buying a second-hand EV are well publicised. To quote Fortune.com, “Drivers don’t want to buy used electric vehicles.” That makes sense, given buying an older EV may turn out to be a ticket to a world of financial pain. However, one would hope that EVs become more reliable over time, and a second hand market for these vehicles develops. In the meantime, the auto manufacturers shift to building more electric vehicles may encourage those looking for a more reliable option — on the second hand market.

EV Manufacturer Competition

Vehicle manufacturers have endured low returns on capital for decades. Fierce competition focused on building fancier, bigger and better vehicles generally does not bode well for long-term sustainable returns. A similar fate awaits as the same car manufacturers race to become the leading EV manufacturer. This is great for consumers but bad news for investors.

People generally crave the new shiny object. This will be much more prominent with EVs because there is a long runway of experimental designs for EV manufacturers. As technology progresses, EVs will likely be equipped with more features, encouraging people to upgrade to the latest model. This ultimately boosts the used EV market, and demand will only rise as EVs become mainstream. However, right now the market for used EVs is not very strong, so this should be upside for Car Group.

Like every other industry, the volume of used vehicle sales will go through peaks and troughs. But, I believe it will likely trend upward from current levels due to the inevitable transition to EVs.

Car Group (ASX: CAR) Share Price

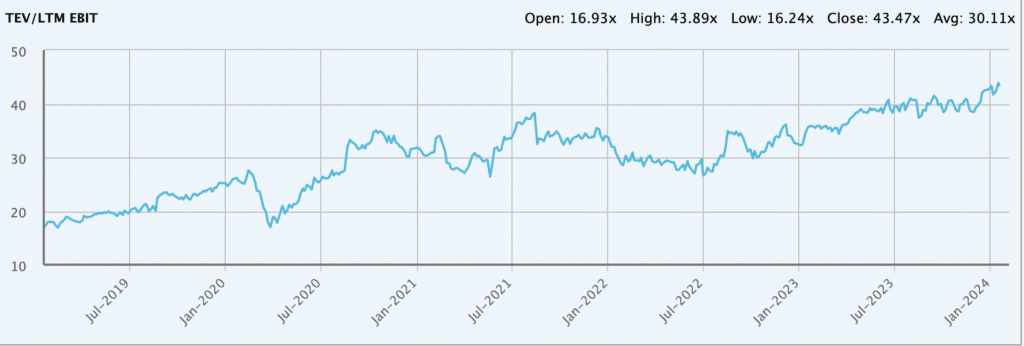

With a proven network effect in Australia, and growing evidence of similar developments in the US, South Korea and Brazil, I think it’d be reasonable to expect Car Group to trade at a fair premium. Below, you can see that Car Group is, in fact, currently trading at a high multiple of underlying earnings relative to the last 5 years. The chart below excludes interest, tax and the $338m large one-off non-cash net gain on the step acquisition of Trader Interactive in FY2023, which boosted statutory but not underlying profit in FY 2023. Data is from S&P Capital IQ.

Matt Brazier has previously flagged Car Group’s declining return on capital employed in his coverage of its FY 2023 results. The other significant risk is if management becomes overly aggressive and hasty in their expansion plans and as Matt Brazier rightly points out, their incentive structures are heavily skewed towards EBITDA and EPS tragets.

Disclosure: the author of this article does not own shares in Car Group. The editor of this article does not own shares in Car Group. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.