Here is why I believe the Australian Export Awards is a valuable hunting ground for quality ASX growth stocks.

What is the Australian Export Awards?

The Australian Export Awards (AEA) is a national program that recognises and honours Australian companies engaged in international business who have achieved sustainable growth through innovation and commitment.

The awards ceremony is held annually and is celebrating its 60th year. It’s presented by the Australian Trade & Investment Commission (Austrade) and the Australian Chamber of Commerce & Industry.

All States and Territories run independent export awards programs. Once a business wins its respective local State or Territory, it progresses as a national finalist and is benchmarked against its peers across the country.

The AEA splits the awards into the following 13 categories.

- Advanced Technologies

- Agribusiness, Food and Beverages

- Creative Industries

- E-commerce

- Emerging Exporter

- International Education and Training

- International Health

- Manufacturing and Advanced Materials

- Professional Services

- Regional Exporter

- Resources and Energy

- Small Business

- Sustainability

There are plenty of sectors to scour for opportunities or monitor emerging competitors for your existing positions.

Eligibility and Judgement Criteria

High barrier to entry

A business must be providing a product or service that is made or delivered through Australian content or value-add (at least 50%). And obviously, it should be making export sales.

Applicants are required to provide three years of export sales unless the company is applying for an Emerging Exporter Award.

The applicant must also demonstrate that they deliver net foreign economic returns to the Australian economy: ‘net return’ to Australia in terms of profit repatriation and creation of employment in Australia. This is quite a high threshold for a lot of businesses in Australia, especially those attempting to expand overseas.

Australian Export Award judges this somewhat like investors

The panel evaluates applications in accordance with the following factors.

The business and its product/services (25% weighting)

The overarching focus in this area is the viability of the business and its product/service and whether activities showcase leadership and innovation within its industry. This is so important. It’s integral for a company to be one of if not the leader in its industry to generate high returns on capital. The panel is in a sound position to evaluate this considering the amount of competitor financial information they possess through the applications.

International marketing strategy (40% weighting)

The quality of the marketing strategy is assessed in light of the applicant’s international competitive advantage and sustainability of international revenue. It’s important to note that the quality of international revenue is assessed on a year-to-year percentage change in value either over the last three years or since the applicant commenced exporting. So, this may include companies that benefited from short-term tailwinds. I believe a company needs to be doing something different from its competitors to succeed internationally. So, what better way to assess this with competitor information at their fingertips?

Business management (25% weighting)

One of the criteria the panel considers in evaluating management is the quality of the capital base (substantial net profit) and sufficient capital (cash and resources) to support export activity. This essentially rules out a lot of proof of concept businesses with unproven business models. Quality compounders should be able to show it possesses a profitable business model and the financial fortitude to keep reinvesting profits into long runways of growth overseas.

International business planning & direction (10% weighting)

Australian Export Awards’s track record in idea generation

As part of my assessment of AEA’s business judgement skills and for brevity’s sake, I have only reviewed those winners that have been listed on the ASX since 2000.

Cream of the crop

Below is the list of all the ASX-listed Australian Exporter of the Year winners since 2000.

QBE Insurance (ASX: QBE) (2001)

QBE is the elder statesman in this hall of fame and the only winner, who has underperformed the All Ordinaries (INDEXASX: XAO) index across 10 (9.4% pa), 20 (8.2% pa) and 30 (9.5%) year periods.

The ASX-listed insurer is also the only winner to record a negative compounded annual growth rate in its share price. Its share price has compounded at (1.5%) pa.

Resmed (ASX: RMD) (2002, 2006)

Resmed is the only double winner, so it’s no surprise that its share price has compounded at the highest rate.

Since 2005, the Resmed share price has compounded at 18.9% pa.

Below is a brief snapshot of some early indicators of the rise in Resmed’s industry reputation.

- 2002

- Zentih Award from the American Association for Respiratory Care

- 2006

- UK Association for Respiratory Technology and Physiology named ResMed as its Manufacturer of the Year

- Received the 2006 Australian Design Award for one of its key products

- FDA clearance for a homecare product

Cochlear (ASX: COH) (2007)

Prior to winning the crown in 2007, Cochlear won the Large Advanced Manufacturer Award in 2003. The Cochlear share price has compounded at 12.8% pa.

Cochlear was the first cochlear implant company to have FDA approval for a multichannel cochlear implant. In 2001, Cochlear won the Medical Design Excellence Award in New York for one of its key implants. And then in 2005, Cochlear’s sound processors were the first to feature dual microphones, which allow people to pick up on sound from all around them.

PWR Holdings Ltd (ASX: PWH) (2012)

PWR won the Small to Medium Manufacturer award back to back in both 2011 and 2012, culminating in taking the top crown in 2012.

The PWR share price has compounded at 18.3% pa since listing in late 2015. It accelerated quickly since the pandemic.

There were a few telltale signs leading up to PWR’s victories.

- 2009

- Manufactured first F1 heat exchange core for Renault

- 2010

- Exclusive cooling solutions provider to World Champion Red Bull F1 racing team

- 2012

- Wins OEM contract for cooling of prestige German marque supercar, entering the hybrid electronic cooling market.

Now, PWR supplies advanced cooling solutions to all the Formula 1 and Formula E racing teams.

Appen (ASX: APX) (2015)

Since listing, the Appen share price reached a peak of $40, representing a 60x return since listing for $0.63 per share and a compounded annual growth rate of 31% pa. However, recent AI developments have meant Appen’s labour services are experiencing lower demand as Claude uncovered in his excellent research piece.

Its currently at $4.39 per share.

Four of the five winners have not only outperformed the All Ords Index but smashed it out of the park. Combing over these winners, I’m amazed by how long it took for each of them to gain industry and national recognition. It truly takes at least a decade to build a strong reputation in business.

It’s always easy in hindsight but the list of telltale announcements can provide a useful guide on some early indicators of when a business is emerging as one of the industry leaders.

I think it’s crucial to understand the quality of the customers that a business is landing. That first big contract with a household name could provide significant momentum. Once this contract is extended or renewed, this provides even greater conviction in a company’s ability to generate quality recurring revenue later on.

A common denominator of success for ResMed (ASX: RMD), Cochlear (ASX: COH) and PWR Holdings (ASX: PWH) is that they are all offering mission-critical products in a growing niche space with high switching costs.

All three businesses have been able to innovate and develop customised products and solutions for their customers, constantly raising the barrier to entry.

A customer-centric focus has served them well. I believe their strong and stable gross margins have been an accurate indicator of this.

The same attributes were not present in QBE Insurance (ASX: QBE) and Appen (ASX: APX).

The pretenders

Here are finalists that lagged the All Ords Index.

- Rio Tinto Limited (ASX: RIO)

- 2004 – Minerals & Energy

- The Rio Tinto share price has compounded at 6.6% pa since 2005

- Woodside Energy (ASX: WDS)

- 2000 – Minerals & Energy

- The Woodside Energy share price has compounded at 2.6% pa since 2005

- Compumedics Limited (ASX: CMP)

- 2000 – Small to Medium Manufacturer

- The Compumedics share price has compounded at a negative rate of (4.2%) pa since 2005

- Infomedia Limited (ASX: IFM)

- 2003 – Information Technology

- The Infomedia share price has compounded at 4.4% pa since 2005

- Its largest customer, Ford Europe launched a rival in-house service and tried to charge higher prices to make up for the lost of customer contracts.

- Bravura Solutions (ASX: BVS)

- 2007 – Information Technology

- Since listing in 2016, the Bravura share price has compounded at 3.7% pa

- Bravura reached its highest gross margins of 49% in FY11, but it dropped to as low as 26% in FY15 but has recovered to the mid-30s.

- Future Fibre Technologies (Now known as AVA Risk Group (ASX: AVA))

- 2010 – Small to Medium Manufacturer

- The AVA Risk share price has compounded at a negative rate of (15.4%) pa since listing

- Gross margins has been falling consistently since 2010

- Recorded net profit of $4.9m in FY20, $13.75m in FY21.

- Sold its Services Division for net cash proceeds of $41.9M, allowing it to focus purely on its Technology division

- Recently acquired GJD Manufacturing, a security equipment designer and manufacturer focusing on intruder detection systems for $7.8M

- Codan (ASX: CDA)

- 2011 – Information Technology

- Since 2005, the Codan share price has compounded at 9.1% but since 2012, it has compounded at 18.7%

- Servcorp (ASX: SRV)

- 2012 – Large Services

- The Servcorp share price has compounded at 1% pa

- Bega (ASX: BGA)

- 2014 – Regional Exporter

- Since listing in 2011, the Bega share price has compounded at 6.5% pa

- Freelancer (ASX: FLN)

- 2016 – E-commerce

- The Freelancer share price has compounded at a negative rate of (16.2%) pa since listing in 2013

- No freelancing business has ever generated consistent profit. This is mainly because of the rise in competition and a loophole in the freelancer business model. Once you find a suitable freelancer, nothing prevents the company from the user and freelancer to continue the arrangement outside. On top of this, there are more competitors taking market share away from each other.

- Nuix (ASX: NXL)

- 2012 – Information Technology

- 2015 – Business Services

- Since listing in December 2020, the Nuix share price has dropped by 76%

- It should be noted that Nuix IPO’d during the most optimistic time in equity markets where a lot of irrational expectations had driven the share price of hot growth stocks

- Catapult (ASX: CAT)

- 2018 – Digital Technologies (Finalist)

- Since listing in 2014, the Catapult share price has been very volatile, compounding at a rate of 8.1% pa

- Mighty Kingdom (ASX: MKL)

- 2021 – Creative Industries (Finalist)

- Since listing in December 2021, the Mighty Kingdom share price has fallen by 78%

The biggest thing that strikes out is the number of tech companies. I think this list is a timely reminder of how challenging it is to become a leading tech business globally. It should not come as a surprise given government spending on R&D as a percentage of GDP has historically lagged behind the likes of Singapore, South Korea, Hong Kong, China and Japan.

Australia’s biggest economic competitive advantage lies in its minerals sector. Rio Tinto (ASX: RIO) and Woodside Energy (ASX: WDS) were the poster childs but have failed to outperform the index, reflecting the cyclical nature of their businesses.

A majority of the companies have been unable to sustain high returns on capital due to weak competitive advantages or are still in the process of developing moats.

Codan (ASX: CDA) probably doesn’t deserve to get lumped in the ‘pretender’ category given it managed to compound at an eye-watering rate of 18.7% across the last decade. It also possesses a lot of similar traits to the aforementioned winners, operating in niche and constantly deploying capital towards valuable R&D.

Nuix (ASX: NXL) is an interesting case study because, at face value, it shouldn’t be sitting in the doldrums. It possesses industry-leading solutions that are mission-critical and is generating profits. However, the software business has been riddled with corporate governance issues.

This is why management quality is so important.

ResMed, Cochlear and PWR Holdings are all businesses run by great management teams.

Double conviction

Of all the companies that won two awards, all of them outperformed the All Ords Index with the exception of Nuix.

After winning a category award, it seems the panel has greater conviction in the ability of the business to become a global leader.

It’s important to NOT consider this accolade as a necessary prerequisite for a high-quality compounder. All it means is that the business seems to have some evidence or traits of a potentially successful business. Don’t just throw money at a company because it’s the Australian Exporter of the Year. It’s a much more fruitful exercise to understand why it won the award.

Why Droneshield (ASX: DRO) is worth surveilling

Droneshield managed to win the Advanced Technologies award last year. I know what you’re probably thinking, “the past tech winners haven’t gone too well”. Still, it’s worth taking a closer look at Droneshield.

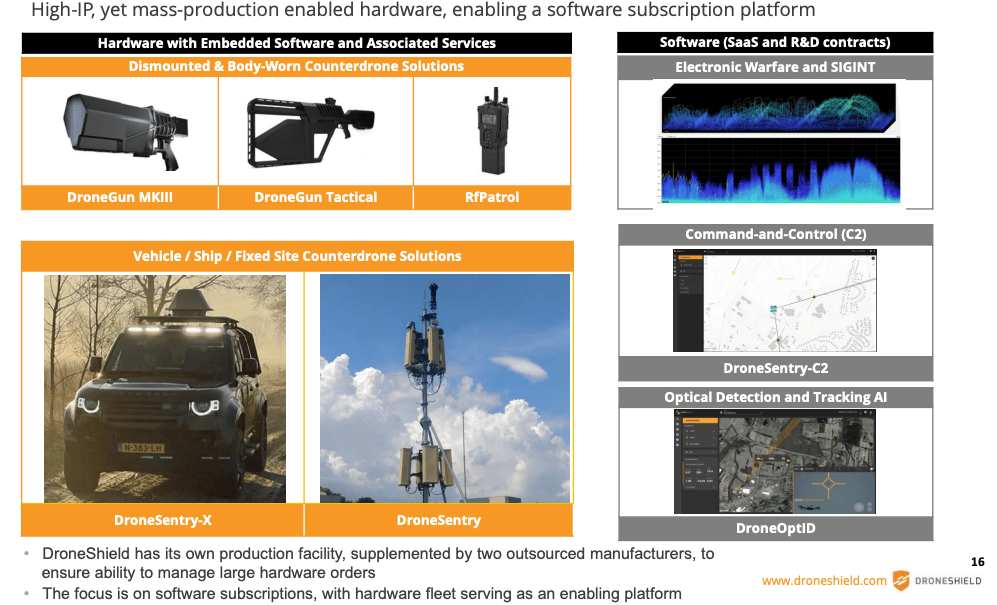

Droneshield develops and sells hardware and software for the detection of small unmanned aerial vehicles that are commonly known as “drones”.

A wide range of industries uses it as a security solution like power plants, electricity grids, defence agencies, airports, stadiums and large public events.

The drone defence business is yet to display strong signs of scalability but recent announcements present soft indicators of its potential.

Droneshield already has contracts in place with the Australian Department of Defence and has sold equipment to Ukraine at the start of the war. It’s also building a reputation among the sporting events circuit like the Olympics, Boston Marathon, Commonwealth Games and the IRONMAN World Championship in Hawaii.

Droneshield is at a stage of building recurring revenue and striving to become one of the leaders in a niche space.

I’d prefer to see more repeat contracts with reputable customers and a slowdown in operating expenses before diving deep into the business. At the moment, Droneshield is on my watch list because there are signs it could become a global leaders in a niche area. However, the niche market for drone shielding is far from mature at this point.

Please remember that these are personal reflections about stocks by an author and is not intended as a recommendation. Disclosure: of the companies mentioned, the author holds shares in PWR Holdings Ltd (ASX: PWH) and Catapult (ASX: CAT). This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

Sign Up To Our Free Newsletter