This morning, workforce and asset monitoring company Damstra (ASX: DTC) announced its quarterly results for the three months to June, 2020. This saw the Damstra share price pop to a new all time high $1.94, before moderating throughout the day.

The headline revenue of $22.1m for FY 2020 was already known, though we note this was bolstered by a one off gain of $1.2m. The company is proud to report EBITDA of $5.5m which is “materially ahead of prospectus forecast”, but this would have benefitted from the aforementioned one-off gain.

As a result, I’m relatively sanguine about the EBITDA result.

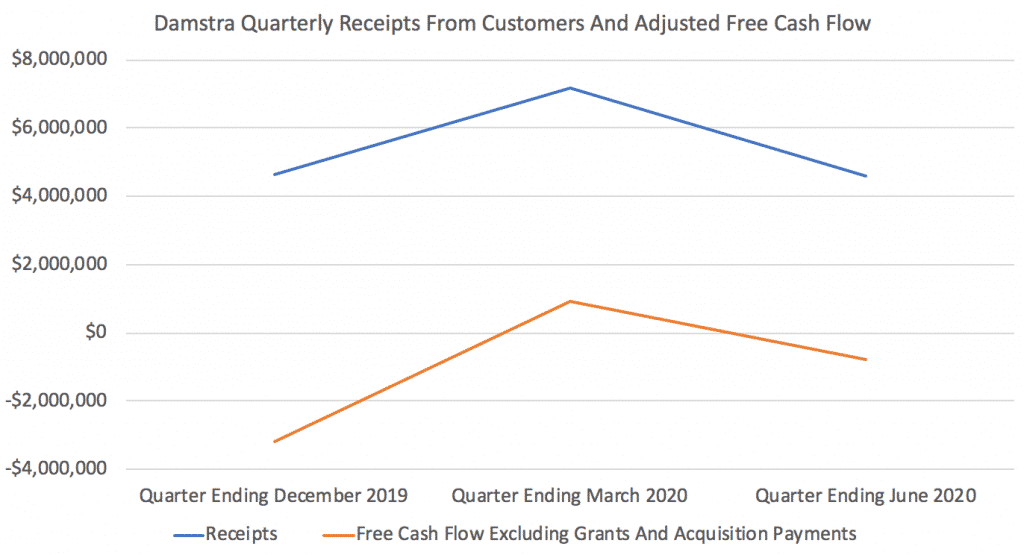

However, one thing I am impressed by is the strong cashflow profile of the company, relative to many other SaaS growth stories. As you can see below, it is not very capital hungry when you exclude acquisitions. This lends credence to the narrative that it listed in order to pursue acquisitions; and that makes sense given scale often allows an improved product and improved unit economics.

On top of that, the release today included some highlights from the various sectors Damstra serves. Interestingly, it said that it increased user numbers in infrastructure from ~49,000 to ~62,000 over the financial year. With luck, management will continue to report this metric, giving us an idea about how the scale and impact of the business changes over time. Will we see secular growth, or cyclical changes?

At a product level, Damstra also gave a little more detail around its facial recognition and temperature scanning device. This is an interesting offering, because it obviously has the potential to contribute to controlling covid. However, the temperature reading is only accurate within 0.3 degrees, so it’s not the perfect technology. Nonetheless, I thought it was good to get more detail in writing about this. To date only six clients have adopted the integrated fever detection/ facial recognition solution, but there is clearly room for growth. This also shows how up-selling can be an important contributor to revenue growth in the future.

Damstra (ASX: DTC) Acquisition Strategy

As alluded to above, one of the most compelling reasons for Damstra to list was to make acquisitions more easily. In this quarterly update, the company went out of its way to show its process to shareholders, which I applaud. Essentially, by buying a sub-scale software product that can be integrated into Damstra, the company can up-sell to customers, grow technical talent, and increase its product appeal to new customers. In doing so, it can cut a lot of duplicate rolls. For example, when Damstra acquired Velpic it was able to reduce staff from 24 to 4 all while maintaining growth in the Velpic product user numbers.

This is good news given some of my concerns about Vault Intelligence, expressed here. On top of that, it’s worth adding that I had a heartening email exchange with the Damstra CFO discussing some of my bear points about Vault, and at this point I’m cautiously optimistic that any challenges arising from the acquisition will be overcome by Damstra.

Damstra (ASX: DTC) and Vault Intelligence (ASX: VLT) Share Price Arbitrage

If the scheme of arrangement goes ahead, Vault shareholders will receive one Damstra share for every 2.9 Vault shares they own. That means at the current Damstra share price of ~$1.80, each Vault share should be worth ~62c. However, at the time of writing Vault is trading at 54c, a 12.9% discount to their value if the scheme of arrangement takes place.

To my mind, it’s rather likely the scheme of arrangement will go ahead as I believe it is in all parties’ interests to make it happen. Therefore, today I sold some of my Damstra shares and bought some Vault shares to try to exploit this arbitrage. The net impact of my trades has been an increase in my exposure to Damstra/ Vault. The big risk in this approach is that for whatever reason the takeover falls through, and I’m left with Vault shares I have no desire to hold.

A Strong Rise In The Damstra Share Price

Ultimately, at a zoomed out level, my view on Damstra remains in line with this excellent piece by Fabregasto, titled Damstra Holdings Finds Success With Focus. Since that was published in May, the share price has approximately doubled, and I have sold some shares, but I also remain a happy holder; preferably for the long term.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive an occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer. The author owns shares in Damstra and was active in both Damstra and Vault Intelligence this morning.