Damstra Holdings Ltd (ASX: DTC) was founded in 2002 as Damstra Mining Services – a labour hire firm focused on servicing the NSW coal mining industry (commencing with just one site) before it developed a workforce management system. It was sold to labour hire major Skilled Group in 2006, but founder (and CEO) Christian Damstra bought the company back from Programmed Maintenance Services in 2016 for just $7M – as PMS deemed it non-core post its own acquisition of Skilled the prior year. At the current Damstra Holdings share price of 90c, Damstra has a market cap 4 years later of $126M (18x what the CEO paid to buy back the company).

Given demerger arguably undervalued Damstra, there is already a parallel with Freedom Foods/A2 Milk (with Freedom Food’s original ~20% shareholding in A2M now worth some ~24x its sale proceeds from 2015). No doubt Damstra has benefited from no longer being a small part of a much larger listed business without much management attention or access to capital.

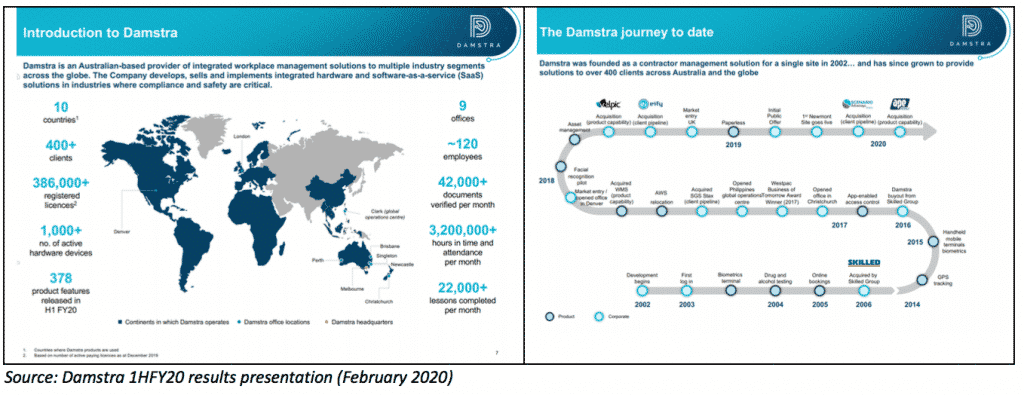

Post its liberation from PMS in 2016, Damstra was relaunched as a pure technology company and has expanded its module suite significantly through a mixture of organic product development and bolt-on acquisitions, also expanding into overseas markets including the US (2017) and the UK (2018) – see graphic above right. Since listing in October last year, the company has made 2 small strategic bolt-on acquisitions:

- Scenario Advantage Workforce (a carve-out from global ERP management software provider Projection Group) for $4M, approximately ~3x revenue ($1.3M in FY19)) and ~15x EBITDA (~$260K, pre expected synergies). Most importantly, the complementary acquisition of SAW added new international clients in the mining and utility industries including Anglo-American, Stanmore Coal, Adani Ports and Energy Australia; and

- APE Mobile (a Perth-based provider of paperless collaboration solutions to the civil infrastructure and mining industries) for $5.5M ($3.0M of DTC scrip, $2.5M cash). APE generated revenue of $1.2M in FY19 (~90% recurring) and the majority of its ~90 clients are based in Australia. In addition to cost synergies, Damstra expects material cross-selling opportunities.

The company plans to undertake further strategic and accretive acquisitions – which provide entry to new markets and access to new customers (enabling cross-selling opportunities for the existing product suite), and/or which add new modules or technological capability. At 31 March 2020 Damstra had a cash war chest of more than $10M and undrawn debt facilities of ~$5M. And, of course, it could use its own scrip to fund M&A transactions.

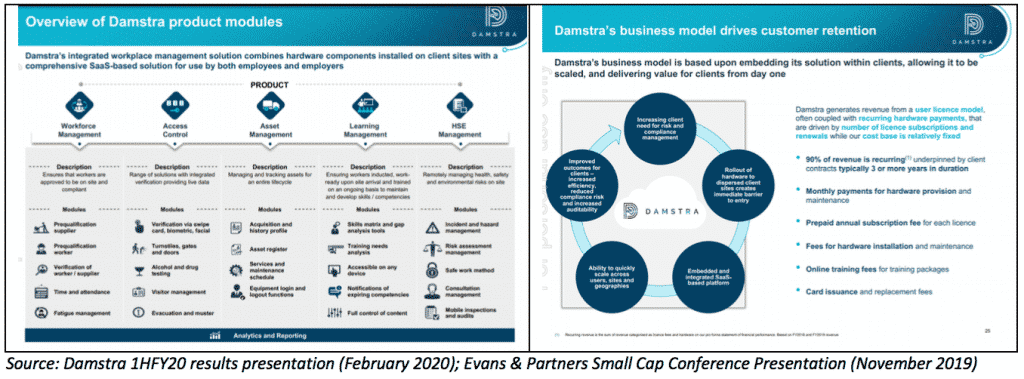

Damstra’s software is a workplace management solution, which combines hardware components on client premises (such as automated access control for visitors and employees and alcohol/drug testing), and a SAAS solution for both employers and employees (which incorporates staff time & attendance, staff rostering, registration & accreditation, training & learning management, asset management and incident reporting – see below left).

Damstra’s software provides real time tracking and predictive insights in relation to people and asset management, and integrates seamlessly with key enterprise ERP, HR and payroll, and analytics/reporting systems.

Like most software companies, the amount of revenue Damstra generates from customer subscription contracts (typically 3 years or longer) is a function of the number of Damstra modules used, the number of user licenses on Damstra’s platform, and the number of hardware devices connecting the platform, to the client’s premises. Customers pay subscriptions annually in advance, and pay hardware fees monthly, over the life of the contract.

Recurring hardware revenue is annuity-like in nature, with Damstra typically utilising a financing facility to purchase equipment (repaid over 3 years) and years 4 to 7 of a piece of hardware’s typical useful life being highly cash generative (~96% margin after allowing for minor ongoing maintenance). The company also generates revenue from bespoke customisations to meet customer requirements, training programs, and miscellaneous items such as issuing and replacing employee access cards.

Per the first graphic above, at the end of 2019 the company serviced 386,000 registered licences across more than 400 clients in 10 countries, with more than 90% of revenue recurring and a client retention rate of 97% in FY19.

Key blue chip clients at IPO included large global mining majors Newmont Goldcorp and Glencore (with Anglo American and Stanmore Coal subsequently added via the SAW acquisition), construction and engineering giants Thiess, Lafarge Holcim and John Holland, energy players AGL and Arrow Energy, and other large industrial clients such as Orica and Bridgestone.

There are a number of key structural tailwinds underpinning an investment in Damstra Holdings Ltd (ASX: DTC) shares. The company focuses specifically on customers (typically in the mining, resources and construction industries) with large workforces – which are often spread out over a wide geographic area (if not across multiple countries) and often in remote settings. Safety and compliance are paramount for management of these companies, and attention is focused keenly not just on achieving positive OH&S outcomes, but also on improving the availability of resources (i.e. maximising “up time”, and reducing time lost to injuries etc) to enhance productivity.

These customers are therefore attracted to a SAAS-based workforce management solution which can (1) improve visibility over a complex (and sometimes global) workforce and thereby improve focus on staff safety, wellbeing and training; (2) produce accurate real-time information to assist with increasing regulatory and compliance needs; (3) reduce costs (and swap capex for opex) by outsourcing workforce management tasks; and (4) enable the customer to keep pace with the increasing trend of digitisation of workflows.

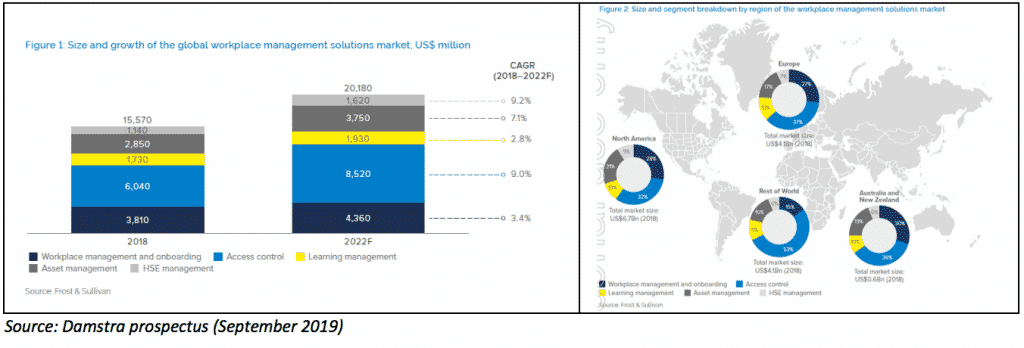

Now, this wouldn’t be a software discussion without a consideration of the TAM. Damstra investor materials quote research from management consultants Frost & Sullivan which quantify the TAM at ~US$16B in 2018, growing to ~US$20B by 2022F. Unsurprisingly, the US and Europe together represented approximately 70% of the total global market in 2018 (see below right).

Prima facie that sounds very nice, thank you – but the market is very fragmented and Damstra competes against a large number of rival products – from huge global ERP vendors (including but not limited to SAP, Microsoft and ADP) who operate across multiple segments, to smaller and more narrowly focused specialist operators, as well as in-house customer software solutions – and as a result there is a wide amount of variability with respect to functional and geographic coverage.

The headline US$16B TAM also ignores the difficulty of luring customers away from incumbents. More realistically, if churn is somewhere between, say, 5% and 15% (such that incumbent retention is between 85-95%), that would suggest a more meaningful TAM of US$1.6B in 2018. There is of course greater potential opportunity from new incremental spend entering the market however (US$4.6B per Frost & Sullivan between FY18A and FY22F), and Damstra believes the penetration of cloud-based SAAS solutions within the total market is still relatively early – so the realistic TAM is likely to grow significantly over the next decade.

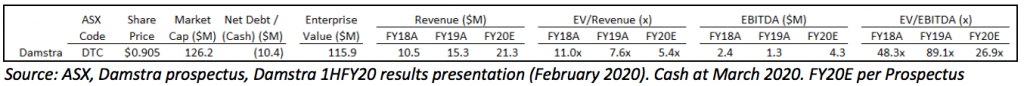

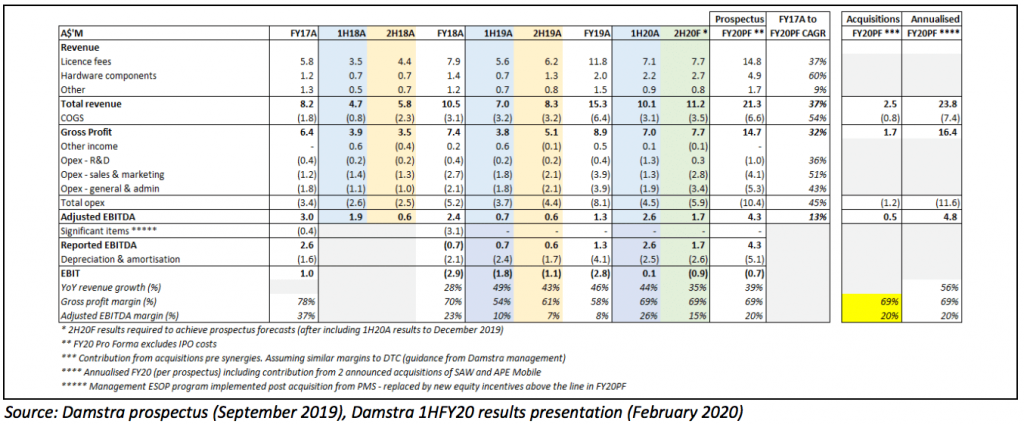

Damstra’s revenue growth over the past few years has been strong, with revenue projected to have grown at a CAGR of 37% between FY17 and the FY20 forecasts outlined in the prospectus. Those FY20F forecasts are likely to be exceeded however based on the strong performance for the December 2019 half-year alone, and keeping in mind the SAW and APE Mobile acquisitions (which will contribute to FY20F results but add ~$0.5M of EBITDA, pre-synergies and cross-sell opportunities, on an annualised basis, as shown in the far right column below.) Operating cash flow for 1HFY20A was $3M.

A large chunk of the 44% revenue growth for 1H20A is attributable to the rollout of the global Newmont contract which per management now comprises 25% of total Damstra revenue. The company also highlighted other client wins, successful cross-selling initiatives. Management is investing to accelerate growth, with R&D spend increasing significantly as the company aims to expand its technological capabilities and increase the speed of product feature releases.

Damstra’s 4C for the March 2020 quarter (released last month) confirmed a further quarter of $3M of operating cashflow. Management communicated that there had been minimal impact on the company of COVID-19 (attributed both to the mission-critical nature of Damstra’s software and also the fact that many customers operate in industries deemed to be “essential”). The company did however provide FY20 revenue growth guidance of “30-40%” (representing a range of $19.9M to $21.4M) – which suggests a potential revenue miss versus prospectus forecasts, and this is driven by delays in greenfield rollouts. So while longer term Damstra should be part of the solution to Covid-19, Claude left Damsta off this recent selection of 10 ASX companies benefitting from social distancing. On the bright side, the 4C did iterate that management expect FY20F gross margin and EBITDA to exceed forecasts.

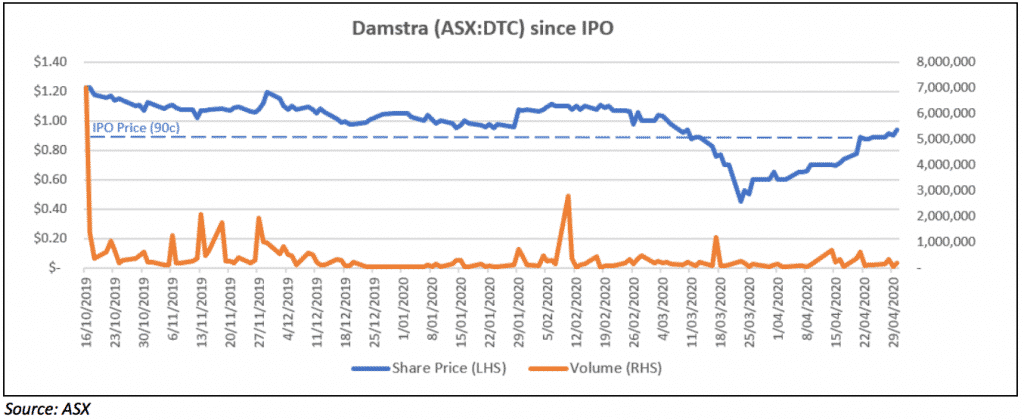

Despite the strong 1HFY20 results announced in February, the string of positive 4C quarterly cashflow statements released since listing and two acquisitions (so far), the Damstra share price is still languishing around the IPO price (90c), and is 33% below the all-time high ($1.34) achieved in the month after listing. The DTC share price actually fell as low as 40c during the March COVID-19 capitulation (a staggering 70% discount to its recent high) – although it’s arguably not so unusual that a newly listed growth stock would be one of the first babies thrown out with the bath water.

Management own ~33% of the company and are thereby incentivised to grow shareholder wealth. Damstra has iterated a multi-pronged pathway to future growth that is focused on continued product development (including new modules), greenfield new client wins globally, further acquisitions and potentially monetising data by using it to improve customer operational efficiencies on site.

In a recent interview, the CEO revealed that Damstra always has a large pipeline of potential acquisition opportunities it is assessing, and that the company would certainly look to exploit lowered valuations (i.e. as a result of COVID-19) to acquire more companies. Based on its M&A activity over the last few years it wouldn’t surprise me at all to see another couple of acquisitions before the end of 2020.

This post is not financial advice, and you should click here to read our detailed disclaimer.

DTC is a core holding for me (having more than doubled my position during March) and I’m cautiously optimistic about the company’s prospects over the next few years.

_________________________________________________________________________________

Disclosure: I (@Fabregasto ) and Claude hold shares in Damstra and will not sell for at least 2 days after the publication of this article. However, Claude reserves the right buy some more shares at any time, which is consistent with the views in this article.

If you haven’t already tried Sharesight, it saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade, you’ll get at least 2 months free and we’ll get a small contribution to help keep the lights on.

Sign up to our infrequent newsletter to get ideas and entertainment Fresh and Fast to your inbox!