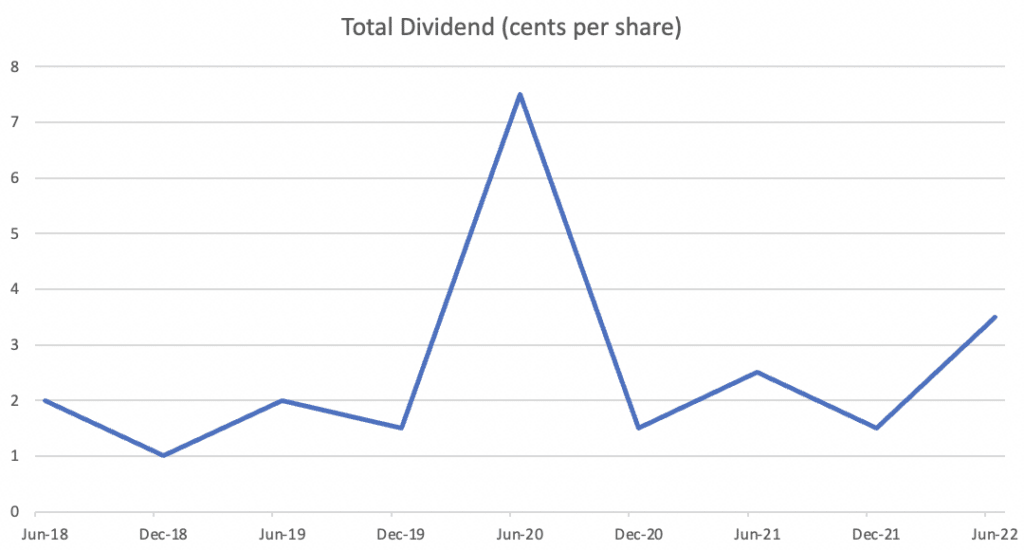

Last month accounting and financial advisor service provider Diverger (ASX: DVR) released its annual results for FY 2022 showing earnings per share of 9.47 cents, up 21%. Happily, the FY 2022 Diverger results saw an improved dividend, up 20% to 5 cents per share. Profit was just over $3.5 million.

Revenue was up 33% to $125 million, but I find it more useful to focus on revenue excluding the pass through revenue paid to authorised advisers, which the company calls net revenue. Diverger net revenue gained 9% to just over $30 million.

These Diverger results showed free cash flow (excluding acquisition payments but including lease payments) of about $4.6m, showing strong cash conversion of profit.

The earnings per share quoted above, being 9.47 cents, assumes that the options on issue are not exercised. If they are, then that would lead to considerable dilution. The diluted earnings per share is 8.9 cents per share, and I would use this as a conservative basis for valuation. Even, using that more conservative figure, Diverger is trading on only about 11.8 times earnings. This is very low compared to other companies that are growing earnings at around 10% to 20% each year.

Diverger is a strange company no longer run by its founder, and substantially owned by another company that operates in the same industry, called HUB24 (ASX: HUB). This makes me uncomfortable, because HUB24 might not care much about dividends. It also puts a dampener on the share price, since the original founders have been selling down over the last few years. The market expects therefore that they may sell more.

Diverger’s dividend policy is to pay out 40% – 60% of its earnings which is reasonable in order to also invest in modest growth. Given Diverger is retaining over 45% of its annual earnings, I would definitely expect some improvement in earnings per share. This could be massively imperilled by large acquisitions, such as the proposed acquisition that contributed to my original thesis for Diverger falling apart. However, it seems that the acquisition of Centrepoint Alliance is not going ahead, so the threat of undue dilution is lessened.

I don’t think I’ll ever really get on board with investing in small companies that love to dilute. Over my time I have seen many, such as Paragon Care (ASX: PGC), go nuts with expansion, without ever creating sustained value for shareholders. It is relatively easy to grow the size of a business, but factors such as maximising competitive advantages are much more important than pure scale, when it comes to creating excess value.

I chose Paragon because it’s a good example of how the ‘expansion for expansion’s sake’ cycle can give short term momentum to the share price, even over a period of years.

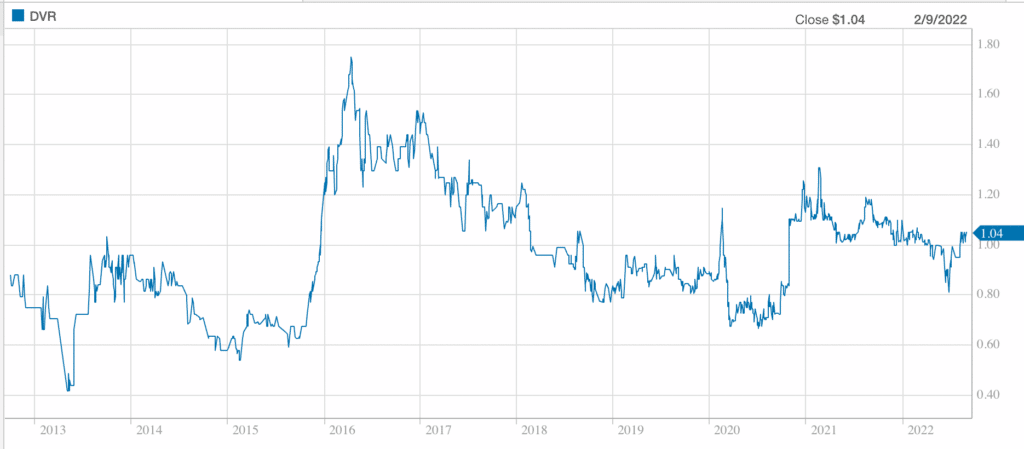

As you can see below, Diverger (mostly as its previous incarnation Easton, ASX: EAS) has hardly been a long term winner. But it has paid dividends along the way.

In fact, Diverger has been overall a much better investment than Paragon Care, largely thanks to dividends.

Diverger’s Would-Be Empire Is The Major Risk

As I previously covered, my thesis for Diverger broke when it proposed an acquisition of Centrepoint Alliance (ASX: CAF), which would have seen extensive dilution, massive debt, and uncertain gains to shareholders.

Regarding the Centrepoint Alliance acquisition proposal, the CEO said: “I received both positive and negative feedback from a wide range of shareholders. I believe some of that feedback would have been addressed had we been able to publish the merger model, which would have shown the substantial earnings accretion benefit to DVR shareholders on very achievable cost synergies.”

Personally, I would be more positive about large acquisitions if the Diverger share price was trading at above $1.50, because it would enable me to sell my shares at a decent price. To threaten to dilute shareholders for a large acquisition at around current prices is particularly galling, because it denies those shareholders who disagree with the acquisition the opportunity to exit at a reasonable price.

Is Diverger A Good Dividend Stock?

Consistent and wise operational management should be able to create value for Diverger shareholders. While this year saw some increased costs, setting up a platform for growth, the company expects corporate cost growth to stabilise over the next few years. That means we should see operating leverage.

However, in the short term, various input costs are going up due to inflation, and the company is being cautious with price increases to “to mitigate downside risk of moving out of step with the market.” That means in FY 2023 we should not expect operating leverage to kick in, and so earnings should grow at around the same rate as revenue (at best).

When considering Diverger, one of the positives is that it has two quasi recurring income streams. First, it earned over $6.2m in subscription fees from its accounting services division. This provides workpapers, precedents, checklists and other tools required for accountants to run their own businesses.

Second, Diverger receives fees worth 0.22% of the funds under management in its CARE managed portfolios, worth $5.8m last year. These managed accounts include options like the CARE Essentials High Growth Portfolio and CARE Essentials Defensive Portfolio. Any adviser can select these from the HUB24 portal. Incidentally, Diverger also pays fees to HUB 24 responsible entity services, highlighting the intertwining of the two companies.

Regarding the CARE managed accounts, the Diverger CEO said, “it is worth emphasising that circa 75% of our FUM growth in CARE is inflows, which shows that advisers (who have an open APL to choose from with no constraints from DVR) believe the portfolios are performing well and competitively priced for clients.”

These two businesses should scale quite well, and I believe that good management could turn modest revenue growth into impressive profit growth. However, it seems to me that the board is more focussed on executing large acquisitions, and spent considerable sums pursuing Centrepoint Alliance (ASX: CAF) during the year. The immediate share price reaction the the proposed acquisition was for the price to drop, and the share price has recovered since the acquisition became unlikely. In my opinion the substantial efforts of the board were damaging to shareholders, and I do believe there is a major risk when it comes to the inclination of the board to pursue unpopular acquisitions.

At the current price of $1.05, Diverger is yielding 4.8%, fully franked. While my old thesis is still broken due to the untimely acquisition proposal of CAF, I do think that Diverger is a decent dividend stock, at current prices. If the share price rises and the dividend yield falls, I will likely sell my shares. However, if the company keeps increasing its dividend, then the price at which I would sell my shares would continue to increase. If the dividend stops growing completely, I’ll probably sell my shares.

Overall, keeping in mind the big risk mentioned above, the FY 2022 Diverger results looked quite good to me. Finally it was good to see two directors buy small parcels of shares after this result, as that will improve alignment with shareholders.

Did you find this article useful? Sign up to receive access to hidden, Free content like this!

Please remember that these are personal reflections about stocks by an author, and this article is not intended as a recommendation. The author owns shares in Diverger and will not trade them for at least 2 days after publishing this article. This article is not intended to form the basis of an investment decision. It is an investment diary intended to be valuable only for the cognitive process it demonstrates. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.