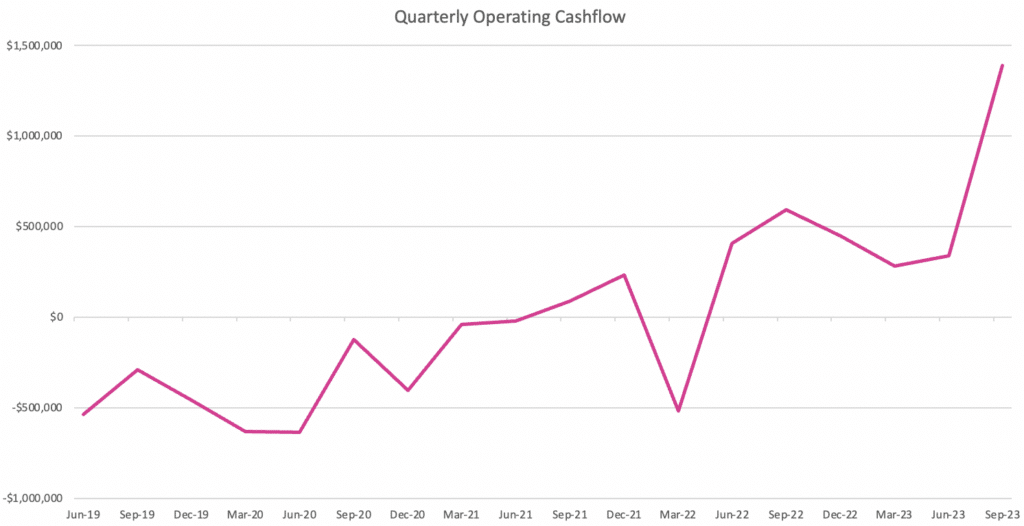

This morning, data backup company Dropsuite (ASX: DSE) reported its quarterly update. Dropsuite is no longer compelled to report an Appendix 4C, but it still shares the key operating cashflow. In the case of Dropsuite, this is a decent proxy for free cashflow, because it doesn’t have large amounts of investing cashflow (since it expenses its R&D). As you can see below, Q3 FY 2023 was a record result for Dropsuite, with record quarterly operating cashflow of $1.39 million.

The company was sure to highlight that this quarter benefitted from good timing; for example, some payments shifted a few days from last quarter (which was a bit weak) to this quarter. Therefore, while we can certainly rejoice in the positive longer term trajectory of Dropsuite’s operating cashflow, we should prepare ourselves for the likelihood that this was a somewhat lucky quarter (and operating cashflow may drop in a future quarter). The September quarter was the strongest in FY 2022, after all.

The biggest negative in this report was that the company lost a customer (resulting in an ongoing cancellation of end user accounts). This was due to the fact that economic ructions in the country of this domain name provider saw a strongly falling currency against the USD. With Dropsuite priced in USD, this meant that its product was no longer the right fit for that company (which itself is in decline due to disruption from new competitors). Despite this churn event (causing the loss of around 53k users), the company still grew end users by 3% to around 1.1 million. The CEO said “This is a simple bump in the road and it has been a while since we’ve been focussed on email backup.”

It was heartening to hear management front up to a range of questions on the call and I note the examination of churn metrics. The Dropsuite CEO Charif El-Ansari said (words along the lines of):

“We look at the annual churn of managed service provider — the customer who is choosing our product and buying our product. When we calculate revenue churn we are looking at the revenue from the MSP partners 1 year ago, then looking at how much of that revenue churned (sub 3%). The end user churn is going to be higher; it is in the 5% – 7% range, which is extremely healthy from a mid-enterprise standpoint.”

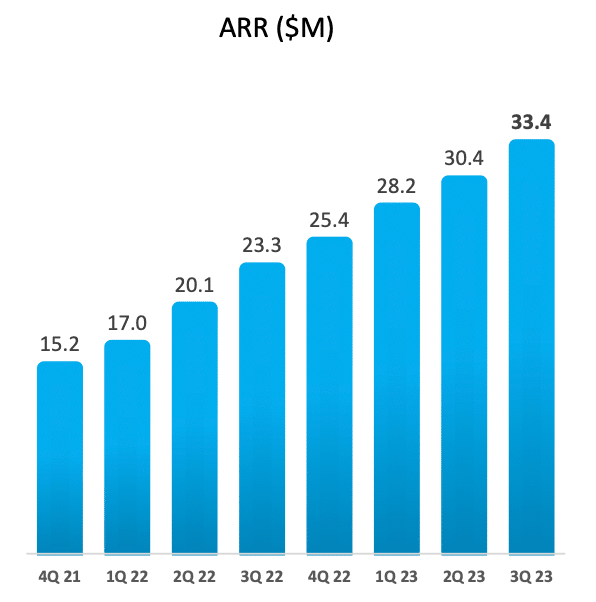

Zooming out, Dropsuite still plans to “stay profitable but drive durable ARR growth for the foreseeable future”. This has been consistent plan; though personally I would like it if they would focus on maintaining both ARR growth and profit growth. I think one of the reasons that the share price is languishing is probably because the company does not commit much to profit growth. That said, it has a track record of profit growth, and does not seem to lack financial discipline.

For example the CEO seems aware that it is important not to make a bad acquisition and expressed some concern that he did not want to be feeling rushed or make the wrong acquisition. This remains a risk but at least we know the CEO is thinking about it carefully.

That said, it is evident that the excitement around the business has been busted by arguably overblown spectre of Microsoft’s supposedly competing backup product. I’ve covered this issue after the last quarterly results.

We have a fast growing, profitable, cashed up and cashflow positive business still suffering high customer concentration (meaning just a few customers could take a very large chunk out of the business, if they simply left). On that topic there is no change with management disclosing that from a user number perspective “we’re talking in that 60% – 65% range in our top 10 partners.”

I note the slight increase in incremental ARR growth on the prior quarter. ARR grew by $3m from $30.4m to $33.4m over the three months to September.

Overall nothing has really changed with my Dropsuite thesis, despite the stock going from 23c to 37c back to 23.5c over the last year. I am happy to continue holding my shares.

Disclosure: the author of this article owns shares in DSE and will not trade them for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter