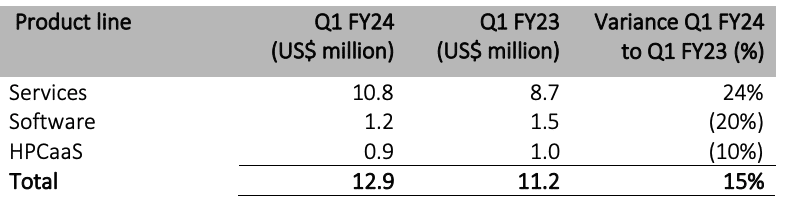

Seismic data solutions and high-performance computing (HPC) provider DUG Technology Limited (ASX: DUG) published another positive set of results for Q1 FY 2024. Services revenue contributed US$10.8m in the quarter, representing a 24% lift relative to Q1 FY 2023. Strong mineral exploration activity has been a key driver of project-based revenue, as mineral explorers capitalised on rising commodity prices. Despite recent falls in commodity prices, appetite for mineral exploration appears to be steady with DUG Technology recording a 69% increase in its services order book compared to 30 June 2023.

Source: DUG Technology Q1 FY 2024 Results

The DUG Technology results revealed EBITDA of US$3.4m and net operating cash outflows of US$0.1M. Accounting for lease liabilities, it currently holds US$2.3m in net cash. In my last update, I noted DUG Technology’s greater focus on scalable and larger projects. It appears to be on the right track but has recent growth been due to transient industry tailwinds or structural factors?

The Mining Cycle

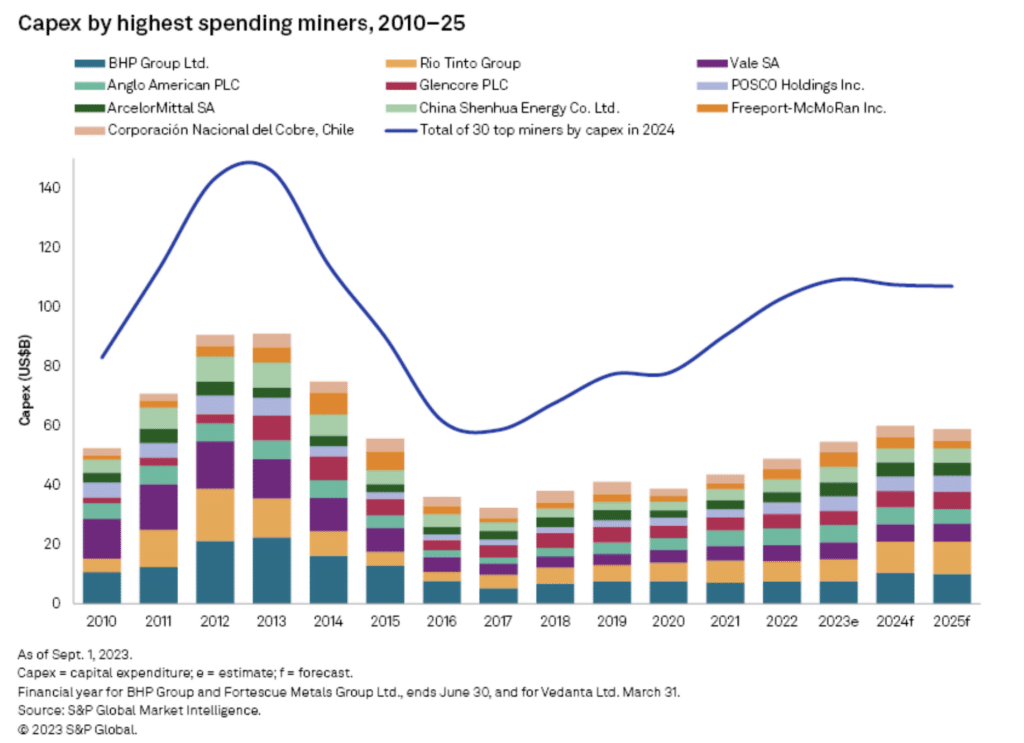

Mineral exploration businesses use DUG Technology’s data solutions to find mineral sources that are economically worthwhile digging. When prices for these minerals are soaring, mining explorers are more incentivised to inspect mineral deposits. Vice-versa when prices fall. In the last few years, DUG Technology has benefitted from a double combo of rising commodity prices and production output from mining companies. This is reflected by the spending levels of the top 30 mining companies depicted below.

Source: S&P Global Market Intelligence as of September 2023

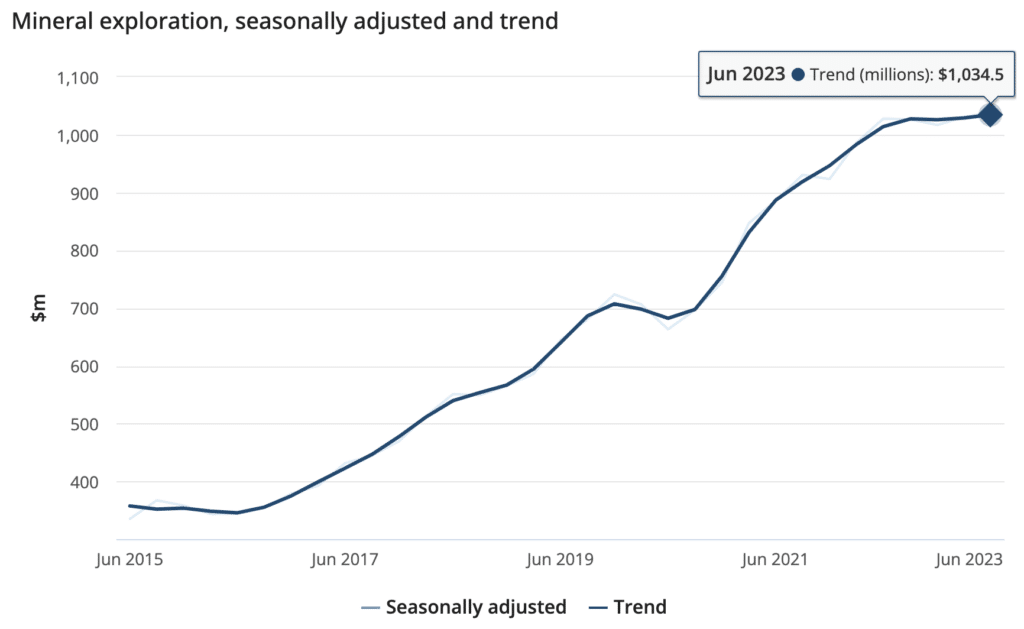

Closer to home, mineral exploration spending in Australia has experienced strong growth but appears to be slowing down.

S&P Global is predicting capital expenditure to rise again in 2024 but slow down in the following year. Australia seems to be already moderating. I find it difficult and almost impossible to predict future mining exploration activity. But I do know it plays an important role in shaping DUG Technology’s services revenue.

Early in my investing journey, I often made the mistake of attributing a company’s strong growth to microeconomic factors like a superior product or solution stealing market share when in fact cyclical influences were more dominant. In the case of DUG Technology, I think it’s more cyclical than when I first analysed the business, and this is primarily due to the nature of its customer base.

In cyclical businesses, it’s generally perilous to invest when conditions are ripe. This is because optimal conditions can fuel excessive investor optimism. As a result, share prices of businesses anchored to the mining industry are often overvalued. So, it’s interesting to see the DUG Technology share price trading at near all-time highs since listing in August 2020.

If you’re interested in less cyclical businesses, Claude covered three stocks that recorded solid results in FY 2023.

Disclosure: the author of this article does not own shares in or have a position in DUG Technology. The editor of this article does not own shares in or have a position in DUG Technology. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.