The Supply Network (ASX: SNL) results were record breaking in FY 2022. Supply Network operates its bus and truck parts distribution business under the Multispares brand. In the FY 2022 Supply Network results, the company recorded 22.1% growth in revenue to $198.5 million and net profit after tax soared to $20 million, representing a 44.6% jump on FY 2021. Operating cash flow also increased by 9.2% to $18.1 million, but a lift in capital expenditure reduced free cash flow from $11.3 million to $10.7 million.

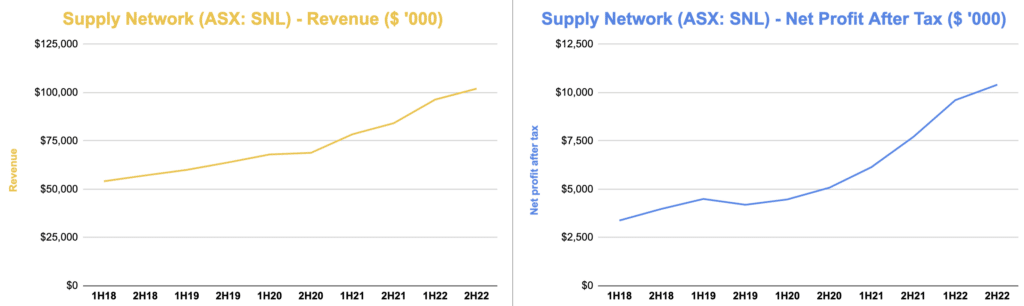

This strong free cash flow (despite increased investment) enabled Supply Network to record and distribute a total fully franked dividend of 32 cents per share for the year. As you can see below, the company has been on a long term growth trajectory (though it does have ups and downs).

Due to supply chain challenges, Supply Network boosted its inventory balance from $54.1 million to $63.3 million in FY 2022. It continues to be in a sound financial position with $8.8 million in long-term debt and short-term debt under control at $0.6 million. The cash balance rose from $5.5 million to $6.9 million in FY 2022

There is little talk and coverage of Supply Network across stock forums and broader medial channels but Claude provided a great overview of the business a few months ago. It flies under the radar probably because it operates in a relatively mundane industry compared to tech and mining, which generally attract the most attention on the ASX, because of the potential for higher returns over shorter period (with higher risk, as well).

Supply Network Management Remains Measured

A lot of high-growth companies tend to shine the spotlight on the higher growth rates in recent years, which can encourage investors to extrapolate these rates to continue across the near-distant future. Some of these management teams do focus on short term performance, in order to achieve financial gains from meeting their short-term incentive performance targets, rather than striving for long-term sustainable growth in shareholder returns.

In Supply Network’s case, management remains sensible and shrewd, acknowledging that the recent growth has been driven by strong economic growth and positive industry trends. Strong business performance was mentioned last, indicating management’s understanding that factors outside their control remain influential on Supply Network’s performance.

That said, one could argue management is reasonably conservative, given its history of underpromising and overdelivering. Despite achieving a record growth rate in sales of 22.1%, management expects sales growth to normalise over the next two years and move towards the long-term average of 12% per annum. This could imply much lower growth in FY 2023 (though the market does not seem to believe that will be the case, based on the share price).

It’s no surprise that Supply Network has been able to achieve much higher returns on asset relative to its main listed comparison companies, Maxiparts Ltd (ASX MXI) and Bapcor Ltd (ASX: BAP). Achieving consistently high returns on assets requires incredible cost discipline and capital allocation skills, which stems from the strong focus on return on capital and significant experience in Supply Network’s leadership team.

In recent years, Supply Networks has benefitted from a number of favourable external macroeconomic factors like the unprecedented growth in e-commerce accelerating the use of trucks to deliver goods, and the rising shift towards electric vehicles and renewable sources of energy. As electric vehicles enter the fleets of customers, the number of different parts potentially required increases, making large-scale supplies like Multispares even more important. And, as a bonus for Supply Network, the constant battle to become greener has fuelled demand for minerals that can generate renewable energy, pushing up the use of mining transport trucks (which also require spare parts).

The biggest internal factor driving Supply Network’s performance has been the growing consolidation of the industry. Smaller players are being outmuscled by Supply Network and Maxiparts due to their superior supply chain network and scale. Most notably, Maxiparts recently acquired Truckzone Group, which operated 10 sites across Australia. The Supply Network management team provided the following graph to illustrate the industry dynamics.

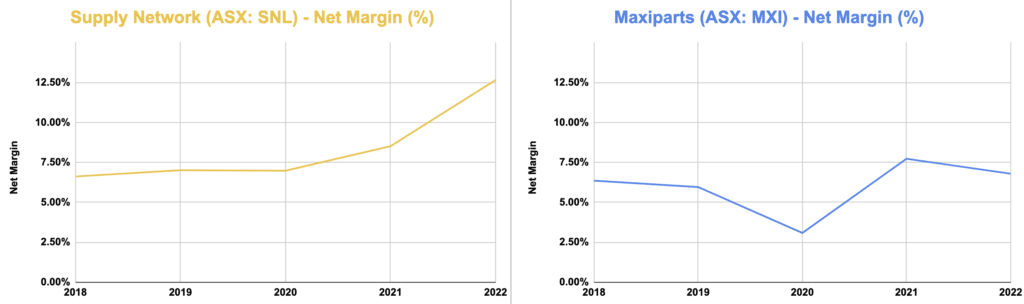

Supply Networks has been able to race away from Maxiparts because of its sole focus on bus and truck parts distribution. Maxiparts has juggled both the parts distribution business and the capital-intensive manufacturing of trailers, tippers and vans. This is partly why Maxiparts has historically recorded much lower returns on assets. However, Maxiparts has taken a new direction, and this could adversely impact future Supply Network results.

Competition Improving

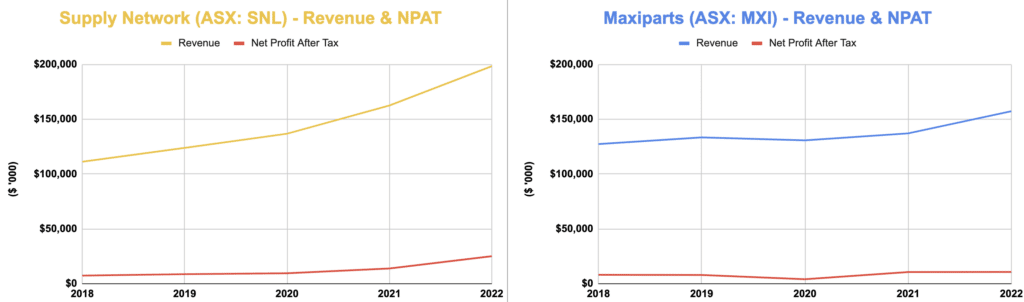

Blindsided by the very tough trailer manufacturing business, Maxiparts appears to have finally woken up from its long slumber, turning its focus to the aftermarket parts distribution business. Once upon a time, Maxiparts actually had a head start over Supply Network in the aftermarket parts business, generating more revenue in this segment in FY18 and FY19 as seen below.

Supply Network’s early decision to try and become the leading aftermarket bus and truck parts distributor reaped dividends. It invested heavily in developing a more efficient supply chain and adopted technology to achieve operating efficiencies, which not only enabled them to win more market share but also to scale profitably.

In comparison, Maxiparts was heaping capital, time and effort into the struggling trailer business and the more profitable aftermarket parts segment was a secondary focus. As a result, Maxiparts couldn’t match Supply Network’s product range, scale and supply chain operations to offer the best and most valuable service to customers. This is ultimately why Maxiparts hasn’t been able to hit the same level of net profit margins as depicted below.

Source: Supply Network results and Maxiparts results

Strategies and playbooks are copied by competitors all the time so the biggest question is whether Maxiparts is capable of executing as well as Supply Network. I think the comment outlined in Supply Network’s FY19 annual report sums up why it’s achieved such sustained success. They said:

“There is no single single game changer for our industry and our plans for profitable growth continue to be built on many small steps that improve service levels and operating efficiency.“

Maxiparts has hit the ground running with its acquisition of Truckzone for $18 million, which I consider a reasonably big move. In contrast, Supply Network hasn’t made any big acquisitions, rather relying on incremental organic growth. Organic growth often confers more durable growth over the long term, because it’s generally achieved by improving internal aspects of the business like customer service, supplier relationships or improving employee productivity. It’s much harder to buy these intangibles via acquisitions.

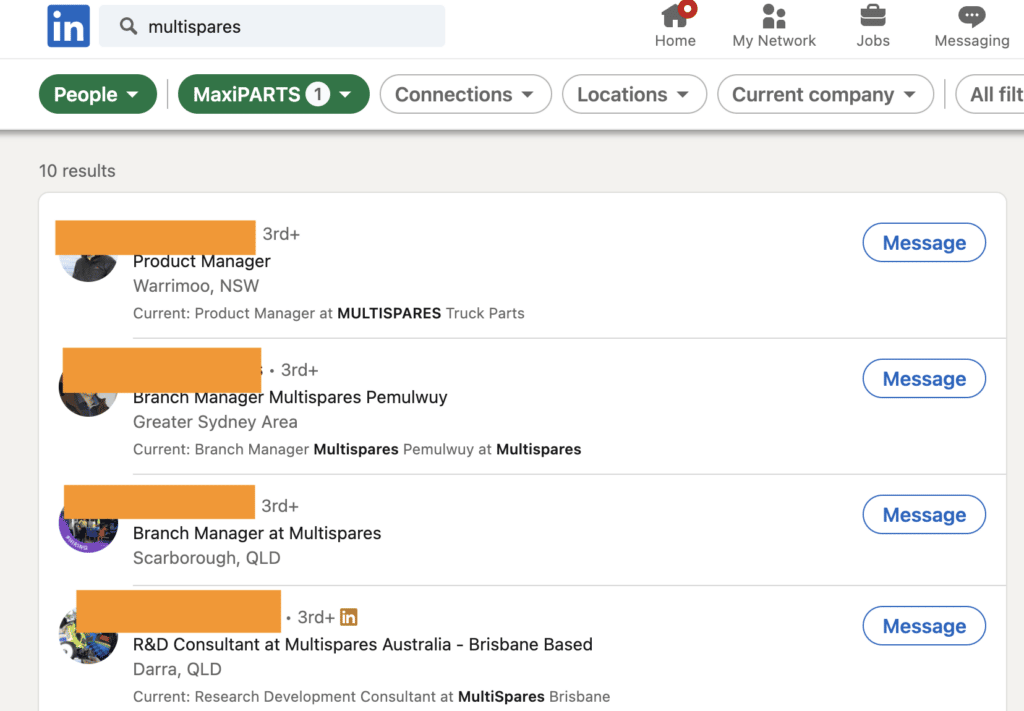

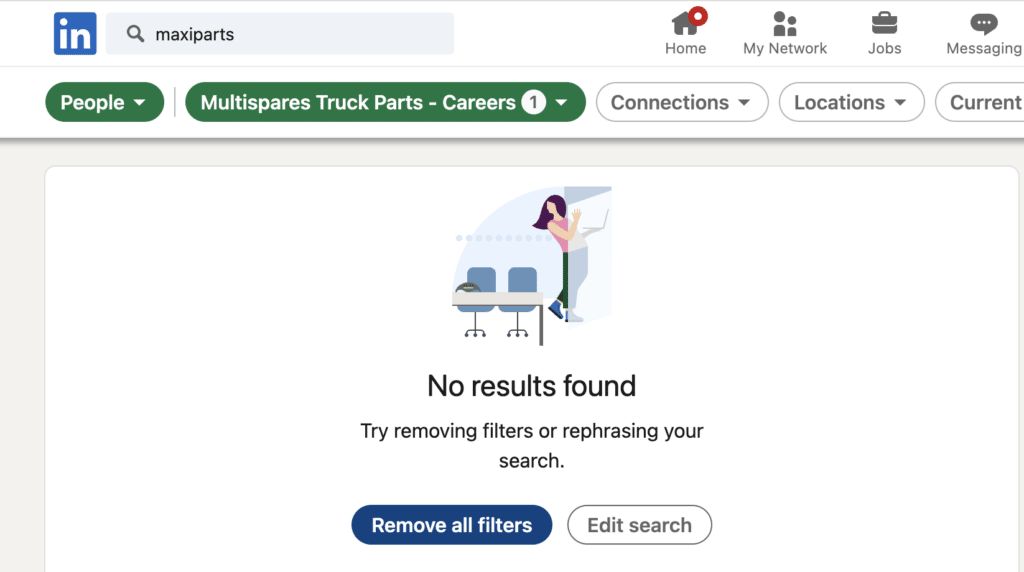

I think it will take some time for Maxiparts to catch up with Supply Network because it will need to expend greater time, effort and money to implement the same investments like IT systems, expertise in the aftermarket parts by hiring quality employees, distribution capacity and other little cogs in the machine that drives returns on capital. I found it interesting to see that I could not find any Maxipart employees that were previously employed at Supply Network, but I could find ten current Supply Network employees that came from Maxiparts.

Please note this is a small sample of people, but nonetheless, it’s a small indicator positive that Supply Network is able to attract experienced employees. As investors, we like a company that is attracting talent from its competitors, because those employees are sometimes voting on which is the better company, with their own two feet.

One of the great attributes of the Supply Network management team is the length of tenure across the leadership team. The tenure of the executives and directors ranges between 14 to 22 years at Supply Network. All of them also have deep and relevant industry experience and the founder has skin in the game with a 28.3% shareholding.

The leadership team at Maxiparts also looks quite good, as they seem to promote within. Maxiparts CEO Peter Loimaranta has been with Maxiparts for over 17 years, but is the only one I could find, with this rather extensive level of experience. And not all the directors on the board possess industry experience, unlike Supply Network.

Could Supply Network (ASX: SNL) and Maxiparts (ASX: MXI) Both Win?

Supply Network is currently trading at a price-to-earnings multiple of around 21x, which is higher than the historical PE average of 16x. Applying a conservative annual revenue growth rate of 10% and using a discount rate of between 9% to 11% gets me to a valuation range between $8.02 to $11.08. So, the current Supply Network share price seems reasonable, but I’d prefer to wait until it hits my target range of $8.50 to $9 before calling it attractive, given the heightened level of pessimism across the markets at the moment. Please also note that Claude has a slightly lower valuation than I do, as he explained in this article, after this set of Supply Network results.

Maxiparts arguably also presents a sound opportunity and both companies will likely continue to dominate the aftermarkets industry. The PE multiple for Maxiparts is currently around 12.7x, hovering above a historical average PE multiple of 9.6x. This could prove cheap if Maxiparts can execute its renewed strategic focus in the aftermarket parts space.

Of course, the big risk facing both Supply Networks and Maxiparts is that their businesses are quite capital intensive. As they grow, they need more inventory, and indeed, as inflation pushes prices up, these companies need more working capital, to fund the increasing cost of the same level of inventory. Therefore, the current inflationary environment is unfavourable to both these companies. Investors may wish to wait until inflation slows, in order to minimise this risk. At the very least we will get more information about how inflation is impacting the business, after the next set of Supply Network results.

Sign Up To Our Free Newsletter

Disclosure: the author of this article does not own shares in Supply Network (ASX: SNL) or Maxiparts (ASX: MXI) and will not trade these shares for 2 days following this article. The editor of this article Claude Walker does own shares in SNL and will not trade these shares for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Save time at tax time: If you’d like to try Sharesight, please click on this link for a FREE trial. It saves heaps of time doing your tax and gives you plenty of insights about your returns. If you do decide to upgrade to a premium offering, you’ll get 4 months off your subscription price (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. A Rich Life does not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.