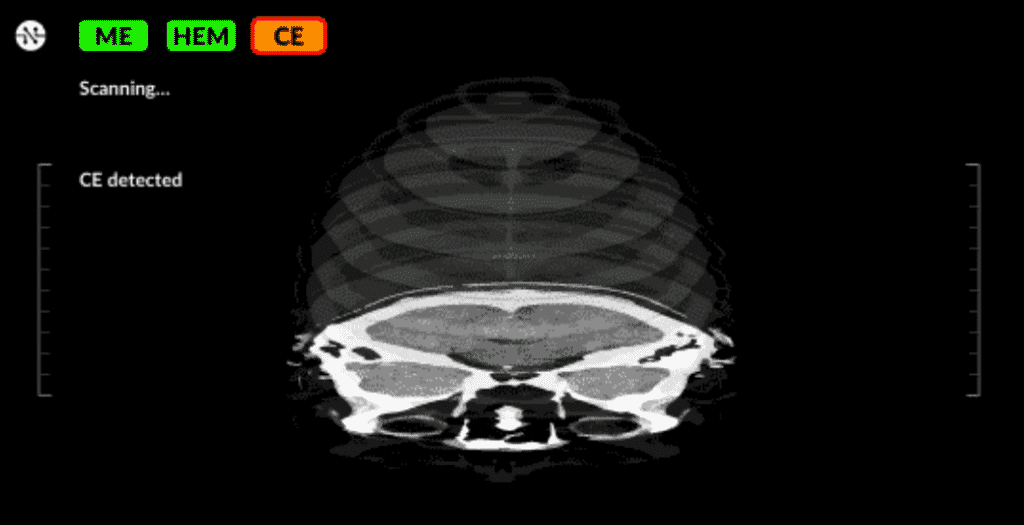

Each year radiology imaging software company Pro Medicus (ASX:PME) attends the famous Radiological Society of North America conference. In 2019, the company showcased its artificial intelligence (AI) accelerator program. That program is designed others to write encourage algorithms that can help radiologists improve speed and accuracy of diagnosis.

The CEO said:

“At the RSNA and this year we had more new product than ever before including Visage AI Accelerator and our new Breast Density algorithm which we demonstrated as a work in progress.”

He continued:

“…our machine learning model which was used to produce the Breast Density algorithm. As an extra validation, we had a team of five breast imaging specialists at Yale each curate over 500 cases using our curation tools and then tested the algorithm against these curated cases. The results were so promising we decided to commercialise the product and have applied for FDA approval. By using our own platform, we were able to get a project from research through to submission for FDA approval in under 8 months which is way under what it would otherwise have taken using traditional tools.”

On top of that, as we mentioned in our Pro Medicus H1 FY 2019 Results Analysis, the company has done a deal with tele-radiology company Nines. Tele-radiology will be particularly important during the coronavirus pandemic. That’s because CT scans are an important diagnostic tool for the disease. However, that is more so the case in China where they are much less expensive.

Nines is a good fit, because it is also developing tools to make radiologists more accurate and efficient.

Importantly for Pro Medicus, many of its contracts, particularly in the USA, are linked to study volume. If the major US hospitals (clients of PME) do more CT scans due to the coronavirus pandemic, then Pro Medicus will increase its revenue.

On the other hand, if hospitals are overwhelmed, then they may not have the time or capacity to conduct CT scans and CT scans that would otherwise be conducted for elective procedures will be postponed indefinitely.

On top of that, the global shut-down caused by the virus will possibly hamper medium term implementations, and tenders, making it harder for the company to grow its customer base.

Longer term, this pandemic will surely highlight the importance of remote work. Given Visage has the reputation of being the fastest remote radiology viewer, used by the best US hospital groups (like Mayo Clinic), Pro Medicus will stand to benefit.

I have not yet bought any more Pro Medicus shares during the current sell-off, but the company is top of my watchlist. By way of disclosure (and absolutely not advice) I last bought shares at $10 but would probably pay more than that today.

At this time the overall impact of pandemic on businesses is very hard to ascertain, but is generally a strong negative. For Pro Medicus, at least, there may be some longer term benefits in highlighting the importance of fast and efficient technology that allows for remote diagnosis by radiologists. Offsetting this, it trades on a very high multiple and so could see significant downside yet from its current price of over $16.

Note: the title of this post was changed to better reflect the content of the article.

If you’d like to receive an occasional Free email with more content like this, then sign up today!