Over the last couple of days, ASX listed software small caps IntelliHR (ASX:IHR), Rightcrowd (ASX:RCW), and Volpara (ASX: VHT) all reported their quarterly cashflow Appendix 4C reports, for the quarter ending December 2021. I have written about each company before and will likely update Supporters once they report their next half year results, so I won’t rehash each thesis here. However, it’s always worth checking in to see how the quarterly cashflow looks.

IntelliHR (ASX: IHR) achieved record receipts from customers, but free cashflow cratered to new lows, with cash burn (excluding grants) at almost $3 million. This was substantially due to a significant increase in employee costs.

The company explained that it “continued to invest strategically in longer term horizon capabilities, including the expansion of its global hubs in North America and the UK and product development to support partnership and enterprise client demands. The quarter also saw some outflows associated with finalisation of COVID related deferred expenditure commitments.”

With any luck, cash burn will reduce from here. If not, the $10.8 million of cash in the bank will surely prove insufficient to reach breakeven. At this point, it seems that IntelliHR has been overly flippant about cost control, but on the other hand, it was good to see that annualised recurring revenue grew 18% for the quarter to $5.65 million, putting the company on just over 10x ARR at the current share price of 17 cents. Happily, churn remains low, but sadly, it seems very likely to need to raise more money.

Rightcrowd (ASX: RCW) fell short of achieving record cash receipts, but was more prudent with its cash burn, and actually generated free cash flow if you include a large government grant worth over $2m. Contracted Annual Recurring Revenue (ARR) at 31 December 2021 closed at $9.1m, up just 4.5% on the last quarter. That puts the company on about 5x contracted annualised recurring revenue.

On the bright side, churn remained below 5%, and the company says “Several material new enterprise deals sit at an advanced stage in the pipeline but have been re-forecast to close in Q3 and Q4.”

Rightcrowd has about $8.2 million in the bank so it has about a year’s worth of cash burn from here. That will put it in a tough situation because it does not expect P&L break-even until the end of FY23. Therefore it will run close to needing more capital though it may be able to survive without.

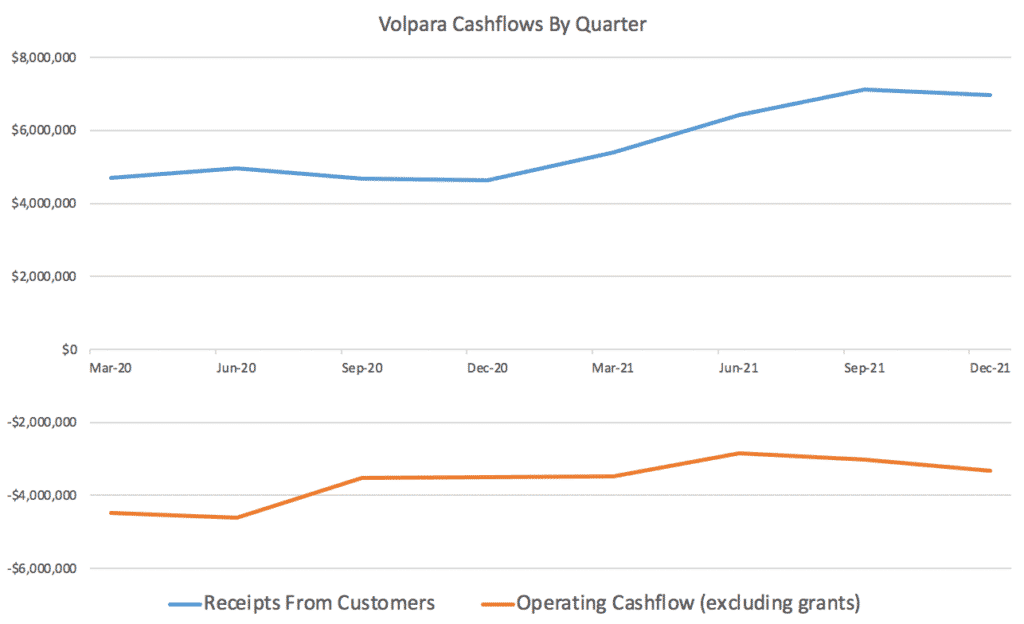

Volpara (ASX: VHT) saw receipts from customers moderate a little quarter on quarter, but its cash burn did reduce overall, as promised. Figures are in NZD unless stated otherwise.

Unfortunately, this was due to a reduction in investing cash outflow, and operating cashflow excluding grants actually declined again, suggesting that the company’s slow march towards breakeven is floundering a little.

With cash burn over $3.5 million per quarter, the company is on track to need to raise more capital given it has about $21.3 million in the bank. Volpara’s ARR grew by about 5% quarter on quarter to USD $20.5 million or about AUD $29.2 million, putting the company on about 8x ARR at the current price of 92.5 cents.

Given the current sell off in small cap software stocks, these businesses are likely to suffer from the fact that they have not yet reached breakeven, and they may need to raise more capital. That could be punishing for shareholders if the dilution occurs at a low price. As such, I am carefully reviewing my allocation to each of these stocks. I haven’t taken any action yet, and nor have I made up my mind, but I am considering trimming these positions into strength, especially Volpara, which is on a relatively high multiple for relatively subdued growth (and significant ongoing cash burn).

Arguably, growing companies with positive operating cashflow provide better risk vs reward.

Please remember that these are personal reflections about stocks by an author. I own shares in each of them and reserve the right to trade shares in them any time from tomorrow. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.

For early access to content like this, join our Free newsletter!

Note: If you haven’t already tried Sharesight, we thoroughly recommend testing it out. The service allows you to see your proper investing returns over multiple time periods, including sold positions, and to do a thorough review of your wins and losses. It saves heaps of time doing taxes.If you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade to a paid subscription, you’ll get 2 months free, and we’ll get a small contribution to help keep the lights on.