At the end of January, we get the quarterly cashflow reports from many up-and-coming small cap stocks; generally those that are not yet cashflow positive over a full year period. So far, in this quarterly reporting season, MedAdvisor (ASX: MDR) clearly has the standout result.

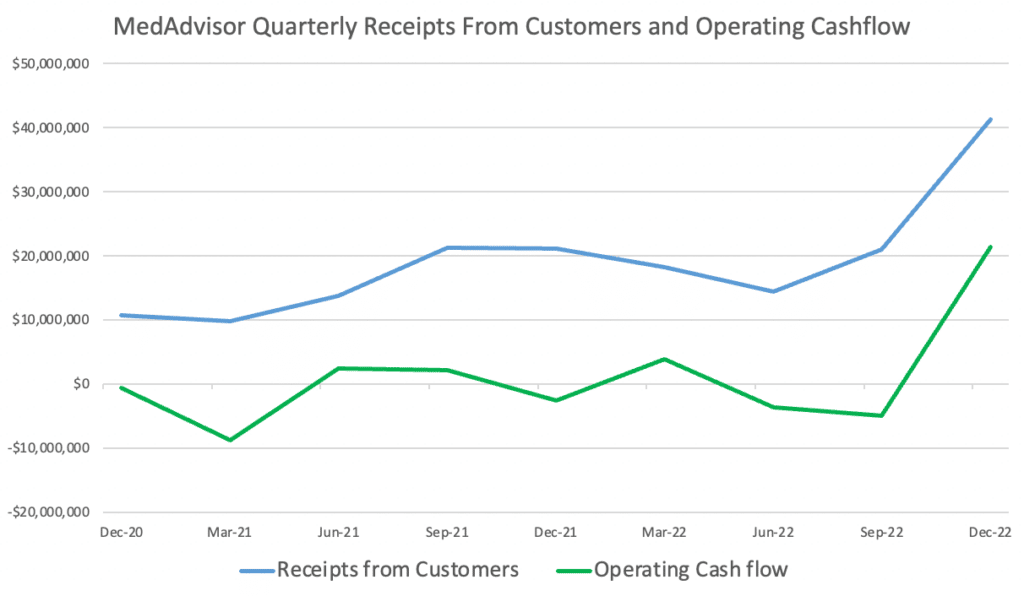

In Q2 FY 2023, Medadvisor (ASX:MDR) reported record quarterly receipts from customers of over $41 million, and generated record operating cashflow of $21.4 million. This is a huge increase from the previous quarter (negative $4.9 million), the prior corresponding period (negative $2.5 million), and its former best ever quarter ($3.9 million). You can see the great improvement in the chart below.

According to the company, the huge improvement was “underpinned by the expansion of the COVID-19 awareness program combined with increased pharmacy participation in the US digital platform, inMotion.’ Furthermore, gross margins in the US business improved significantly due to “the growth of higher margin digital programs.”

MedAdvisor’s Best Quarter Ever

MedAdvisor looks like it might be firing in both Australia (where it has more of a software business) and in the US, where it has a lower margin communication and marketing business. The recent acquisition of Guildlink improving revenue in Australia by $1.3 million to $4.7 million for the quarter. Without the acquisition, revenue would have been pretty flat in Q2 FY 2023.

MedAdvisor Share Price Up Considerably

When MedAdvisor acquired Guildlink, it raised capital at $0.16 per share. On news of today’s strong quarterly, the market pushed MedAdvisor shares up to $0.30, almost double the capital raising price less than a year ago. Excluding options, MedAdvisor has around 545 million shares on issue implying a market capitalisation of about $165 million.

When MedAdvisor was trading around $0.16, I wondered whether the company was at a transition point. However, I wasn’t game to buy shares, and wrote that “I would prefer wait until I have evidence that MedAdvisor is actually capable of reaching breakeven.” Well, I may have missed some gains out of an abundance of caution, but with this strong result, MedAdvisor easily surpassed breakeven, and is back in my investible universe.

There is no guarantee that MedAdvisor will remain cash flow positive, and we will have to wait for the half year report to see whether any changes to working capital have impacted this quarter. However, today’s result definitely makes it seem much more feasible that the company could one day more than justify its current share price, by returning free cash flow to shareholders.

In any event, the company remains some way from sustainable profitability and free cashflow since it has a strategy that “will move the business toward a more sustainable and profitable future by FY24.” After this quarter MedAdvisor has over $32 million in cash so its balance sheet is looking stronger, too.

The new CEO of MedAdvisor Rick Ratliff commented that the company’s “focus for the remainder FY23 and beyond, is executing on a pathway to profitability, prioritising initiatives that will move the business toward breakeven and lay the foundation for profitability in FY24.“

Whether or not the company fulfils this longer term potential, we can at least say with certainty that this is the best quarterly result from MedAdvisor, so far. You can see our prior coverage of MedAdvisor here.

Disclosure: The author does not own shares in MedAdvisor and will not trade them for at least 2 business days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

Sign Up To Our Free Newsletter