Last week two small-caps I own Control Bionics and Ansarada both reported quarterly results. In some ways, they couldn’t be more different. Control Bionics had a flat result, and hardly made an effort to sell the story. Ansarada had a stronger result, but shouted about it from the rooftops. Neither fill me with confidence, but let’s take a look at the detail.

Ansarada (ASX: AND)

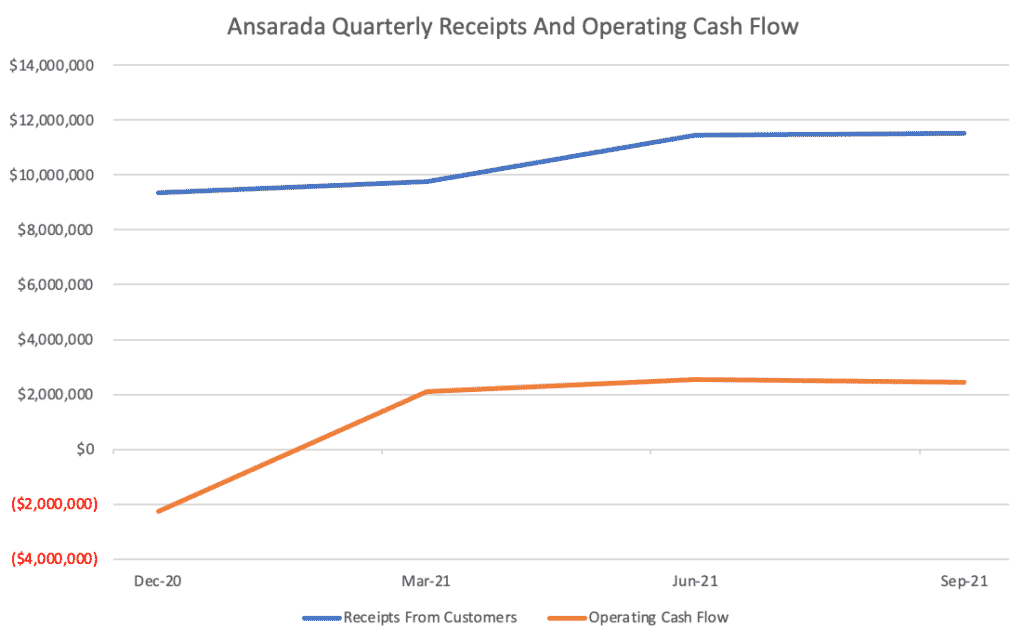

Hot off the heels of announcing a synergistic acquisition, Ansarada reported its quarterly cashflow, showing about $0.9m of free cash flow, even after including payments for acquisitions. Without that, it would have been closer to $2m in free cash flow. Based on this result, it’s not unreasonable to expect that Ansarada could generate $8m in free cash flow per year.

Overall, it looks like Ansarada is performing roughly in line with what I thought it would when I wrote “an introduction to Ansarada“, which is good to see. However, one development I dislike is that the company has been paying Hotcopper to spam its users about Ansarada, both for its recent acquisition, and for this quarterly.

Ansarada has over $20m in cash, so it’s not clear why it would need to promote its share price.

However, I do note that management will have a large number of shares released from Escrow from around February 2022 to September 2022, which will then allow them to sell.

Therefore, I am thinking I’ll probably aim to sell some or all of my shares before then.

In the meantime, Ansarada has a market capitalisation of about $195m at a share price of $2.20.

Based on annualising the receipts from the last quarter, I estimate it is trading on less than 4.5 times likely FY2022 revenue. That means it is cheaper than many other similar companies such as Damstra, which has actually missed guidance twice and therefore lacks credibility. So for now I’ll hold on to Ansarada a little longer, just to see if the share price can keep climbing.

Control Bionics (ASX: CBL)

As a reminder, Control Bionics is in the business of giving special needs people access to the internet, gaming platforms, and communications devices. Since listing, its story has been that it would build a sales team, and increase sales. However, the quarterly cashflows show that the company is only doing half of what it said it would do.

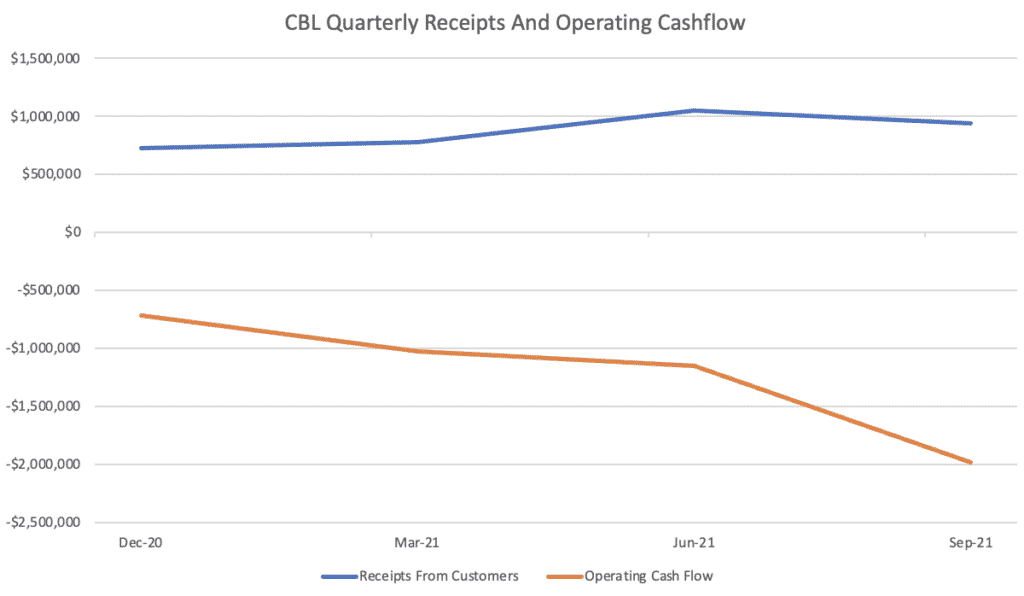

The good news is that CBL has improved its quarterly receipts, but the bad news is it has massively increased its expenditures, and we’re simply not seeing an adequate return on that investment.

Unfortunately, the company doesn’t seem to care about communicating with investors, saying only that there were “Delayed conversion to sales of submitted funding applications in Australia and USA,” and “One-off people costs related to recruitment of key senior management team (including the new Vice President – North America, Head of Sales – Australia, Head of Funding in the USA), and annual bonuses for key management, as reported in the 2021 Annual Report.”

Understandably, the market has sold off the shares on this news since there’s a certain degree of arrogance in saying that you recruited a management team, and gave bonuses, but actually saw lower receipts from customers.

That said, CBL still has $10m in cash so it can keep carrying on like this for another year or so before it needs capital again.

One possibility is that the communications are abrasive because the management are not really focussed on the stock price and are confident that the current expenditure will result in stronger quarters in the near future, and they want to let the numbers do the talking. You see, the company says that they have prepared a “wider product range which will see us go from two system offerings to four system choices”, and that “the new range will be released in Q2.”

And in the release, the CEO said that “the extended challenges of COVID-19 restrictions globally had an effect

on our revenue conversion, but our pipeline is growing and we are excited about our future in an easing environment.”

With quarterly revenue of around $780k in the USE and $280k in Australia, it’s fair to say the company has shrunk slightly in the latest quarter but retains the potential to grow on a full year FY 2022 basis, given revenue of around $4m in FY 2021.

Ultimately, with increasing cash burn and flat sales, CBL is looking like a very risky proposition. This was not a good quarter.

However, my affinity with this mission driven company clearly make me biased, and I do not think I would hold any shares but for the fact that I am drawn to its ethical nature. For now, though, I am inclined to take the risk that the company fails to deliver the promised growth in the next two quarters. For me, Control Bionics is a low conviction investment but one I think may well succeed longer term, assuming that this lull in growth is very temporary.

Please remember that these are personal reflections about stocks by author. I own shares in Control Bionics and Ansarada, and will not sell them for at least 2 days after this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.