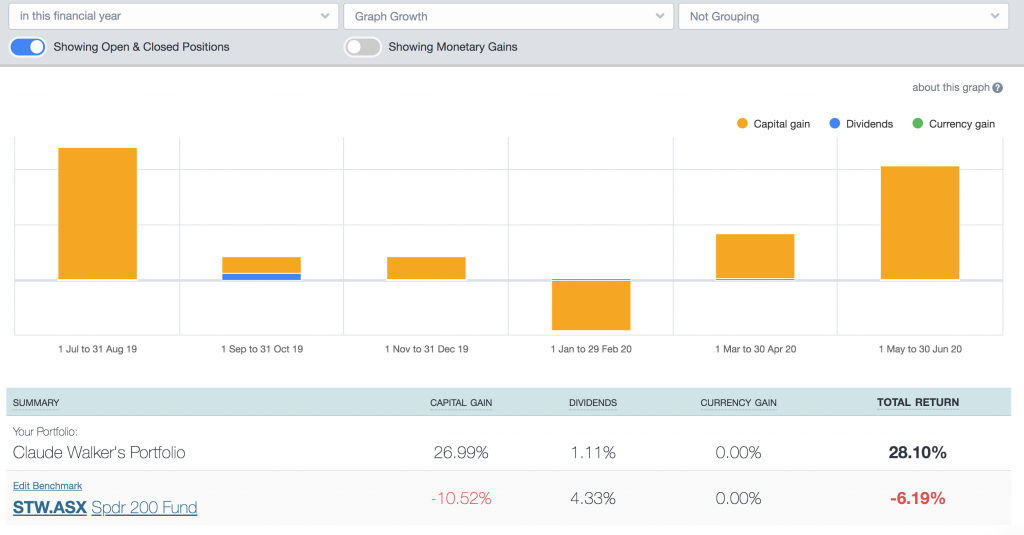

Well, since it’s the last day of the financial year I thought I might take a quick look at how I did. As you can see below, my money weighted return for FY 2020 was about 28%.

While this was an acceptable result relative to the market, I really dropped the ball in a number of ways. My worst mistake was to sell Pushpay too early. It’s a good business model and suffice it to say this atheist lacked faith.

On top of that, I also sold out of Temple and Webster (ASX: TPW) way too early, despite events pretty much flowing exactly as I had expected. It’s a real pity, as a longer hold there would have made a big difference, too.

The lesson I learnt on these two stocks was that anything that replaces enhances social distancing will actually do quite well, at least in the early stages of a recession. There’s no need to overthink it and if a thesis is working I should sell gradually rather than suddenly.

That’s a simple lesson, but it definitely yields me better results. For example, I sold a massively overvalued stock called Novita Healthcare (ASX: NHL), now Tali Digital (ASX: TD1) quite slowly, even though I thought it was too expensive. As a result, I received a much higher average price than I otherwise would have. I usually sell too early when a stock is still going up, so I should at the very least sell more slowly.

May I remember this lesson well.

For the sake of interest, I’ll also review my biggest winners and biggest losers, (based on both absolute and percentage gain) below:

Biggest Absolute Losers Of FY 2020

- Audinate (ASX: AD8) – blindsided by a virus which will prevent large gatherings. I own a tiny position, having sold down.

- Vista Group (ASX: VGL) – failed to see their investment cycle (rebuilding software to transition to cloud). I do not own.

- Easton (ASX: EAS) – just a large position that has not recovered from Covid related falls. I still own.

Biggest Percentage Losers Of FY 2020

- Connexion Telematics (ASX: CXZ) a tiny position I capitulated on near the lows

- Rectifier (ASX: RFT) a small position in a very decent company that I bailed on near the lows.

- Gentrack (ASX: GTK) a genuine thesis blow up — sales growth has stalled suggesting they may not be competing effectively.

Biggest Absolute Winners Of FY 2020

- Energy One (ASX: EOL), a small software company covered here.

- Pro Medicus (ASX: PME) a world beating software company covered here.

- Tali Digital (ASX: TD1) a short term trade based on a view that the company would get hyped up, which it was — intention to sell broadcast here (to supporters).

Biggest Percentage Winners Of FY 2020

- Tali Digital (ASX: TD1)

- Energy One (ASX: EOL)

- Alcidion (ASX: ALC) another small software stock gaining traction with its products.

As always, Supporters can see my full portfolio here.

Of the companies mentioned above, I currently own EOL, ALC, PME, AD8 and EAS.

Save time at tax time: A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link for a FREE trial. It saves me heaps of time doing my tax and gives me plenty of insights about my returns. If you do decide to upgrade to a premium offering, you’ll get 4 months free (the best deal available, I’m told) and we’ll get a small contribution to help keep the lights on.

If you’d like to receive a occasional Free email with more content like this, then sign up today!

This post is not financial advice, and you should click here to read our detailed disclaimer.