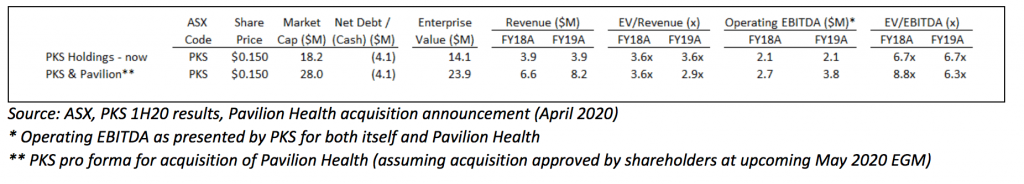

The second Software Week stock is PKS Holdings Ltd (ASX: PKS), a little-known microcap that last traded at a share price of just 16 cents. It has recently announced an interesting and transformational (at this stage of its life) acquisition. I hold this company in my portfolio, so am talking about my own book, and in no way is this intended as a recommendation.

Pacific Knowledge Systems (“PKS) has developed a subscription-based Clinical Decision Support (“CDS”) system focused on automating the decision-making process in large healthcare companies. The system is called RippleDown and it comprises two complementary modules.

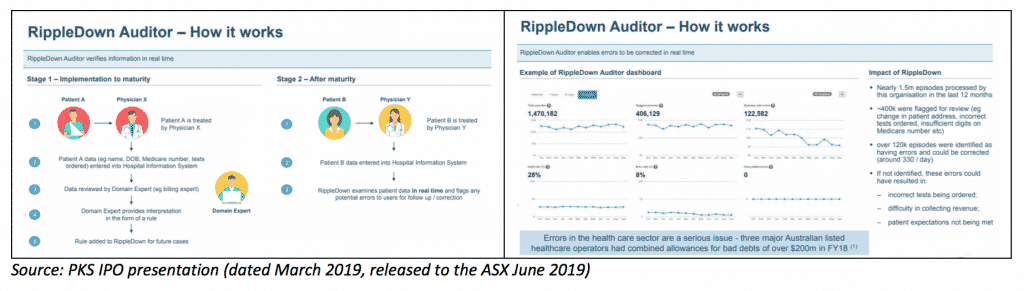

RippleDown Auditor (RDA)

RDA is a knowledge-based system which enables multiple departments within a clinical organisation (such as data entry, billing, and the pathology lab) to audit and work with data in real time. This is aimed at reducing data entry errors which can lead to financial impacts (i.e. lost revenue due to under-billing customers, or denied Medicare funding due to incorrect Medicare numbers) and/or operational impacts (i.e. on patient diagnosis and treatment). The graphic below right illustrates the potential extent of the data errors – with 27% of annual episodes for this example organisation being flagged for review and 8% found to have errors.

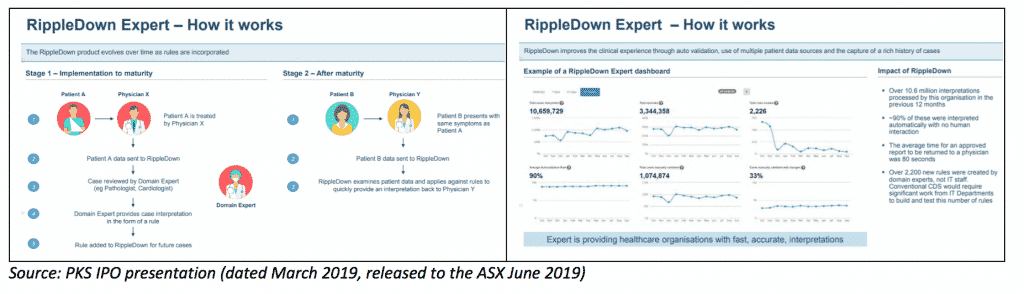

RippleDown Expert (RDE)

RDE is an iterative and collaborative platform which records clinician expert analysis of patient data (i.e. by a cardiologist or pathologist) and creates rules to interpret this information – which can then be applied for future patients (i.e. who may present with similar symptoms) in order to improve decision making and generate detailed treatment recommendations. The RDE module is aimed at automating and replicating the decision-making process at scale by utilising the domain expert’s experience and knowledge to enable a higher volume of faster and more accurate decisions.

The vast majority of PKS’s revenue is derived from system usage fees (73% of income for 1H20), with recurring annual licence fees comprising 17% of December half revenue, and the remainder coming from training, consulting and one-off initial licence fees.

Macro drivers and the PKS Holdings Ltd (ASX: PKS) go-to-market strategy

This post is not financial advice, and you should click here to read our detailed disclaimer.

The tailwinds supporting potential demand for the RippleDown product are fairly obvious (and largely are the same structural drivers for broader medium-term healthcare industry growth):

- Most Western countries have a rapidly ageing population with the Baby Boomers now in their late 60s to early 70s and the proportion of people aged 65+ about to increase dramatically over the next couple of decades (especially as life expectancy increases); and

- Margins in the healthcare sector have come under pressure due to increased competition, rising labour rates and government funding not keeping pace with increasing patient volumes.

As a result, healthcare organisations are keenly focusing on improving operational efficiencies in processing patients and minimising errors, and on maximising revenue and lowering working capital requirements. Software and process automation are a sensible solution for this market.

According to market intelligence firm BIS Research, the global CDS market generated ~US$1.6B of sales in 2018 and is expected to grow at a CAGR of 8% to US$3.5B by 2028. While this is a tiny segment of the global healthcare IT market (measured at US$134B by research firm Markets and Markets in 2018), there is clearly a lot of “white space” for PKS to play in with only ~$4M of annualised revenue currently (that’s prior to the acquisition of Pavilion, which we’ll touch on shortly).

PKS’s sales strategy is two-pronged: via its own internal sales & marketing team, and via channel partners: Abbott Laboratories in the key US market, and Philips NV and Thermo Fisher in Europe. For FY19, revenue outside of Australia and New Zealand comprised 56% of total company income. PKS’s customer list includes names such as Australian Clinical Labs, NSW Health Pathology and Sydpath here in Australia, as well as Lancet Laboratories in South Africa, and the Gribbles Pathology network in Malaysia and Quest Laboratories in Singapore (both part of Healthscope’s former Asian pathology business).

While the vast majority of installed sites have come via channel partners, direct installations comprised 73% of total 1H20 revenue. Based on the PKS prospectus information (which I’ve not seen updated since IPO), direct installations generated almost 40x as much revenue on a per site basis – which may be due to customer mix (i.e. hospitals vs. pathology labs), or perhaps I am mashing together different data points – but the company has confirmed that direct installations are considerably higher revenue and margin than via channel partners. The company has plans to grow both channels over the medium to long term, but I do note that direct customer growth has been stagnant over the last four years.

PKS Holdings Ltd (ASX:PKS), Its Financial performance and Its non-IFRS reporting

That all sounds pretty positive, but what about financial performance?

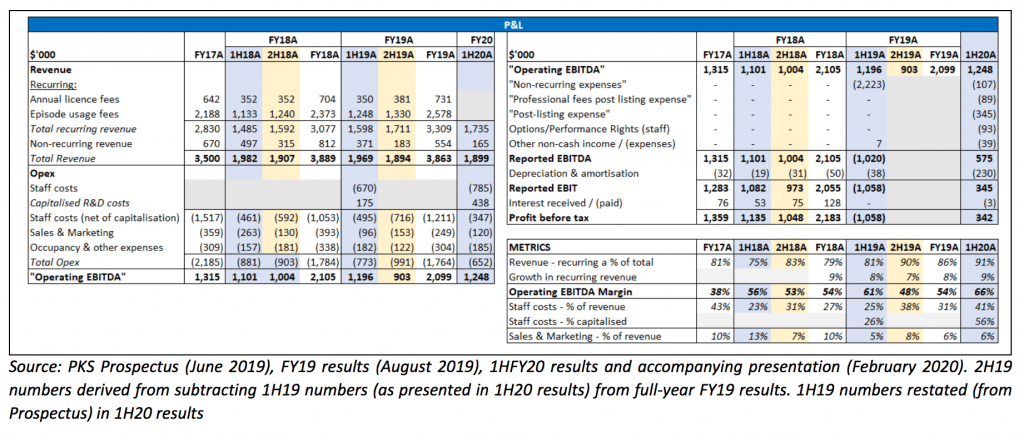

The table below, cobbled together from the prospectus and the August 2019 and February 2020 results tells us some interesting things:

- EBITDA margins are high – especially for such a small business: 54% in FY18A and also in FY19A, apparently 66% for the half-year ended December 2019 (more on that below);

- While total revenue has hardly moved, recurring revenue has grown solidly – by high single digits in each of FY18A, FY19A and 1H20A. Recurring revenue (typically viewed as higher quality than lumpier non-recurring revenue) has increased from ~80% of total revenue in FY18 to 91% for 1H20A. Non-recurring revenue has declined over the period above; and

- There has been minimal investment to this point in Sales & Marketing costs (only 6% of total revenue in FY19A and the Dec-2019 half). Historically most S&M activity has been undertaken by external consultants, and one of the key growth strategies post IPO was to ramp up internal S&M capability (for geographies outside channel partner exclusive territories/customers).

It’s worth noting however that the company’s public financial reporting has been a bit opaque since listing. Statutory FY19 results looked nothing like prospectus comparatives with FY19 statutory revenue of less than $0.3M – presumably due to being prepared for the vehicle used to acquire the operating business. That required the preparation of Pro Forma numbers to illustrate underlying performance – which was certainly helpful – and introduced the concept of non-GAAP “operating EBITDA” – which is not at unusual on the ASX in the year of our lord 2020 it must said.

Operating EBITDA got another run in the 1H20 results released in February, but also drew attention to a number of below-the-line items totalling ~$0.7M and which otherwise would have resulted in a significant reduction in half-on-half EBITDA if they’d been above the line. A number of these items appear to be connected with the company’s IPO (in June 2019) and if so, and if truly one-off in nature, then fair enough – but ideally, we would have loved an explanation of “post listing expense” (included in “non-recurring items” in the investor presentation). If this is actually increased opex as a result of being listed, this would be recurring and should go above the line – which would mean EBITDA declined by ~30% (~$0.4M) to $0.9M for 1H20. This would actually make sense, as costs from being listed (ASX listing fees, compliance costs etc) can amount to $0.5M for smaller companies – but this is yet to be confirmed.

Finally, Operating EBITDA of $1.2M for 1H20 was post what appears to be a significant change in the company’s policy on the capitalisation of software development costs. It isn’t at all unusual for technology companies to capitalise a significant proportion of development costs, and then amortise these below EBITDA over an extended period; 10 years for PKS. This is permissible under accounting standards and reflects the multi-year benefit that can be derived from the development of proprietary software. Prima facie (without knowing the mix of R&D vs non-R&D staff for both periods), it looks like there has been a material increase in the proportion of development costs capitalised – which also explains the sharp increase in Depreciation & Amortisation in 1H20. We will track this over future reporting periods.

Taking all of this at face value (though reserving our right to be wary), PKS has generated ~$2M of Operating EBITDA between FY18 and 1H20. Operating 1H20 EBIT was ~$1M, suggesting annualised NPAT of ~$1.4M (assuming a 30% tax rate) and an undemanding valuation of ~12x P/E, or 9.5x P/E if you back out the $4M cash balance). The share price is up 15% since the announced acquisition of Pavilion (discussed shortly, I promise), so was trading at a P/E of less than 11x (~8x excluding cash) beforehand [n.b: taking all of the above at face value].

PKS Holdings’ Partnership With Abbott Laboratories (NYSE: ABT)

One of the key future growth drivers is the company’s worldwide partnership with Abbott Laboratories – the US$166B market cap behemoth. PKS launched a white-label version of RippleDown for Abbott called “AlinQS CDS” in late FY17, and as notable from the earlier graphic, the number of installations secured via the Abbott partnership increased by 50% between June 2019 and December 2019 to 27 (with a further 3 added over January and February 2020). These additional licences will start contributing meaningfully to PKS revenue from FY21 onwards.

Importantly, the Abbott software license and distribution agreement was extended in November 2019 (to April 2022 with an automatic 2 year renewal), and amended to significantly improve the commercial terms for PKS with respect to revenue sharing (based on a new volume-based mechanism) for the AlinQS CDS system. The November announcement also disclosed that this system had been sold to pathology and medical groups in Europe, North and South America, the Middle East, Africa and even Australia; and also quantified a pipeline of 250 “large pathology and hospital businesses” globally. The new agreement also included CPI increases for annual license fees backdated to 2016 – which presumably would drive something like a 10% increase in revenue for Abbott installations over 2H20 and 1H21.

Interestingly, PKS stated in its 1H20 results presentation that average annual customer contract value for Abbott installations is $15,500 – more than 3x the average pre-IPO metrics detailed above, suggesting that the Abbott partnership is considerably more valuable for PKS than the European agreements with Phillips and Thermo Fisher. The new agreement also included parameters around how and where PKS can deploy its own direct sales force – so with that now agreed, we would expect to see more investment made in PKS’s direct S&M capability over 2H20 (with a direct Australia/NZ Sales Manager appointed several months ago).

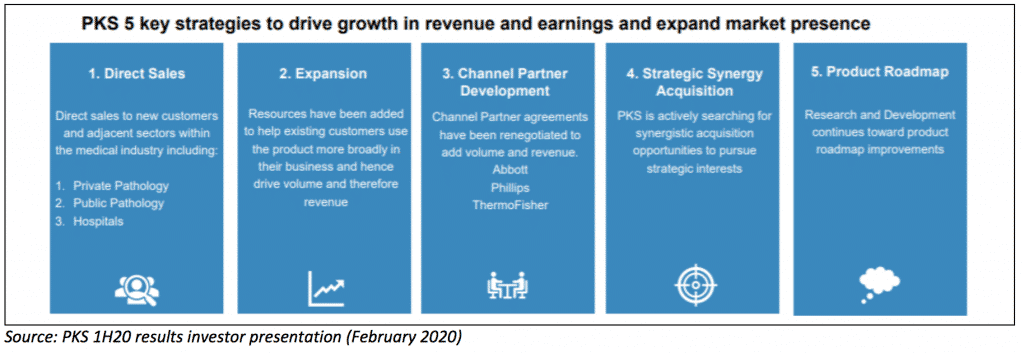

Continued development of the Channel Partner path to market (in particular the signing up of new partners) and investment in the direct sales capability are two of the 5 “key strategies” laid out in the February 2020 investor presentation (below), along with expanding the use of the RippleDown system within existing customers (particularly in hospitals with their labyrinthian department structures).

As you would expect, continued product development is also on the agenda, and the AGM presentation from November 2019 suggested the potential use of Machine Learning techniques (which would make sense for the RippleDown system), though I haven’t seen this subsequently mentioned.

PKS Holdings (ASX: PKS) Acquires Pavilion Health

A key plank of PKS’s growth strategy above is strategic acquisitions of companies providing complementary technology and software systems into the healthcare market (hospitals in particular) – and to this end the company announced its first acquisition late last month in an all-scrip deal.

Pavilion Health is an Australian cloud-based SAAS company which provides audit and risk applications and related consulting services to hospitals and health bodies internationally. The acquisition appears to make a great deal of sense from a strategic perspective:

- Pavilion already has strong penetration within PKS’s target hospital market with access to more than 550 Australian hospitals (64% penetration in the public hospital segment and 45% within the private hospital sector). Pavilion brings new blue chip Australian hospital customers such as the Healthscope network, Cabrini, Epworth, St. Vincents and Calvary hospitals amongst other well known healthcare organisations – to which PKS will aim to cross-sell its RippleDown system;

- Pavilion’s PICQ and RISQ tools (which, respectively, audit hospital clinical records to ensure data accuracy, and uses hospital data to identify incident trends) appear to be highly complementary in nature to the RippleDown system. Also, Pavilion brings cloud-based and SAAS expertise which management claim will further enable the development of RippleDown, while the PKS rules engine will be useful in optimising Pavilion’s RISQ product;

- Pavilion’s consulting business is a useful lead into software opportunities, and it also has profitable operations in other international markets including Ireland, Singapore and the Middle East; and

- The acquisition strengthens PKS’s senior management team by adding Pavilion’s Chief Technology Officer, Chief Operating Officer and Chief Commercial Officer, who will collectively have a 22% shareholding in the merged company post deal. Therefore, we think they will be highly incentivised to grow the business, as they are not taking any cash off the table (i.e. from PKS) in the proposed deal.

Pavilion on a standalone basis appears to be lower margin than PKS based on the respective financial information above right. But I’d argue this is nit-picking considering the myriad strategic benefits outlined above, and these numbers are prior to any cross-sell opportunities and potential cost synergies. The transaction also should provide meaningful EPS accretion – effectively doubling revenue while giving away (in the form of PKS scrip) only 35% of the combined company. The deal is subject to shareholder approval at an EGM to be held later this month.

I like the fact that this is an all-scrip deal and the shareholder alignment it creates. Further, this frees up PKS’s existing ~$4M cash balance to pursue other strategic acquisitions in the future.

Closing Thoughts

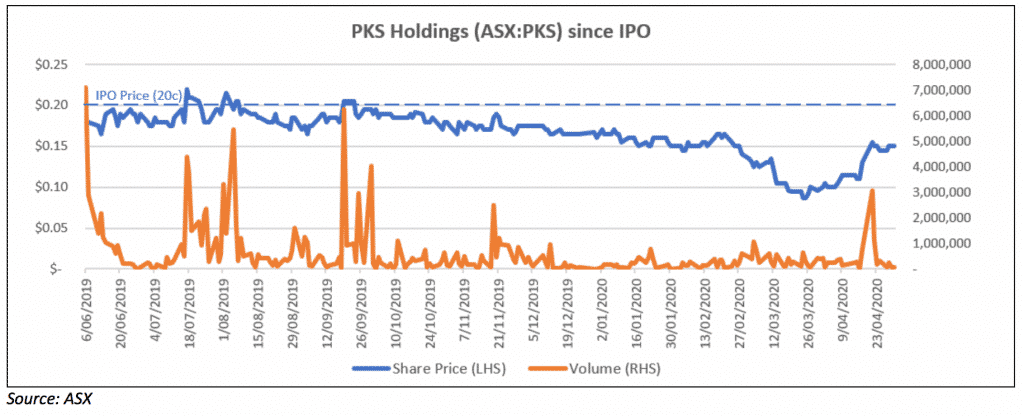

PKS hasn’t gained much attention since IPO and was 25-30% below its 20c IPO price even prior to the COVID-19 wobbles over March and April (during which time it fell below 10c). It’s recovered 50% or so since its nadir in late March, but is still 25% below its IPO price, though at least it currently seems to have stronger buying interest following the Pavilion announcement.

In a March 2020 episode of the Rules of Investing podcast, Chairman Mike Hill iterated that PKS planned to make a number of strategic acquisitions over the medium term, consistent with the stated strategy since listing. While I don’t think PKS will be as active in the M&A space as Damstra (ASX: DTC), which I covered yesterday. Nonetheless, I do think we may see PKS make another acquisition in the next 12-18 months.

______________________________________________________________________________

Disclosure: I (@Fabregasto ) hold shares in PKS Holdings and will not sell for at least 2 days after the publication of this article.

If you haven’t already tried Sharesight, it saves heaps of time doing taxes. A Rich Life depends on Supporters to pay for its free content, so if you’d like to try Sharesight, please click on this link to for a FREE trial. If you do decide to upgrade, you’ll get at least 4 months free and we’ll get a small contribution to help keep the lights on.

Sign up to our infrequent newsletter to get ideas and entertainment Fresh and Fast to your inbox!