Australian game developer Playside (ASX: PLY) is levelling up after producing stellar growth in Q2 FY 2024, resulting in a jump in the Playside share price from under 65c to almost 75c at the time of writing. Since I covered the Q1 FY 2024 trading update, quarterly revenue lifted by 34% to $20.7m. This was driven by a 68% jump in revenue for Playside’s Original IP segment, contributing $11.1m in revenue for the quarter and a small increase of 8% for the work-for-hire segment.

Strong sales of Dumb Ways to Die along with licensing deals with Meta (NASDAQ: META) and Netflix (NASDAQ: NFLX) were the big catalysts behind the surge in revenue for Original IP. The results alone are great but I think the announcement of a decade-long license agreement with Warner Bros. Interactive along with an upgraded revenue guidance from $55-60m to $60-$65m provided a double whammy of excitement. However, management expects the 2H FY 2024 EBITDA to be breakeven due to greater staff costs, resulting in a FY 2024 EBITDA range of $11-13m.

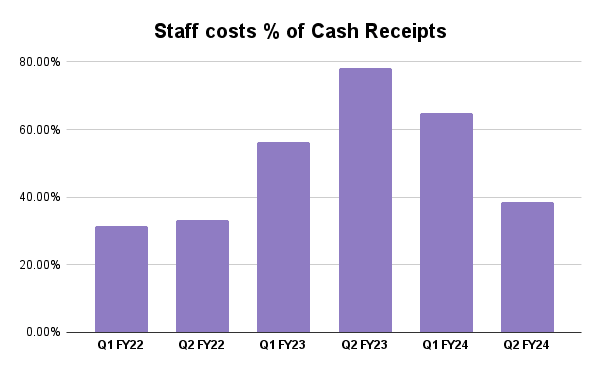

As I noted in my last article, the biggest challenge for Playside to transition from developing established movie franchise IP games to bigger PC/Console games is managing employee costs. Whilst Playside has kept staff costs much lower this quarter, management expects this to increase as it hires more staff to develop more original IP games for PC/Console.

Source: Playside Trading Updates

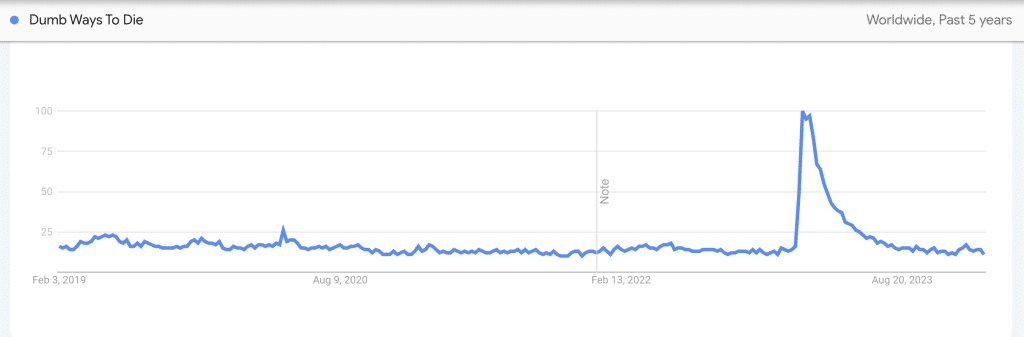

Developing PC/Console games requires more skilled gaming artists because the graphics generally need to be of a higher quality. Interestingly, Microsoft recently announced 1,900 job cuts to its Activision division citing a need to change its business model and a slowdown in demand for games. This could help Playside recruit skilled gaming staff at a cheaper cost. However, I do have some concerns over the softening demand for PC/Console games, which doesn’t bode well for Playside’s long-term strategy. In saying this, CEO and Founder Gerry Sakkas advised The Dumb Ways to Die franchise has provided the capital needed to fund the development of bigger PC/Console games. The Dumb Ways to Die franchise is proving to be a strong performer. Certainly it seems revenue from this franchise is proving much more resilient than the (now subsided) spike on google search trends for Dumb Ways To Die (Topic).

By maintaining the Dumb Ways to Dumb franchise and work-for-hire segments as ongoing revenue streams, Playside can deepen its pool of capital and reinvest this towards developing the next breakthrough PC/Console game. This is ultimately the path towards long-term scalability. Internationally, Gravity Co Ltd (NASDAQ: GRVY) operates a similar business model. Gravity specialises in developing role-playing games and has consistently leveraged its early success with Ragnarok. Gravity capitalised on the popularity of the game by continually expanding characters and storylines. This success allowed it to diversify its revenue streams even further by branching out to console games.

Playside has opportunities across all game formats, including virtual reality through Meta. The same cannot be said of a lot of game developers and I believe this works to Playside’s advantage. It seems to becoming a much more resilient business and its potential to develop the next big hit continues to grow.

But at a market capitalisation of ~$310m and EBITDA expected to be $11-$13m, the stock is trading at around 24 times forecast FY 2024 EBITDA. That is too optimistic for my liking given the wide range of possible outcomes.

Disclosure: the author of this article does not own shares in PLY. The editor of this article does not own shares in PLY. Neither will trade shares in PLY for at least 2 days following the publication of this article. This article is not intended to form the basis of an investment decision and is not a recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).