Games developer Playside Studios (ASX: PLY) produced record quarterly revenue of $15.5m in Q1 FY 2024. This was a $2.8m jump compared to the most recent quarter and a 140% lift relative to Q1 FY 2023. The biggest contributor was Playside’s Original IP segment, providing a revenue uplift of $2.2m since Q4 FY 2023. Work for Hire revenue chipped in with the remaining growth of $0.6m. It remains the dominant revenue driver with $8.9m in revenue compared to $6.6m for Original IP for Q1 FY 2024. Higher revenue translated to positive operating cashflow of $1.5m but capital expenditure on research and development resulted in a negative free cash flow quarter of -$356,000.

Playside founder and leader Gerry Sakkas again highlighted the significant revenue opportunity in developing larger titles for PC/Console. Sakkas appears driven to grow the Original IP revenue stream by exploring larger game concepts that are dominated by bigger gaming developers like Microsoft (NASDAQ: MSFT), Activision Blizzard and Electronic Arts Inc (NASDAQ: EA). Developing original games provides vast revenue upside but I think it comes with greater risks.

Scalability Challenge

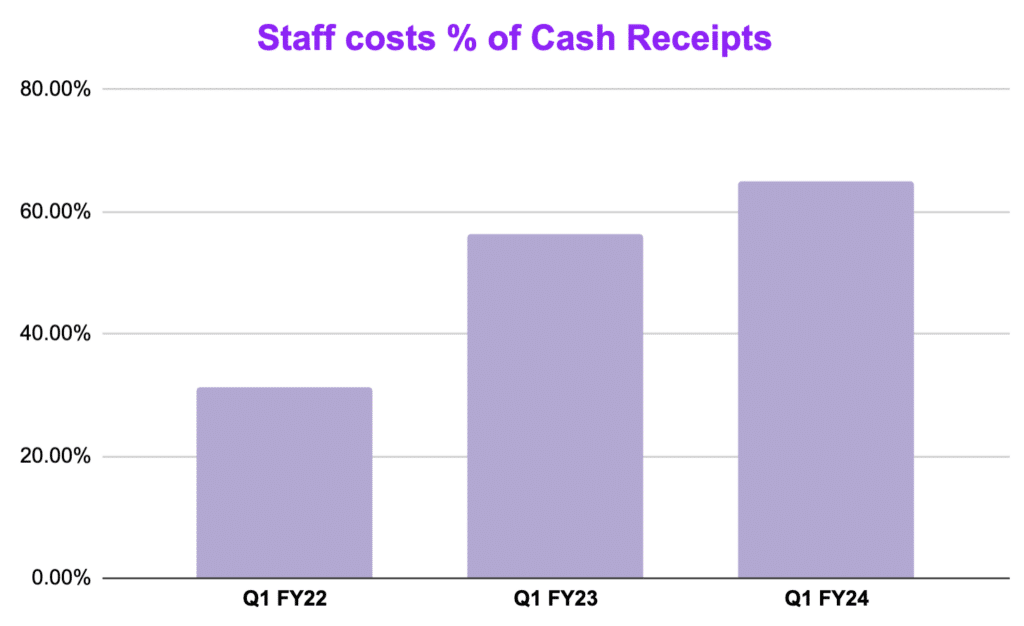

The biggest risk lies in scalability. Employee expenditure is the largest operational cost and continues to rise as a percentage of cash receipts and revenue. Jean-Phillippe Picard also highlighted this in his review of the FY 2023 results last month.

LinkedIn shows nearly half of Playside’s 290-strong workforce is involved in arts and design. Most of them are 3D artists, who develop the intricate graphics and animations you see in a game. This Reddit thread suggests the most expensive part of developing larger gaming titles for PC/Console is the art as 3D artists need to develop graphics for customised characters or other features within a game. As Playside focuses more on Original IP, employee costs will likely be harder to contain.

Even Playing Field

The level playing field of the gaming industry is a massive detractor in my view. Competition and size didn’t stop success stories like Candy Crush and Angry Birds. However, developing larger titles comes with greater competition dominated by larger studios. The popularity of these games often comes and goes very quickly so gaming companies can produce very volatile financial results. Those with unique brands and IP are generally the most valuable.

Most games are similar in nature but often popular and unique characters catapult them to stardom. Another big factor is the unique style of gameplay but this can be quickly replicated. This is how customer loyalty is often built.

Games Workshop (LON: GAW) pulled this off through a unique game played online but also in physical stores with the same level of enthusiasm. A sheer focus on optimising its core storyline and characters facilitated a scalable business model. Such commitment translated into long-term customer loyalty, helping Games Workshop achieve a share price compounded annual growth rate of nearly 30% in the past decade. But clearly immense brand value of Warhammer, built over many years, is a key driver of the extraordinary return.

With $31.7m of cash in the bank, Playside is in a sound position to experiment and develop groundbreaking games. But a key question I’ll be asking myself is what makes this game special? At this stage, I don’t think there is anything to indicate long term customer loyalty. There is plenty of potential, including, perhaps, with the “Dumb Ways To Die” brand; but too much uncertainty for me, at this stage.

Disclosure: the author of this article does not own shares in or have a position in Playside Studios. The editor of this article does not own shares in or have a position in Playside Studios. This article is not intended to form the basis of an investment decision and is not an official recommendation. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. You should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the relevant product disclosure statement. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.