As a shareholder of RPM Global (ASX: RUL), I was keen to dial into their virtual 2023 AGM today, mainly to request if they could please give investor presentations (to all investors) after half year and full year results.

I should highlight, here, my paymasters are retail investors, so I generally get my back up when the “little” people get a raw deal. If you wonder why the sharp tongue this is why: she whose bread I eat, her song I sing.

In that context, it was very heartening to hear the CEO of RPM Global, Richard Mathews, commit verbally to bringing in investor presentations for half year and full year results.

That will be a clear and measurable improvement in governance and will likely help lead to a higher share price, through greater market confidence in management. Of course, that only removed one of the two main issues I highlighted in this old Auzbiz segment on RPM Global’s FY 2023 Results.

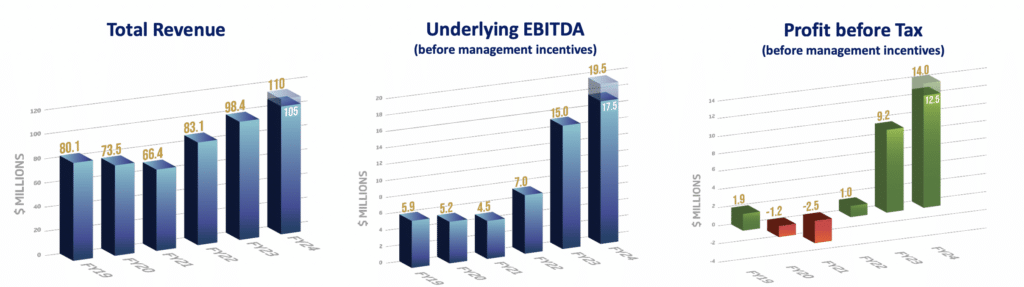

Fortunately, another shareholder (not myself) queried the use of adjusted EBITDA before management incentives. This attempt to get investors to exclude multimillion dollar payments to management from their mental measurement of progress protruded like a wart on a management presentation that otherwise only lacked a manager presenting it (to plebs like me, anyway).

On the question regarding the exclusion of management incentives, the CEO replied words along the lines of (my paraphrased note below):

“There has been a lot of discussion [of that] since we put out guidance… when you look at disclosures we’re very clear about that… we set very high targets for management team, to achieve those targets are a real stretch… it seems as though it would be a lot simpler just to include them and not highlight them on a consistent basis… when we look at guidance for next year, we’ll probably make that change.”

If the company would be so kind as just to give profit before tax guidance (after management incentives), then retail shareholders wouldn’t have to worry about being at an informational disadvantage because they are unable to quiz management about what the management incentives might be. Though perhaps with an investor presentation, that problem would be solved two ways.

I guess we don’t really know what will happen in the future, but today it seems that RPM Global has committed to significantly improving the treatment of retail investors. That is good in itself; but the willingness to improve is also is evidence of honest, competent leadership.

I said in my full coverage of the RPM Global (ASX: RUL) FY 2023 results that “It is not my highest conviction long-term investment, but I’m happy to have the stock in my portfolio and I still consider it undervalued at current prices.” Today, I would say my conviction is slightly improved, and I still consider it undervalued.

Sign Up To Our Free Newsletter

Disclosure: the author of this article owns shares in RUL and will not trade them for 2 days following this article. This article is not intended to form the basis of an investment decision. Any statements that are advice under the law are general advice only. The author has not considered your investment objectives or personal situation. Any advice is authorised by Claude Walker (AR 1297632), Authorised Representative of Equity Story Pty Ltd (ABN 94 127 714 998) (AFSL 343937).

The information contained in this report is not intended as and shall not be understood or construed as personal financial product advice. Nothing in this report should be understood as a solicitation or recommendation to buy or sell any financial products. Equity Story Pty Ltd and BlueTree Equity Pty Ltd t/a A Rich Life do not warrant or represent that the information, opinions or conclusions contained in this report are accurate, reliable, complete or current. Future results may materially vary from such opinions, forecasts, projections or forward looking statements. You should be aware that any references to past performance does not indicate or guarantee future performance.