In the half year ending December 2021, Sequoia Financial Group (ASX: SEQ) generated revenue of $79m, up about 50%, profit of $2.6m up 56%, and free cash flow of about $2m, even after acquisition payments. Its dividend increased 25% from 0.4 cents per share to 0.5 cents per share, suggesting it will yield over 1.5% in the next twelve months, at its current share price of 72 cents.

When I argued that Sequoia was growth at a reasonable price, earlier this month, I wrote:

“The company has forecast at least $2.1 million in net profit for the half ending December 2021, and I am hoping we’ll see about $4.2 million in the second half, to bring full year profit to $6.3 million.”

The good news for shareholders is that “at least $2.1 million” amounted to a very solid $2.6 million in profit. This means that the company only needs $3.7 million in the second half to meet my expectations for the full year. Of course, there is a real possibility that the results will come in above my expectations, since much of the company’s business is tax driven, so it receives demand for business as the end of the tex year approaches.

On the conference call, the CEO laid out the longer term plan is to achieve $400m of revenue at an 8% EBITDA margin on that number, implying $32million EBITDA, and (most importantly) “almost all of that converting to cash”. That to me is an unrealistic stretch goal, all the more so since the company mentioned that around $9 million was pulled forward from the second half, so the underlying revenue would be closer to $70 million. The EBITDA run rate is about $11 million, so it would imply almost tripling operating profit to achieve that.

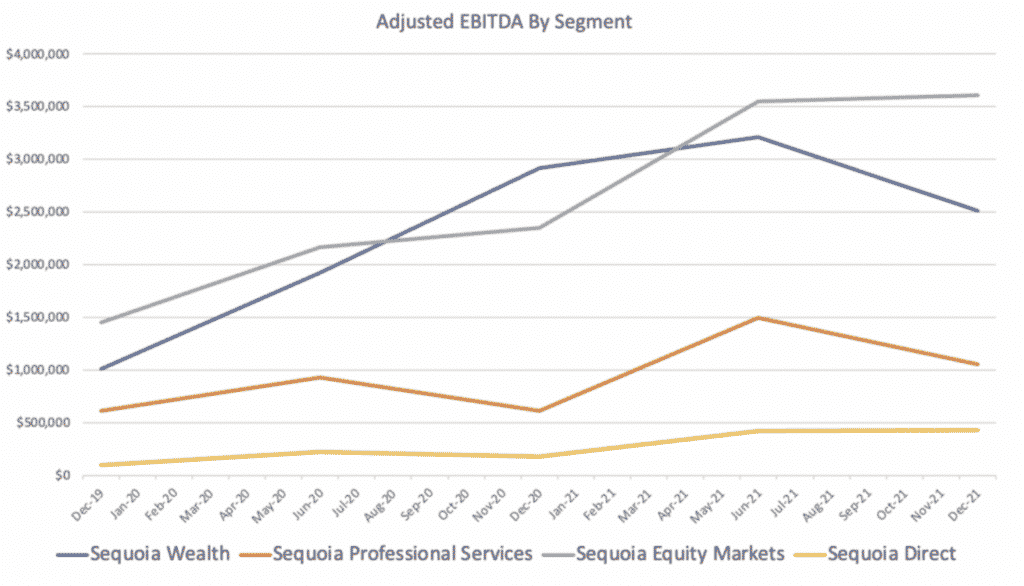

I like to do a health check on each segment by looking at how their adjusted EBITDA is going over time. Now of course, I wouldn’t choose this metric (I’d prefer free cash flow), but this is the best we have on a segment basis. As you can see below, each segment grew versus the prior corresponding period, but for the wealth segment.

It seems to me that the Sequoia Wealth business is the only one that went backwards, but this was because in the prior corresponding period the company booked a gain of around $600k from “gain on portfolio investments” but in this half it booked a lost of $160k on “portfolio investments”. I checked with the CEO Garry Crole about this anomaly.

He replied that there were three major differences, being:

- We invested heavily in education this half to assist advisers who left their FASEA exam education requirements to this half.

- We booked a loss on investments held in this division of around $400k opposed to $300k profit.

- We allowed for reserving of $500k in claims that do not exist compared to the prior periods where simply reported actual claims paid. In this half we allowed for any claims paid plus added an additional reserve.

He added that, “if you normalised all these the EBITDA would have been about $1m higher.“

Now, I’m not one to rest my laurels on “normalised adjusted EBITDA” but this probably at least means that we can still say that all the segments are growing organically. The company was quick to emphasise that there was ~$9m of pulled forward revenue this half (that they will give back in the second half, as it were).

Of course the true test will be in the second half when the company is supposed to generate the significant majority of the profit.

Management With A Sensible Plan

One of the most notable things about the conference call was the passion with which the CEO outlines a sensible, reasonable (if at times overly ambitious) path. One of the bits I liked the best was when Garry Crole said that “My life legacy to improve the distribution of financial services to the Australian community”. Now many CEOs are inspiring in one way or the other and it doesn’t guarantee success, but it is still a positive in my book.

Notably, the CEO reiterated the clear plan to use some of the existing cash flow to reinvest in buying ‘bolt on’ businesses, with the offer of equity in Sequoia for those vendors who are staying, and pure cash for those who are leaving.

Is Sequoia Good Value?

One of the simplest arguments for Sequoia being good value is that it has turned around its Morrison’s Securities business. Morrisons provides broking execution solutions to AFSL holders such as financial planners, financial advisors, and others requiring a white labelled broking solution.

Morrisons is a good business but capital intensive at the outset, since it requires $7.5 million in regulatory capital held in the bank. Nonetheless, it has really improved in recent years, and is now producing plenty of cash, driving the top-performing Equity Markets segment. On the call the CEO said “We’re winning a lot of 3rd party AFSL holders across to Morrisons on a weekly basis.” This is noteworthy because it is a good business, which is profitable, and growing organically.

In terms of the financials, the Equity Market division which includes Morrisons grew revenue by 40% to over $40m, and generated EBITDA of $3.6 million in the half year up about 50%. If you annualise that you have a segment earning over $7m EBITDA with a fairly high organic growth rate. It wouldn’t be crazy to value that at 10x EBITDA. So even allowing for an additional $2m standalone costs, you could imagine that segment alone being a company worth $50m. However this is a moot point as the business is worth more alongside Sequoia’s other businesses; it would be value destructive to seperate it out.

Nonetheless, it is a useful mental exercise for valuing the overall business.

Morrisons benefits from volatility, as a clearing broker, so unlike the other divisions, which may be impacted by a cyclical downturn, Morrisons should be able to keep growing, if it keeps bringing in new clients. Then, it is in the enviable situation of being able to benefit from the growth of those clients.

And ultimately, that is their modus operandi. By providing a great range of back office services to AFSL holders generally, Sequoia (one hopes) will benefit from their success. This is an attractive business model, because it aligns the service provider like Sequoia with the clients; but Sequoia still leverages the clients’ human capital, reputation, and hard work.

After accounting for the regulatory capital required, Sequoia overall has about $10m of cash. At the current share price of 72c it has a market cap of about $97 million. Assuming a very conservative $6.3 million profit, it is on a FY 2022 P/E ratio of about 15.4.

If we assume that Sequoia can grow profits at just 12% per year for 3 years after FY 2022(that being lower than current growth rates), then it is on an FY 2025 P/E ratio of about 11.

Now, assuming decent growth for years to come requires some trust in management, but given the track record so far, I think the above assumptions are actually probably too conservative. Therefore, I bought more shares in Sequoia after the results, at 72.5 cents per share.

The author owns shares in Sequoia and I will not sell any for at least two days after the publication of this article. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer