The older I get the more obvious to me it becomes that there is no single great way to play the markets. My own style focusses on tech and healthcare, because in my opinion those are the industries that have the most tailwinds. As a result of being a self styled tailwind investor, it makes perfect sense to gain experience analysing, following and understanding industries that have tailwinds.

It’s hardly a special insight to say that software is a growth industry. So the real question I end up asking myself half the time is; “what is the best ASX Software Stock For Me To Buy Today?”

This article will attempt to share some of my own thoughts on the subject, though this of course should be taken in the context of my own situation, portfolio, and biases. It’s certainly not advice, and should not cause any trade decision by you. You do you; but this is my thinking.

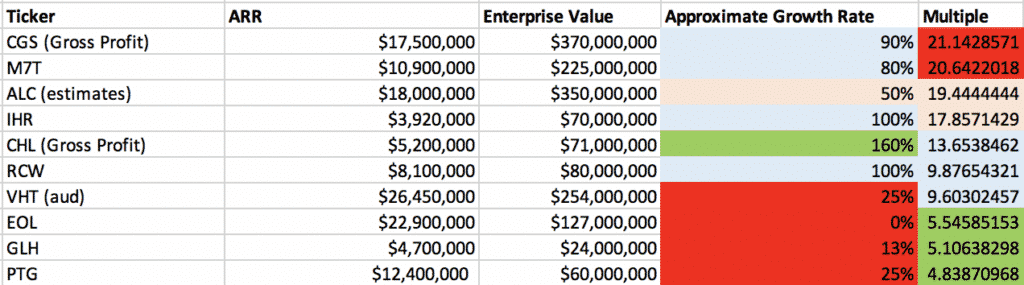

First of all, I thought I’d gather together a few of my most likely candidates, and then share some thoughts on each. While I’m not afraid to go down the forecasting rabbit hole from time to time, I am a big believer that generally speaking my actions should be explainable in fairly simple terms. The table below is a super simple form of note-taking where I take a metric and compare companies. This isn’t an even or fair comparison, but it still does inform my broader views. Take a glance at the list, then I’ll go through each company.

The approximate growth rate is mostly historical, but for Volpara and Proptech, where I’ve taken a guess at organic growth in the next year. Because this table is mostly backward looking, it is not useful as a valuation tool! Rather, it’s just a guide to what the market might be extrapolating (or not). Also, the share prices have changed in the day since I did the enterprise values.

Cogstate (ASX: CGS) is a company that basically provides software based services to companies that sell and develop Alzheimer drugs. I’ll write a longer note on it separately, but suffice it to say on my own analysis I choose to be “harsh” by looking at gross profit rather than revenue, in part because gross profit margins are rather low. That said, growth is high. I see Cogstate as being like Appen… it is selling the spades in a gold rush. That means I think there is potential for a few years of very high growth before competition starts crimping growth and/or margins. Arguably, this has meme stock potential and that is enough to justify the high multiple. It’s also the perfect size for small cap funds at the moment. Cogstate is profitable, so it shouldn’t need to raise capital. (Held)

Mach7 (ASX:M7T) is a lower tier radiology software and storage company. It’s arguably the closes to Pro Medicus on the ASX, but it doesn’t really have the same kind of pricing power, as evidenced by its massive losses every year. This one is on a pretty hefty multiple of ARR, but its strong ARR growth rate means it deserves a spot on the watchlist. Management reckon that they will generate a “positive EBITDA” in FY 2022, so we may see a profitability inflection point the following year. (Not Held)

Alcidion (ASX:ALC) is arguably one of the higher quality medical software companies on the ASX, but I’ve had to guess its ARR. It only provides recurring revenue, which is admirable. It’s not fast enough growing to really justify its multiple at the moment, but actually we may see growth increase in the future, given its success in the UK NHS recently, and continued growth in Australia. (Held)

IntelliHR (ASX:IHR) is the HR Software company I’ve written about too much lately. Its best strength is probably the fact it has such a very large growth runway. (Held)

Camplify (ASX:CHL) is the airbnb of trailers and campervans. I have to say I’m pissed off at myself for not catching on to this earlier. To my mind it is near certain that demand for campervans will increase massively given the increased risks of flying, and staying in hotels. In fact, you can even see how AirBnB fared so much better than Booking.com did, during the pandemic. This one also has massive meme stock potential, and is appears to be dominated by founders, pre-IP investors Acorn (ASX:ACQ), strategic partners Apollo Tourism (ASX:ATL), and NRMA. To me, all this suggests that it’s still good value despite the share price run-up. This has meme stock potential if people focus on revenue instead of gross profit. (Held)

Rightcrowd (ASX:RCW) sells visitor management software to large enterprise and little badges that can be used for contract tracing at large offices, and across multiple locations. It’s right place, right time solutions are driving high recurring revenue growth, and it has come down to a reasonable multiple. In my opinion this stock is in the doghouse, and rightly so. Eventually, though, I’d imagine the temptation of buying shares at a discount to what the Morgans’ flippers paid for them may see the stock consolidate with longer term investors. Rightcrowd belongs in my portfolio as a “sweet spot” covid play which seems to be gaining market share through having a trusted solution. I’ll be looking to take some profit before the next capital raising, but with freshly filled coffers that will probably be a while away. A strangely sparse and unhelpful annual report keeps me wary. (Held)

Volpara (ASX:VHT) is a much loved breast cancer screening software company. It really needs to stop losing money, but its revenue is likely to grow longer term, given the clear need for early intervention and the widely respected product. To me, the inflection point we need to see is the profitability inflection point, because it seems unlikely Volpara is capable of more than about 30% organic growth. Still, easy to see this business doubling from here. The question is how much dilution, if any, will be needed to achieve that. (Held)

Energy One (ASX: EOL) has given flat guidance, so I’ve rather harshly put 0% as its growth rate even though I don’t think that will be the case long term. As a profitable dividend paying company, it can afford to not grow, since it doesn’t need to please the market. On the other hand, if it actually does grow at all, it will look reasonably priced, at worst. For example, if it achieves 20% growth in a year, then it would look very cheap compared to others. (Held)

Global Health (ASX:GLH) is a potential turnaround story. It has grown very slowly over quite a few years and its management has not been impressive. Nonetheless, it has established a small niche in electronic medical records for allied health and community based healthcare. Supposedly the new management team will be able to grow the business. If so, you could easily see a higher multiple, but there’s a long history of failure to consider. (Not held)

Proptech Group (ASX:PTG) saw a stronger second half so I’ve assumed organic growth, despite acquisitions making for a messy picture. Although not quite profitable, it’s close enough that you’d say it easily could be. The multiple is low because of all the dilution associated with their acquisition strategy. However, if the company integrates the acquisitions and shows some organic growth, let alone sustained organic growth, then I think it will trade at more like 8x ARR. Director buying recently. (Held)

Conclusion

As it turns out, I did make a teeny tiny little purchase of Energy One shares today, mostly because a buy order I had previously made, was hit. However, I already have a large holding, so I probably shouldn’t buy much more! In all likelihood, I’ll wait to buy more at around $4, if it gets there.

On top of that I have orders to buy small amounts of RCW, IHR and PTG at below current prices.

Putting that aside, the winner from this process was Camplify; so I bought some more of that, bringing it up to a 3% holding. I’m very annoyed I did not load up at $1.40, but that may cause me to anchor to the lower price and not buy, even when I should. Of course, the risk with Camplify is that I don’t know it well, since it has only been listed less than a year. Therefore, new information could change my view.

Please remember that these are personal reflections about stocks by author. I own shares in a number of the companies mentioned and may be active in some of them. This article should not form the basis of an investment decision. It is an investment diary valuable only for the cognitive process it demonstrates. We do not provide financial advice, and any commentary is general in nature. Please read our disclaimer.